~~Stock Performance~~

Market Cap: Approximately ₹15,386–16,047 crore as of May–June 2025.

Share Price: As of June 27, 2025, the stock closed at ₹1,231.85 (BSE), down 14.62% over the past year. The 52-week high was ₹1,633, and the low was ₹1,136.40.

Analyst Outlook: The median 12-month target price is ₹1,242.94, with a high of ₹1,511 and a low of ₹1,011, indicating mixed expectations.

Stock Trend: The stock has underperformed, declining 10% over five years compared to a 170% rise in the Nifty 500 index.

Market and Competitive Position

Promoter Holding: 50.16% as of March 2025, stable from June 2024.

Peers: Competitors include Metro Brands, Relaxo Footwear, Campus Activewear, and Mayur Uniquoters. Bata’s high P/B ratio suggests it trades at a premium, but its P/E ratio indicates potential value compared to peers.

Global Context: Bata Corporation, the parent company, operates 5,300 stores across 70 countries and 21 production facilities, reinforcing Bata India’s strong backing.

Sentiment and Challenges

Consumer Sentiment: Some posts on X reflect negative sentiment, with users criticising Bata’s quality compared to earlier decades, indicating potential brand perception issues.

Market Challenges: Bata struggles with stagnant sales growth and competition in the premium segment, where rivals like Metro Brands have gained traction.

Conclusion

Bata India remains a dominant player in the Indian footwear market but faces challenges with slow revenue growth and declining profitability in FY24. Its focus on premiumization and store expansion shows promise, as evidenced by a strong Q2 FY25. However, the stock’s underperformance and high P/B ratio suggest investor caution. For detailed financial statements, refer to Bata India’s annual reports on bata.in or platforms like Moneycontrol and Equitymaster.

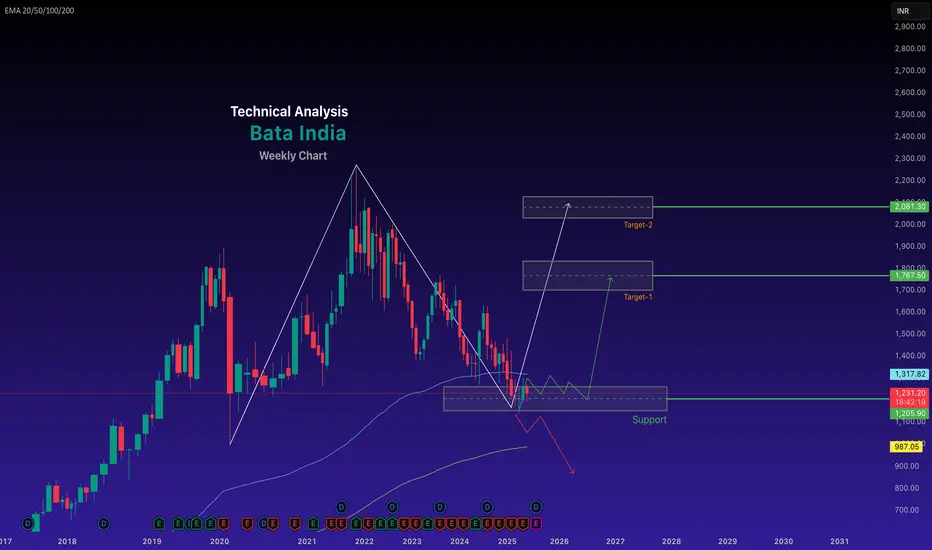

Support and resistance marked in the chart for your reference

~~Stock Performance~~

Market Cap: Approximately ₹15,386–16,047 crore as of May–June 2025.

Share Price: As of June 27, 2025, the stock closed at ₹1,231.85 (BSE), down 14.62% over the past year. The 52-week high was ₹1,633, and the low was ₹1,136.40.

Analyst Outlook: The median 12-month target price is ₹1,242.94, with a high of ₹1,511 and a low of ₹1,011, indicating mixed expectations.

Stock Trend: The stock has underperformed, declining 10% over five years compared to a 170% rise in the Nifty 500 index.

Market and Competitive Position

Promoter Holding: 50.16% as of March 2025, stable from June 2024.

Peers: Competitors include Metro Brands, Relaxo Footwear, Campus Activewear, and Mayur Uniquoters. Bata’s high P/B ratio suggests it trades at a premium, but its P/E ratio indicates potential value compared to peers.

Global Context: Bata Corporation, the parent company, operates 5,300 stores across 70 countries and 21 production facilities, reinforcing Bata India’s strong backing.

Sentiment and Challenges

Consumer Sentiment: Some posts on X reflect negative sentiment, with users criticising Bata’s quality compared to earlier decades, indicating potential brand perception issues.

Market Challenges: Bata struggles with stagnant sales growth and competition in the premium segment, where rivals like Metro Brands have gained traction.

Conclusion

Bata India remains a dominant player in the Indian footwear market but faces challenges with slow revenue growth and declining profitability in FY24. Its focus on premiumization and store expansion shows promise, as evidenced by a strong Q2 FY25. However, the stock’s underperformance and high P/B ratio suggest investor caution. For detailed financial statements, refer to Bata India’s annual reports on bata.in or platforms like Moneycontrol and Equitymaster.

Support and resistance marked in the chart for your reference

- Disclaimer --

This analysis is based on recent technical data and market sentiment from web sources. It is for informational purposes only and not financial advice. Trading involves high risks, and past performance does not guarantee future results. Always conduct your own research or consult a SEBI-registered advisor before trading.

#Boost and comment will be highly appreciated

Market Cap: Approximately ₹15,386–16,047 crore as of May–June 2025.

Share Price: As of June 27, 2025, the stock closed at ₹1,231.85 (BSE), down 14.62% over the past year. The 52-week high was ₹1,633, and the low was ₹1,136.40.

Analyst Outlook: The median 12-month target price is ₹1,242.94, with a high of ₹1,511 and a low of ₹1,011, indicating mixed expectations.

Stock Trend: The stock has underperformed, declining 10% over five years compared to a 170% rise in the Nifty 500 index.

Market and Competitive Position

Promoter Holding: 50.16% as of March 2025, stable from June 2024.

Peers: Competitors include Metro Brands, Relaxo Footwear, Campus Activewear, and Mayur Uniquoters. Bata’s high P/B ratio suggests it trades at a premium, but its P/E ratio indicates potential value compared to peers.

Global Context: Bata Corporation, the parent company, operates 5,300 stores across 70 countries and 21 production facilities, reinforcing Bata India’s strong backing.

Sentiment and Challenges

Consumer Sentiment: Some posts on X reflect negative sentiment, with users criticising Bata’s quality compared to earlier decades, indicating potential brand perception issues.

Market Challenges: Bata struggles with stagnant sales growth and competition in the premium segment, where rivals like Metro Brands have gained traction.

Conclusion

Bata India remains a dominant player in the Indian footwear market but faces challenges with slow revenue growth and declining profitability in FY24. Its focus on premiumization and store expansion shows promise, as evidenced by a strong Q2 FY25. However, the stock’s underperformance and high P/B ratio suggest investor caution. For detailed financial statements, refer to Bata India’s annual reports on bata.in or platforms like Moneycontrol and Equitymaster.

Support and resistance marked in the chart for your reference

~~Stock Performance~~

Market Cap: Approximately ₹15,386–16,047 crore as of May–June 2025.

Share Price: As of June 27, 2025, the stock closed at ₹1,231.85 (BSE), down 14.62% over the past year. The 52-week high was ₹1,633, and the low was ₹1,136.40.

Analyst Outlook: The median 12-month target price is ₹1,242.94, with a high of ₹1,511 and a low of ₹1,011, indicating mixed expectations.

Stock Trend: The stock has underperformed, declining 10% over five years compared to a 170% rise in the Nifty 500 index.

Market and Competitive Position

Promoter Holding: 50.16% as of March 2025, stable from June 2024.

Peers: Competitors include Metro Brands, Relaxo Footwear, Campus Activewear, and Mayur Uniquoters. Bata’s high P/B ratio suggests it trades at a premium, but its P/E ratio indicates potential value compared to peers.

Global Context: Bata Corporation, the parent company, operates 5,300 stores across 70 countries and 21 production facilities, reinforcing Bata India’s strong backing.

Sentiment and Challenges

Consumer Sentiment: Some posts on X reflect negative sentiment, with users criticising Bata’s quality compared to earlier decades, indicating potential brand perception issues.

Market Challenges: Bata struggles with stagnant sales growth and competition in the premium segment, where rivals like Metro Brands have gained traction.

Conclusion

Bata India remains a dominant player in the Indian footwear market but faces challenges with slow revenue growth and declining profitability in FY24. Its focus on premiumization and store expansion shows promise, as evidenced by a strong Q2 FY25. However, the stock’s underperformance and high P/B ratio suggest investor caution. For detailed financial statements, refer to Bata India’s annual reports on bata.in or platforms like Moneycontrol and Equitymaster.

Support and resistance marked in the chart for your reference

- Disclaimer --

This analysis is based on recent technical data and market sentiment from web sources. It is for informational purposes only and not financial advice. Trading involves high risks, and past performance does not guarantee future results. Always conduct your own research or consult a SEBI-registered advisor before trading.

#Boost and comment will be highly appreciated

renderwithme

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

renderwithme

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.