📉 BANK NIFTY Trading Plan – 12th May 2025 (15-Min Chart Analysis)

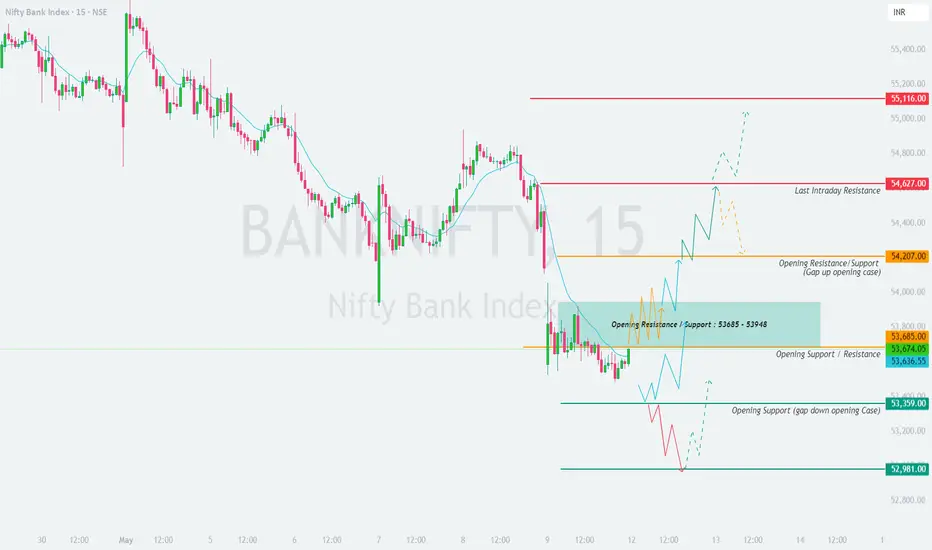

Bank Nifty closed near 53,674. The chart shows well-identified support and resistance zones. As per our standard, a gap opening is considered when the index opens 200+ points away from the previous close.

Let's go through the action plan based on three different opening scenarios with strategic insights and disciplined approach 👇

🟢 SCENARIO 1: Gap-Up Opening (Above 53,948 – 54,207)

If Bank Nifty opens with a 200+ points gap up above the Opening Resistance Zone of 53,685 – 53,948 and sustains above 54,207, bullish sentiment may dominate the session.

👉 Let the price stabilize for first 15–30 minutes before initiating trades to avoid trap moves.

🟨 SCENARIO 2: Flat Opening (Between 53,636 – 53,685)

A flat opening keeps us within the current indecisive zone. This area is likely to offer choppy moves in the first session of the day.

👉 Best approach here is to let the market pick a direction. Only then act with confirmed breakouts.

🔻 SCENARIO 3: Gap-Down Opening (Below 53,359)

If Bank Nifty opens with a significant gap down (200+ points) and trades below 53,359, we shift focus to the 52,981 Support Zone.

👉 Patience is key. Don’t catch falling knives; let the structure build and respond with tight risk control.

📘 Options Trading Risk Management Tips 🧠

📌 Summary & Conclusion:

Key Zones for the Day:

🔸 Opening Resistance Zone: 53,685 – 53,948

🔸 Gap-Up Resistance Support: 54,207

🔸 Last Intraday Resistance: 54,627

🔸 Major Resistance: 55,116

🔸 Opening Support Zone: 53,636 – 53,359

🔸 Gap-Down Support: 52,981

This is a classic range-to-breakout setup. Let price settle and show direction near marked levels. Don’t pre-empt; react with discipline and proper confirmation.

⚠️ Disclaimer:

I am not a SEBI-registered analyst. The above views are purely for educational purposes. Please consult your financial advisor before making any trading decisions. Trade responsibly.

Bank Nifty closed near 53,674. The chart shows well-identified support and resistance zones. As per our standard, a gap opening is considered when the index opens 200+ points away from the previous close.

Let's go through the action plan based on three different opening scenarios with strategic insights and disciplined approach 👇

🟢 SCENARIO 1: Gap-Up Opening (Above 53,948 – 54,207)

If Bank Nifty opens with a 200+ points gap up above the Opening Resistance Zone of 53,685 – 53,948 and sustains above 54,207, bullish sentiment may dominate the session.

- []Watch for early rejection or acceptance near 54,207 (Resistance/Support). A strong bullish 15-min candle above this level may trigger a long entry.

[]Upside target could be 54,627 (Last Intraday Resistance), followed by 55,116 if momentum continues.

[]Entry Plan: Wait for retest of 54,207 after the breakout – look for bullish confirmation candle.

[]Stop Loss: 🔻 Place SL just below 54,000 or on hourly close below 54,207. - Avoid long entries if price fails to hold above 53,948, as it may signal a weak gap-up.

👉 Let the price stabilize for first 15–30 minutes before initiating trades to avoid trap moves.

🟨 SCENARIO 2: Flat Opening (Between 53,636 – 53,685)

A flat opening keeps us within the current indecisive zone. This area is likely to offer choppy moves in the first session of the day.

- []Observe price movement between 53,636 (Opening Support/Resistance) and 53,685.

[]A breakout above 53,685 – 53,948 may open the door for a bullish move towards 54,207.

[]Bearish scenario unfolds only if price sustains below 53,636, heading toward 53,359.

[]Wait for a breakout or breakdown from this tight range before jumping into the trade. - No trade zone: Inside 53,636 – 53,685 with low volume and weak candles.

👉 Best approach here is to let the market pick a direction. Only then act with confirmed breakouts.

🔻 SCENARIO 3: Gap-Down Opening (Below 53,359)

If Bank Nifty opens with a significant gap down (200+ points) and trades below 53,359, we shift focus to the 52,981 Support Zone.

- []Watch for reversal signals near 52,981 – this level may provide a strong intraday bounce.

[]Reversal pattern like hammer or bullish engulfing can offer low-risk long entry.

[]If breakdown continues below 52,981, downside may stretch towards 52,800 – 52,600.

[]Avoid aggressive shorting without confirmation below 52,981, as a short-covering rally can trap weak hands. - Preferred strategy: Wait for price to either break 52,981 or give reversal signal.

👉 Patience is key. Don’t catch falling knives; let the structure build and respond with tight risk control.

📘 Options Trading Risk Management Tips 🧠

- []Avoid trading deep OTM options, especially on flat days – time decay can hurt fast.

[]Trade near ATM or slightly ITM options for better risk-reward and delta advantage.

[]Use proper stop-loss based on candle close (15-min or hourly), not based on emotions.

[]Always define your risk per trade (preferably 1–2% of capital only).

[]Avoid revenge trading. Missing a trade is better than forcing one.

[]Trail profits when in favor. Don’t wait for exact targets to exit profitable trades.

📌 Summary & Conclusion:

Key Zones for the Day:

🔸 Opening Resistance Zone: 53,685 – 53,948

🔸 Gap-Up Resistance Support: 54,207

🔸 Last Intraday Resistance: 54,627

🔸 Major Resistance: 55,116

🔸 Opening Support Zone: 53,636 – 53,359

🔸 Gap-Down Support: 52,981

This is a classic range-to-breakout setup. Let price settle and show direction near marked levels. Don’t pre-empt; react with discipline and proper confirmation.

⚠️ Disclaimer:

I am not a SEBI-registered analyst. The above views are purely for educational purposes. Please consult your financial advisor before making any trading decisions. Trade responsibly.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.