💼 BANK NIFTY TRADING PLAN – 08-Oct-2025

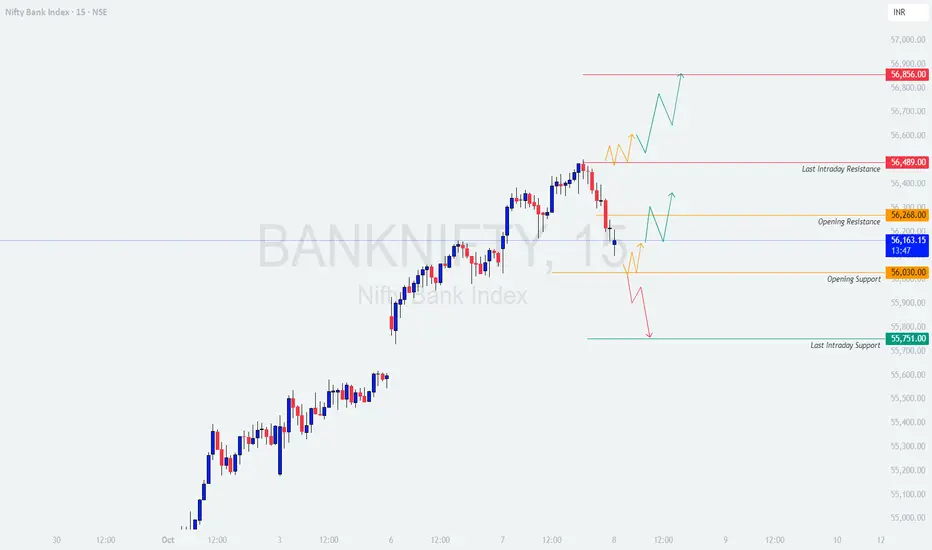

📊 Levels:

• Last Intraday Resistance: 56,489

• Opening Resistance: 56,268

• Opening Support: 56,030

• Last Intraday Support: 55,751

• Previous Close: 56,098

🟢 1️⃣ GAP-UP OPENING (Above 56,298 – around 200+ points from previous close)

If Bank Nifty opens with a gap-up near 56,300–56,350, it will directly test the Opening Resistance zone (56,268–56,489). In such a case, avoid emotional buying at open — wait for the first 30-minute candle to confirm whether the index sustains above 56,489.

✅ Plan of Action:

🟧 2️⃣ FLAT OPENING (Around 56,100 ±100 points)

A flat opening near the previous close (56,098) keeps both sides open — the zone between 56,030 and 56,268 will act as a crucial decision area. Here, the market will likely consolidate before showing the next directional move.

✅ Plan of Action:

🔻 3️⃣ GAP-DOWN OPENING (Below 55,900 – around 200+ points from previous close)

If the index opens near 55,900–55,800, it will immediately challenge the Last Intraday Support (55,751). This is a key level — a bounce from here can lead to strong short-covering, but if it fails, more downside may open.

✅ Plan of Action:

💡 RISK MANAGEMENT & OPTIONS TRADING TIPS

📘 SUMMARY & CONCLUSION

The levels 56,030 (support) and 56,268 (resistance) are the pivot zones for today’s action. The market is currently in a healthy uptrend, but short-term volatility is expected near 56,489. A clear close above this can extend the bullish leg toward 56,850, while weakness below 55,751 may bring momentum to the downside.

The focus should be on confirmation-based trading — follow the structure, don’t anticipate the move. Let the price tell you the direction.

⚠️ Disclaimer:

I am not a SEBI-registered analyst. The above analysis is purely for educational and informational purposes. Please do your own analysis or consult a financial advisor before taking any trade.

📊 Levels:

• Last Intraday Resistance: 56,489

• Opening Resistance: 56,268

• Opening Support: 56,030

• Last Intraday Support: 55,751

• Previous Close: 56,098

🟢 1️⃣ GAP-UP OPENING (Above 56,298 – around 200+ points from previous close)

If Bank Nifty opens with a gap-up near 56,300–56,350, it will directly test the Opening Resistance zone (56,268–56,489). In such a case, avoid emotional buying at open — wait for the first 30-minute candle to confirm whether the index sustains above 56,489.

✅ Plan of Action:

- []If price sustains and gives an hourly candle close above 56,489, this can open the gate for a rally toward 56,850–56,900 zone (next resistance).

[]If price fails to sustain above 56,489, expect a possible retracement towards 56,268 or even 56,030 for retesting demand before any fresh upside. - Option traders should consider a bull call spread or wait for a retest confirmation to avoid buying at the peak.

🟧 2️⃣ FLAT OPENING (Around 56,100 ±100 points)

A flat opening near the previous close (56,098) keeps both sides open — the zone between 56,030 and 56,268 will act as a crucial decision area. Here, the market will likely consolidate before showing the next directional move.

✅ Plan of Action:

- []A decisive hourly close above 56,268 can trigger a momentum move toward 56,489 and then 56,850 if strength continues.

[]Conversely, if 56,030 breaks on downside, weakness can accelerate toward 55,751. - In this zone, it's best to follow price confirmation rather than pre-empting direction. Watch the 15-min price action for early signs of momentum.

🔻 3️⃣ GAP-DOWN OPENING (Below 55,900 – around 200+ points from previous close)

If the index opens near 55,900–55,800, it will immediately challenge the Last Intraday Support (55,751). This is a key level — a bounce from here can lead to strong short-covering, but if it fails, more downside may open.

✅ Plan of Action:

- []Look for rejection wicks or a strong reversal candle near 55,751 for a possible pullback toward 56,030.

[]If 55,751 breaks and sustains, expect the next downside momentum — a quick slide of 200–300 points could be seen. - Avoid catching falling knives; instead, wait for a proper candle reversal confirmation before entering any long side trade.

💡 RISK MANAGEMENT & OPTIONS TRADING TIPS

- []Always wait for hourly candle confirmation before taking a position on breakout or breakdown.

[]Avoid buying deep OTM options on the first candle — premium decay can erode quickly if the market consolidates.

[]Use bull call spreads / bear put spreads to manage theta decay on both sides.

[]Position sizing is key — don’t risk more than 1–2% of capital per trade. - If the first 30-minute candle shows volatility, allow price to settle before execution for better RR (Risk–Reward).

📘 SUMMARY & CONCLUSION

The levels 56,030 (support) and 56,268 (resistance) are the pivot zones for today’s action. The market is currently in a healthy uptrend, but short-term volatility is expected near 56,489. A clear close above this can extend the bullish leg toward 56,850, while weakness below 55,751 may bring momentum to the downside.

The focus should be on confirmation-based trading — follow the structure, don’t anticipate the move. Let the price tell you the direction.

⚠️ Disclaimer:

I am not a SEBI-registered analyst. The above analysis is purely for educational and informational purposes. Please do your own analysis or consult a financial advisor before taking any trade.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.