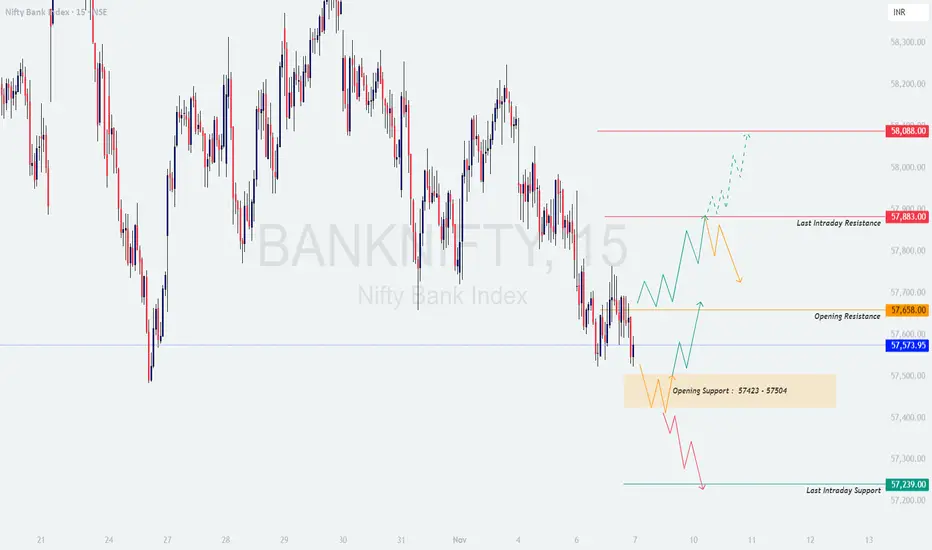

📊 BANK NIFTY TRADING PLAN — 07 NOV 2025

(Timeframe Reference: 15-Min Chart)

Chart Summary:

Bank Nifty is currently trading near 57,574, hovering just above its key Opening Support zone (57,423 – 57,504). The index has been consolidating after recent declines and is now positioned between two crucial areas — Opening Resistance at 57,658 and Last Intraday Resistance at 57,883.

A strong move beyond either side of this range is likely to set the tone for the day. Intraday volatility may rise around the open, so confirmation and patience will be key.

🟢 Scenario 1: GAP-UP Opening (200+ Points)

If Bank Nifty opens around or above 57,750 – 57,800, it will directly approach the Opening Resistance zone. This area will act as the first major test for bulls.

💡 Educational Note:

Gap-up openings often cause over-enthusiasm. Let the market show its intent. Sustained strength with high volume near resistance confirms that institutional buyers are active. A fake breakout without volume can lead to sharp intraday reversals.

🟧 Scenario 2: FLAT Opening (Within 57,504 – 57,658)

A flat opening near the Opening Resistance and Opening Support zones may keep the index choppy in the first 30 minutes. Both buyers and sellers are likely to test strength before committing directionally.

🧠 Educational Tip:

Flat openings are ideal for breakout traders. Always react to confirmed breakouts rather than anticipating them. False moves during consolidation phases are the number one reason for premature losses.

🔴 Scenario 3: GAP-DOWN Opening (200+ Points)

If Bank Nifty opens below 57,350, it enters the weak zone near the Opening Support (57,423 – 57,504).

📘 Educational Insight:

Gap-downs often begin with emotional selling. Most profitable trades form when you identify where sellers exhaust. Watch for signs like declining volume on down candles or sharp rejections near support zones — these often hint at reversals.

💼 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS:

📈 SUMMARY:

📚 CONCLUSION:

Bank Nifty is trading at a crucial inflection point, where 57,658 acts as a key breakout level and 57,423 serves as an immediate defense for bulls. A breakout beyond these levels will dictate intraday direction.

The best trades tomorrow will come from waiting for confirmation — not prediction. Respect price structure, stay disciplined, and always trade based on technical evidence rather than emotion.

📊 Patience + Planning = Profitable Trading.

⚠️ DISCLAIMER:

I am not a SEBI-registered analyst. The analysis shared above is purely for educational purposes and to promote informed trading practices. Please consult a certified financial advisor before making any trading or investment decisions.

(Timeframe Reference: 15-Min Chart)

Chart Summary:

Bank Nifty is currently trading near 57,574, hovering just above its key Opening Support zone (57,423 – 57,504). The index has been consolidating after recent declines and is now positioned between two crucial areas — Opening Resistance at 57,658 and Last Intraday Resistance at 57,883.

A strong move beyond either side of this range is likely to set the tone for the day. Intraday volatility may rise around the open, so confirmation and patience will be key.

🟢 Scenario 1: GAP-UP Opening (200+ Points)

If Bank Nifty opens around or above 57,750 – 57,800, it will directly approach the Opening Resistance zone. This area will act as the first major test for bulls.

- []If price sustains above 57,883 (Last Intraday Resistance), expect bullish continuation towards 58,088, where profit booking may emerge.

[]Look for strong bullish candles with rising volume before taking long positions — avoid chasing the first candle of the day.

[]If price fails to sustain above 57,883 and shows rejection wicks or bearish engulfing patterns, it may retrace back to 57,658 – 57,574.

[]Ideal strategy: Wait for a retest of 57,658 with support confirmation before entering fresh longs. This provides a safer risk-reward setup.

💡 Educational Note:

Gap-up openings often cause over-enthusiasm. Let the market show its intent. Sustained strength with high volume near resistance confirms that institutional buyers are active. A fake breakout without volume can lead to sharp intraday reversals.

🟧 Scenario 2: FLAT Opening (Within 57,504 – 57,658)

A flat opening near the Opening Resistance and Opening Support zones may keep the index choppy in the first 30 minutes. Both buyers and sellers are likely to test strength before committing directionally.

- []Avoid early trades within this band (57,504 – 57,658) — it’s a neutral range with limited edge.

[]If price breaks above 57,658 decisively, watch for momentum toward 57,883 and 58,088.

[]If price breaks below 57,504, expect weakness towards 57,423, followed by 57,239 (Last Intraday Support).

[]Breakouts supported by volume expansion are more reliable — low-volume moves near these zones often trap traders.

🧠 Educational Tip:

Flat openings are ideal for breakout traders. Always react to confirmed breakouts rather than anticipating them. False moves during consolidation phases are the number one reason for premature losses.

🔴 Scenario 3: GAP-DOWN Opening (200+ Points)

If Bank Nifty opens below 57,350, it enters the weak zone near the Opening Support (57,423 – 57,504).

- []If price forms a reversal pattern (hammer, bullish engulfing, or double bottom) near 57,239 – 57,300, traders can look for a short-covering opportunity toward 57,574 – 57,658.

[]However, a sustained break below 57,239 with heavy selling volume could accelerate downside momentum toward 57,100 – 57,000. - Avoid aggressive shorts on deep gap-downs; instead, wait for a pullback toward resistance for better entries.

📘 Educational Insight:

Gap-downs often begin with emotional selling. Most profitable trades form when you identify where sellers exhaust. Watch for signs like declining volume on down candles or sharp rejections near support zones — these often hint at reversals.

💼 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS:

- []Avoid buying options in the first 15–20 minutes — early IV spikes make premiums expensive and often lead to time decay once volatility cools.

[]Define your stop-loss clearly before entering; never risk more than 1–2% of your total trading capital per trade.

[]If you’re directional, prefer ITM options for stability and avoid far OTM strikes on range-bound or flat days.

[]Trail your stop-loss as soon as you capture a 30–40 point favorable move — this locks in profits while reducing downside risk. - Remember: Protecting your capital during uncertain sessions matters more than catching every move.

📈 SUMMARY:

- []🟧 Opening Support Zone: 57,423 – 57,504[]🟥 Resistance Zones: 57,658 / 57,883 / 58,088[]🟩 Support Zones: 57,239 / 57,100[]⚖️ Bias: Neutral-to-Bullish above 57,658 | Weakness below 57,504

📚 CONCLUSION:

Bank Nifty is trading at a crucial inflection point, where 57,658 acts as a key breakout level and 57,423 serves as an immediate defense for bulls. A breakout beyond these levels will dictate intraday direction.

The best trades tomorrow will come from waiting for confirmation — not prediction. Respect price structure, stay disciplined, and always trade based on technical evidence rather than emotion.

📊 Patience + Planning = Profitable Trading.

⚠️ DISCLAIMER:

I am not a SEBI-registered analyst. The analysis shared above is purely for educational purposes and to promote informed trading practices. Please consult a certified financial advisor before making any trading or investment decisions.

Trade closed: target reached

prices took support exactly at my levels (15minute chart) and seen a smart recovery met with higher targets Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.