💼 BANK NIFTY TRADING PLAN – 28-Aug-2025

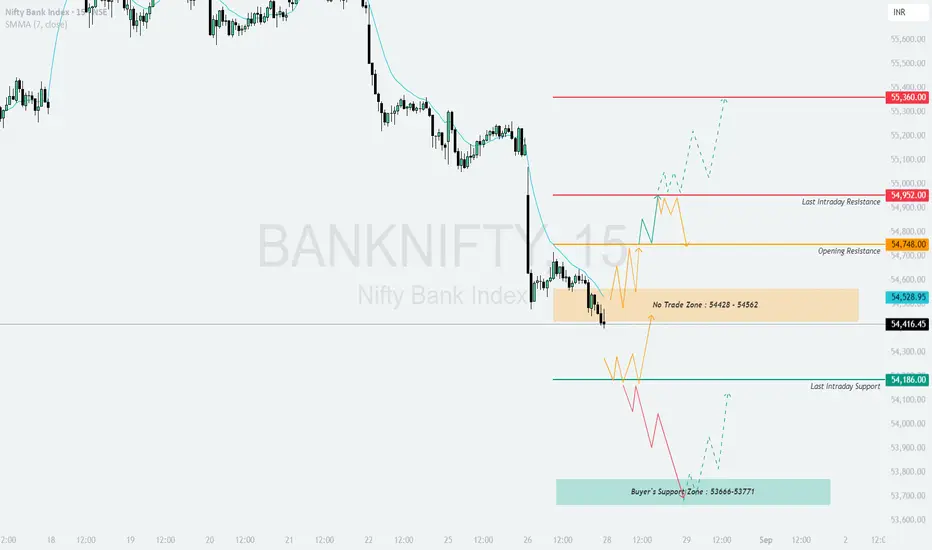

📌 Key Levels to Watch:

Opening Resistance: 54,748

Last Intraday Resistance: 54,952

Major Resistance Above: 55,360

No-Trade Zone: 54,428 – 54,562

Last Intraday Support: 54,186

Buyer’s Support Zone: 53,666 – 53,771

These levels act as decision-making zones for intraday setups.

🔼 1. Gap-Up Opening (200+ points above 54,748)

If Bank Nifty opens above 54,748, early strength will be visible.

📌 Plan of Action:

👉 Educational Note: On strong gap-ups, always avoid chasing; instead, wait for price retests near support to manage risk better.

➖ 2. Flat Opening (Around 54,428 – 54,562 No-Trade Zone)

A flat start near the No-Trade Zone means price is indecisive.

📌 Plan of Action:

👉 Educational Note: Flat openings require patience. Allow 30 minutes for trend clarity before entering trades.

🔽 3. Gap-Down Opening (200+ points below 54,186)

If Bank Nifty opens below 54,186, bearish momentum will dominate.

📌 Plan of Action:

👉 Educational Note: On gap-down days, trend-following trades work better than reversal attempts. Wait for retests before shorting.

🛡️ Risk Management Tips for Options Traders

📌 Summary & Conclusion

🟢 Above 54,952 → Possible upside to 55,360.

🟧 Flat near 54,428–54,562 → Avoid trades until breakout.

🔴 Below 54,186 → Downside towards 53,666–53,771.

🎯 Key Decision Zone: 54,428 – 54,562 (No-Trade Zone) will guide the trend.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This trading plan is purely for educational purposes and should not be considered financial advice. Please consult a financial advisor before making trading or investment decisions.

📌 Key Levels to Watch:

Opening Resistance: 54,748

Last Intraday Resistance: 54,952

Major Resistance Above: 55,360

No-Trade Zone: 54,428 – 54,562

Last Intraday Support: 54,186

Buyer’s Support Zone: 53,666 – 53,771

These levels act as decision-making zones for intraday setups.

🔼 1. Gap-Up Opening (200+ points above 54,748)

If Bank Nifty opens above 54,748, early strength will be visible.

📌 Plan of Action:

- [] Sustaining above 54,952 (Last Intraday Resistance) can push the index towards 55,360, which will act as a major resistance and profit booking zone.

[] Failure to hold above 54,952 may drag prices back to retest 54,748 support, giving rangebound moves. - A breakout above 55,360 should be traded cautiously with partial booking at higher levels.

👉 Educational Note: On strong gap-ups, always avoid chasing; instead, wait for price retests near support to manage risk better.

➖ 2. Flat Opening (Around 54,428 – 54,562 No-Trade Zone)

A flat start near the No-Trade Zone means price is indecisive.

📌 Plan of Action:

- [] If Bank Nifty sustains above 54,748, buyers may take it towards 54,952 → 55,360.

[] If it slips below 54,428, selling pressure may drag it down to 54,186 support. - Avoid aggressive trading inside the no-trade band (54,428 – 54,562), as it can trigger false breakouts.

👉 Educational Note: Flat openings require patience. Allow 30 minutes for trend clarity before entering trades.

🔽 3. Gap-Down Opening (200+ points below 54,186)

If Bank Nifty opens below 54,186, bearish momentum will dominate.

📌 Plan of Action:

- [] Below 54,186, price can slide quickly towards 53,666 – 53,771 Buyer’s Zone.

[] Watch carefully for reversals in the buyer’s zone; if sustained, a recovery bounce can emerge. - If the buyer’s zone breaks with volume, deeper weakness may continue.

👉 Educational Note: On gap-down days, trend-following trades work better than reversal attempts. Wait for retests before shorting.

🛡️ Risk Management Tips for Options Traders

- [] Risk only 1–2% of capital per trade.

[] Use hourly close stop-loss for directional moves.

[] Prefer spreads (Bull Call / Bear Put) on gap days to minimize premium decay.

[] Do not trade aggressively in the No-Trade Zone (54,428 – 54,562). - Monitor Bank Nifty PCR & India VIX to gauge sentiment and volatility.

📌 Summary & Conclusion

🟢 Above 54,952 → Possible upside to 55,360.

🟧 Flat near 54,428–54,562 → Avoid trades until breakout.

🔴 Below 54,186 → Downside towards 53,666–53,771.

🎯 Key Decision Zone: 54,428 – 54,562 (No-Trade Zone) will guide the trend.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This trading plan is purely for educational purposes and should not be considered financial advice. Please consult a financial advisor before making trading or investment decisions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.