BANK NIFTY TRADING PLAN – 07-Oct-2025

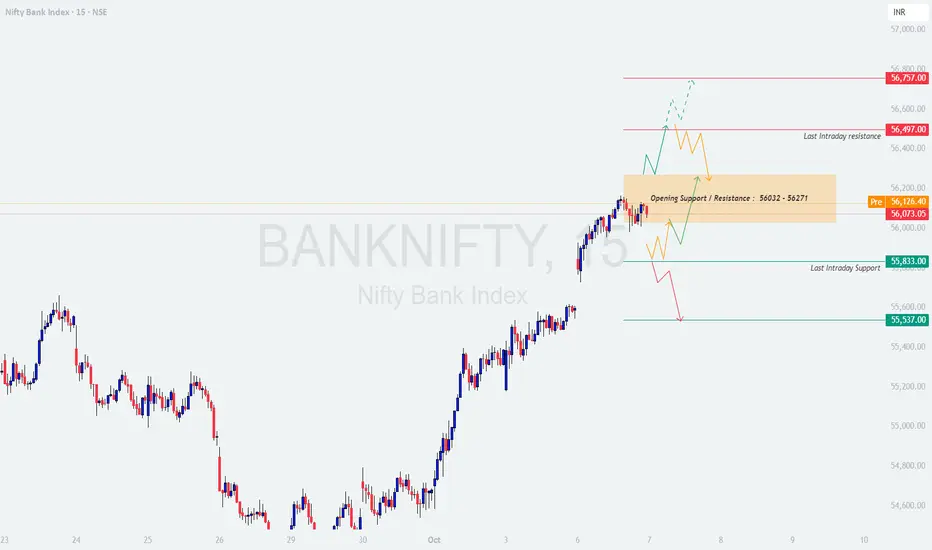

Bank Nifty closed at 56,073, showing slight consolidation after a strong rally in recent sessions. The index is currently hovering around a short-term decision zone, suggesting that the next directional move could emerge from the Opening Support/Resistance band (56,032 – 56,271). Tomorrow’s behavior around this area will be critical to define intraday bias.

📊 Key Technical Levels:

Opening Support / Resistance: 56,032 – 56,271

Last Intraday Resistance: 56,497

Major Resistance: 56,757

Last Intraday Support: 55,833

Major Support: 55,537

🚀 Scenario 1: Gap Up Opening (200+ points)

📘 Educational Note: Gap-ups near resistance often trigger early euphoria but also risk reversal traps. Always confirm a breakout with strong volume and closing strength.

⚖️ Scenario 2: Flat Opening (within ±200 points)

📘 Educational Note: Flat openings reflect indecision. Allow the market to establish direction through initial range expansion before positioning aggressively.

📉 Scenario 3: Gap Down Opening (200+ points)

📘 Educational Note: Gap-downs often create emotional selling. Instead of panic trades, look for reversal confirmations at major supports for high R:R setups.

🛡️ Risk Management Tips for Options Traders

📌 Summary & Conclusion

📈 The index remains in a short-term uptrend but faces immediate resistance at 56,497. A breakout could extend momentum, while a failure near resistance may trigger mild correction. Patience and disciplined entries near levels will be key to capturing tomorrow’s move effectively.

⚠️ Disclaimer: This analysis is for educational purposes only. I am not a SEBI-registered analyst. Please perform your own research or consult a financial advisor before taking any trading decisions.

Bank Nifty closed at 56,073, showing slight consolidation after a strong rally in recent sessions. The index is currently hovering around a short-term decision zone, suggesting that the next directional move could emerge from the Opening Support/Resistance band (56,032 – 56,271). Tomorrow’s behavior around this area will be critical to define intraday bias.

📊 Key Technical Levels:

Opening Support / Resistance: 56,032 – 56,271

Last Intraday Resistance: 56,497

Major Resistance: 56,757

Last Intraday Support: 55,833

Major Support: 55,537

🚀 Scenario 1: Gap Up Opening (200+ points)

- [] If Bank Nifty opens above 56,271, it will likely attempt to test the Last Intraday Resistance at 56,497.

[] Sustained trading above 56,497 may extend the bullish trend toward 56,757, marking a potential breakout zone for momentum traders.

[] However, if the index fails to hold above 56,271 and shows rejection candles near resistance, early profit booking can push prices back toward the 56,032 zone.

[] Traders should wait for a 15-min confirmation candle above 56,497 before entering long positions. Avoid chasing a gap-up blindly.

📘 Educational Note: Gap-ups near resistance often trigger early euphoria but also risk reversal traps. Always confirm a breakout with strong volume and closing strength.

⚖️ Scenario 2: Flat Opening (within ±200 points)

- [] A flat opening near 56,000 will keep the price action within the Opening Support/Resistance zone (56,032 – 56,271).

[] If the price sustains above 56,271, bulls could regain control and target 56,497.

[] On the contrary, a breakdown below 56,032 may invite selling pressure, dragging the index towards 55,833 initially.

[] The best strategy here is to let the first 30 minutes define direction — trade only on clear breakouts from this box range.

📘 Educational Note: Flat openings reflect indecision. Allow the market to establish direction through initial range expansion before positioning aggressively.

📉 Scenario 3: Gap Down Opening (200+ points)

- [] If Bank Nifty opens near 55,800 or below, it will test the Last Intraday Support at 55,833.

[] A decisive breakdown below 55,833 can extend weakness toward 55,537, which is a key bounce zone.

[] Conversely, if 55,833 holds firmly and bullish reversal candles form, expect a short-covering move toward 56,000+.

[] Avoid aggressive shorts near 55,537; this level can attract strong dip-buying interest.

📘 Educational Note: Gap-downs often create emotional selling. Instead of panic trades, look for reversal confirmations at major supports for high R:R setups.

🛡️ Risk Management Tips for Options Traders

- [] 🕒 Avoid trading in the first 15–30 minutes — allow volatility to settle.

[] 🛑 Always use hourly candle closes for SL validation instead of reacting to noise.

[] 💡 Prefer Bull Call / Bear Put Spreads near key levels to manage premium decay.

[] 💰 Follow a strict 1:2 Risk-Reward Ratio — never enter trades without clear R:R visibility.

[] 📉 Trail profits after every 100–150 points to protect gains in trending markets.

[] 🚫 Never risk more than 2%–3% of total capital on a single trade.

📌 Summary & Conclusion

- [] Bullish Bias: Above 56,497, upside targets 56,757 → 56,900.

[] Neutral Zone: Between 56,032 – 56,271, expect sideways volatility until breakout. - Bearish Bias: Below 55,833, weakness may extend towards 55,537.

📈 The index remains in a short-term uptrend but faces immediate resistance at 56,497. A breakout could extend momentum, while a failure near resistance may trigger mild correction. Patience and disciplined entries near levels will be key to capturing tomorrow’s move effectively.

⚠️ Disclaimer: This analysis is for educational purposes only. I am not a SEBI-registered analyst. Please perform your own research or consult a financial advisor before taking any trading decisions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.