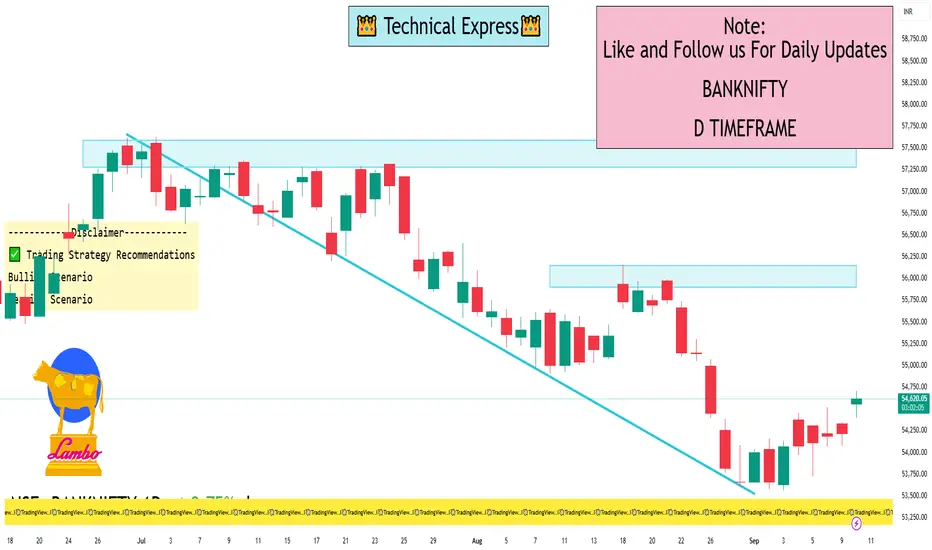

📈 Key Support & Resistance Levels

Immediate Support: 53,917

Positional Support: 52,802

Immediate Resistance: 54,673

Positional Resistance: 55,055, 55,592, 55,747, 55,999, 56,042, 56,076

These levels are derived from recent market data and are crucial for day traders to monitor for potential breakout or breakdown scenarios.

🔍 Technical Indicators Overview

Stochastic RSI: Currently in a bullish zone, indicating upward momentum.

Rate of Change (ROC): Positive, suggesting increasing buying interest.

These indicators align with the current bullish sentiment in the market.

🧭 Market Sentiment & Outlook

The Bank Nifty index has shown consistent upward movement, supported by positive market sentiment and favorable macroeconomic factors. If the index maintains its position above the immediate support levels, further gains toward the next resistance zones are possible.

✅ Trading Strategy Recommendations

Bullish Scenario: Consider initiating long positions if the index sustains above 54,673, targeting the next resistance levels.

Bearish Scenario: Monitor for signs of weakness below 53,917, which could lead to a pullback toward the positional support at 52,802.

Immediate Support: 53,917

Positional Support: 52,802

Immediate Resistance: 54,673

Positional Resistance: 55,055, 55,592, 55,747, 55,999, 56,042, 56,076

These levels are derived from recent market data and are crucial for day traders to monitor for potential breakout or breakdown scenarios.

🔍 Technical Indicators Overview

Stochastic RSI: Currently in a bullish zone, indicating upward momentum.

Rate of Change (ROC): Positive, suggesting increasing buying interest.

These indicators align with the current bullish sentiment in the market.

🧭 Market Sentiment & Outlook

The Bank Nifty index has shown consistent upward movement, supported by positive market sentiment and favorable macroeconomic factors. If the index maintains its position above the immediate support levels, further gains toward the next resistance zones are possible.

✅ Trading Strategy Recommendations

Bullish Scenario: Consider initiating long positions if the index sustains above 54,673, targeting the next resistance levels.

Bearish Scenario: Monitor for signs of weakness below 53,917, which could lead to a pullback toward the positional support at 52,802.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.