📊 BANKNIFTY TRADING PLAN — 03 DEC 2025

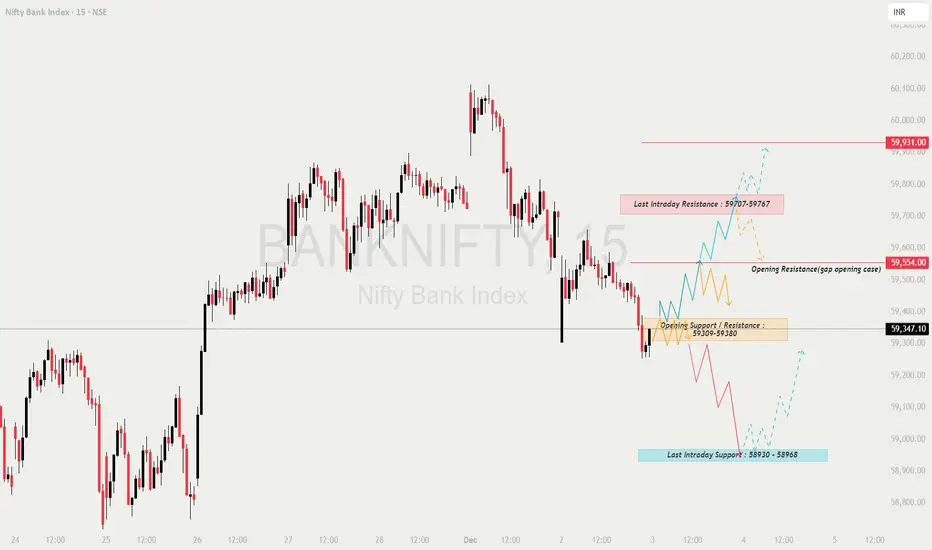

BankNifty closed near 59,347, sitting inside the Opening Support / Resistance Flip Zone (59,309–59,380).

The index is currently attempting to stabilise after a sharp down-move, with both 59,554 and 58,930 acting as the most important decision zones for 03-Dec.

Market direction will depend on how price reacts around these zones at the open.

🔍 KEY LEVELS TO WATCH

🟥 Opening Resistance (Gap-Up Case): 59,554

🟥 Last Intraday Resistance: 59,707 – 59,767

🟥 Major Upside Target: 59,931

🟩 Opening Support / Resistance Flip Zone: 59,309 – 59,380

🟩 Last Intraday Support: 58,930 – 58,968

🟩 Major Breakdown Target: 58,780 – 58,720

🟢 SCENARIO 1 — GAP-UP OPENING (200+ POINTS)

If BankNifty opens around 59,500–59,600, it directly enters the Opening Resistance zone.

📘 Educational Note:

Gap-ups into resistance require confirmation of strength.

Don’t assume continuation — let structure break first.

🟧 SCENARIO 2 — FLAT OPENING (59,250–59,350)

Flat opening puts price directly inside the flip zone (59,309–59,380) — high indecision.

💡 Educational Tip:

Flat opens give the most reliable patterns after the first 3 candles.

Let noise settle, trade clean structure.

🔻 SCENARIO 3 — GAP-DOWN OPENING (200+ POINTS)

A gap-down near 59,000–59,100 brings price close to the Last Intraday Support (58,930–58,968).

📘 Educational Note:

Gap-downs into major support can create high-quality reversal trades, but only after confirmation.

Never pre-empt reversals.

💼 RISK MANAGEMENT TIPS FOR OPTION TRADERS 🔐📘

⚠️ Golden Rule:

Strong levels give clean trades.

Avoid trading in the noise zones.

📌 SUMMARY

Bullish Above:

✔️ 59,380 → 59,480 → 59,554 → 59,707 → 59,931

Bearish Below:

✔️ 59,309 → 59,200 → 59,120 → 58,968 → 58,780

Key Zones:

🟩 Strong Support: 58,930–58,968

🟧 Flip Zone (No-Trade until breakout): 59,309–59,380

🟥 Strong Resistance: 59,554–59,707

Major Trend Decider:

🔑 Sustaining above 59,554 → Trend bullish

🔑 Breaking below 58,930 → Trend bearish

🧾 CONCLUSION

BankNifty is positioned at a critical flip zone.

The day’s trend will depend on whether:

✔️ Buyers reclaim 59,380–59,554, or

✔️ Sellers break 59,309 → 58,930

Follow structure, avoid prediction, and trade only after confirmation.

⚠️ DISCLAIMER

I am not a SEBI-registered analyst.

This analysis is for educational purposes only.

Please consult a certified financial advisor before taking trades.

BankNifty closed near 59,347, sitting inside the Opening Support / Resistance Flip Zone (59,309–59,380).

The index is currently attempting to stabilise after a sharp down-move, with both 59,554 and 58,930 acting as the most important decision zones for 03-Dec.

Market direction will depend on how price reacts around these zones at the open.

🔍 KEY LEVELS TO WATCH

🟥 Opening Resistance (Gap-Up Case): 59,554

🟥 Last Intraday Resistance: 59,707 – 59,767

🟥 Major Upside Target: 59,931

🟩 Opening Support / Resistance Flip Zone: 59,309 – 59,380

🟩 Last Intraday Support: 58,930 – 58,968

🟩 Major Breakdown Target: 58,780 – 58,720

🟢 SCENARIO 1 — GAP-UP OPENING (200+ POINTS)

If BankNifty opens around 59,500–59,600, it directly enters the Opening Resistance zone.

- []If price sustains above 59,554, buyers will push toward:

➡️ 59,707 → 59,767 → 59,931

[]Best long entry:

✔️ Breakout above 59,554

✔️ Retest candle with long lower wick

✔️ Entry on strength → Targets above

[]If price rejects 59,554–59,707 on the first 5–10 min (upper wicks, exhaustion):

Expect pullback to:

➡️ 59,420 → 59,309 zone

[]Only aggressive traders should attempt fade-shorts near 59,707–59,767.

High risk due to strength in the zone.

📘 Educational Note:

Gap-ups into resistance require confirmation of strength.

Don’t assume continuation — let structure break first.

🟧 SCENARIO 2 — FLAT OPENING (59,250–59,350)

Flat opening puts price directly inside the flip zone (59,309–59,380) — high indecision.

- []Range-bound movement expected in first 10–15 minutes.

[]Upside trigger:

✔️ Break above 59,380

Targets → 59,480 → 59,554 → 59,707

[]Downside trigger:

✔️ Break below 59,309

Targets → 59,200 → 59,120 → 58,968

[]Avoid trades inside 59,309–59,380 until a clean directional breakout occurs. - Safer setups:

— Retest of 59,380 for long

— Retest of 59,309 break for short

💡 Educational Tip:

Flat opens give the most reliable patterns after the first 3 candles.

Let noise settle, trade clean structure.

🔻 SCENARIO 3 — GAP-DOWN OPENING (200+ POINTS)

A gap-down near 59,000–59,100 brings price close to the Last Intraday Support (58,930–58,968).

- []If 58,930–58,968 holds, expect a strong reversal toward:

➡️ 59,120 → 59,309 → 59,380

[]If price breaks 58,930 with momentum, downside opens to:

➡️ 58,820 → 58,780 → 58,720

[]Only take reversal longs if:

✔️ Support holds for 2–3 candles

✔️ Higher lows form

✔️ Strong bullish rejection wick appears

[]Breakdown traders should wait for retest of 58,930 after breakdown.

This gives low-risk continuation entries.

📘 Educational Note:

Gap-downs into major support can create high-quality reversal trades, but only after confirmation.

Never pre-empt reversals.

💼 RISK MANAGEMENT TIPS FOR OPTION TRADERS 🔐📘

- []Avoid trading the first 5 minutes — high trap probability.

[]Use ITM options for directional trades for better decay protection.

[]Keep SL based on chart levels, not option premium noise.

[]Avoid averaging losing positions — re-entry is cheaper than recovery.

[]Book partial profits at first target and trail stop loss.

[]During volatile zones, prefer spreads instead of naked options. - Stop trading after 2 consecutive losses — protect capital.

⚠️ Golden Rule:

Strong levels give clean trades.

Avoid trading in the noise zones.

📌 SUMMARY

Bullish Above:

✔️ 59,380 → 59,480 → 59,554 → 59,707 → 59,931

Bearish Below:

✔️ 59,309 → 59,200 → 59,120 → 58,968 → 58,780

Key Zones:

🟩 Strong Support: 58,930–58,968

🟧 Flip Zone (No-Trade until breakout): 59,309–59,380

🟥 Strong Resistance: 59,554–59,707

Major Trend Decider:

🔑 Sustaining above 59,554 → Trend bullish

🔑 Breaking below 58,930 → Trend bearish

🧾 CONCLUSION

BankNifty is positioned at a critical flip zone.

The day’s trend will depend on whether:

✔️ Buyers reclaim 59,380–59,554, or

✔️ Sellers break 59,309 → 58,930

Follow structure, avoid prediction, and trade only after confirmation.

⚠️ DISCLAIMER

I am not a SEBI-registered analyst.

This analysis is for educational purposes only.

Please consult a certified financial advisor before taking trades.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.