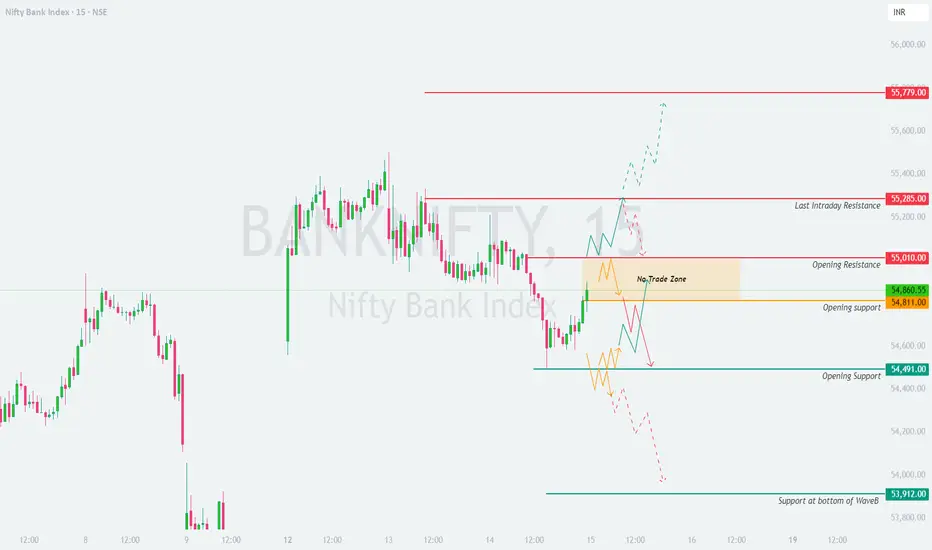

📘 BANK NIFTY TRADING PLAN – 15th May 2025 (15-Min Chart Structure)

📍 Bank Nifty closed at 54,860.55 on 14-May-2025. It is currently positioned just below a critical Opening Resistance at 55,010. There are multiple confluences and potential breakout/breakdown areas around this zone. Key support is visible at 54,491, with a deeper demand zone around 53,912 (Wave B bottom).

A Gap Opening is considered to be ±200 points or more from the previous close.

🚀 SCENARIO 1: GAP-UP OPENING (Above 55,060)

(Gap up of 200+ points above last close)

📍 Bank Nifty closed at 54,860.55 on 14-May-2025. It is currently positioned just below a critical Opening Resistance at 55,010. There are multiple confluences and potential breakout/breakdown areas around this zone. Key support is visible at 54,491, with a deeper demand zone around 53,912 (Wave B bottom).

A Gap Opening is considered to be ±200 points or more from the previous close.

🚀 SCENARIO 1: GAP-UP OPENING (Above 55,060)

(Gap up of 200+ points above last close)

- []If Bank Nifty opens above 55,060, it will directly enter the Last Intraday Resistance Zone of 55,285–55,779.

[]In such zones, the market either continues with momentum or reverses sharply — depending on early candle behavior.

[]Wait for the first 15–30 mins to let price action confirm direction.

[]If the index sustains above 55,285 with strong bullish candles, consider long entries with targets toward 55,600 and 55,779. Stop-loss can be placed just below 55,150. - If rejection or exhaustion patterns appear below 55,285 (like shooting star, bearish engulfing), prepare for short opportunities — especially if it re-enters below 55,010, targeting 54,860 and 54,491.

👉 📚 Educational Tip: Strong gap-ups near resistance often trap late buyers. Confirmation is key before jumping into a trade.

📊 SCENARIO 2: FLAT OPENING (Between 54,700 – 54,950)

(Minor move from the previous close)- []This range includes both the Opening Support (54,811) and Opening Resistance (55,010), making it a no-trade zone initially.

[]Let the price either give a clean breakout above 55,010 or breakdown below 54,491.

[]For an upside breakout, wait for a candle close above 55,010 with follow-through volume. In that case, long trades may be initiated with a target of 55,285 and 55,600+.

[]For a downside breakdown, wait for rejection near 55,010 followed by a fall below 54,811 — then short with a target of 54,491 and 54,300. - Avoid getting chopped inside the 100-point range between 54,811–55,010.

👉 📚 Educational Tip: When price trades in between two key levels, it's best to let the market pick a direction before acting. Avoid impulse trading.

🔻 SCENARIO 3: GAP-DOWN OPENING (Below 54,660)

(Gap-down of 200+ points)- []If Bank Nifty opens below 54,660, it likely heads toward Opening Support at 54,491.

[]This is a crucial support zone. A breakdown below 54,491 can trigger further downside till 53,912, which is the bottom of Wave B and a strong bounce zone.

[]Ideal strategy: Wait for a retest of 54,491 after breakdown. If price retests and rejects, short positions can be initiated with a stop-loss above 54,600 and targets of 54,200 and 53,912.

[]If price bounces strongly near 53,912 with a reversal candle, consider buying for a reversion move to 54,400–54,600. - Avoid fresh shorts near 53,912 without confirmation as it’s a previous buying zone.

👉 📚 Educational Tip: Never short blindly into a strong support zone. Look for candle patterns like morning star or bullish engulfing for reversal signs.

💡 OPTIONS TRADING & RISK MANAGEMENT TIPS:- []⚠️ Avoid trading in the first 5–10 mins unless there’s a clear breakout/breakdown. Let the structure form.

[]🧠 Always define your maximum risk per trade (1–2% of capital).

[]📈 Use ATM or slightly ITM options for better delta and less premium erosion.

[]🔁 Consider deploying spreads (like Bull Call or Bear Put) in volatile markets to limit loss.

[]⏳ Avoid holding OTM options post 2 PM — theta decay increases rapidly.

[]🚫 Do not average into losing trades. It’s better to exit and re-enter than hope for recovery.

👉 🧠 Pro Tip: Treat every trade like a business decision, not an emotional reaction. Risk control > accuracy.

📌 SUMMARY & CONCLUSION:

🔹 Opening Resistance Zone: 55,010 – 55,285

🔹 Opening Support Zone: 54,491 – 54,811

🔹 Major Support: 53,912 (Wave B bottom)

🔹 Momentum Above: 55,285 → Possible rally to 55,779

🔹 Breakdown Below: 54,491 → Potential fall to 53,912

🔹 Wait Zone: 54,811–55,010 (No clear trend)

Bank Nifty is at a decision point. The next 15-minute structure post-open will define the day’s trend. Focus on high-probability setups around breakout or breakdown zones and protect your capital at all costs.

⚠️ DISCLAIMER:

I am not a SEBI-registered analyst. This trading plan is purely for educational and informational purposes. Please consult your financial advisor or do your own research before taking any trades. Markets carry risk — trade responsibly.

- []⚠️ Avoid trading in the first 5–10 mins unless there’s a clear breakout/breakdown. Let the structure form.

- []If Bank Nifty opens below 54,660, it likely heads toward Opening Support at 54,491.

- []This range includes both the Opening Support (54,811) and Opening Resistance (55,010), making it a no-trade zone initially.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.