Core Logic for Short-Term Long Positions

1.Distinct Sentiment Rebound Signals After BottomingMarket sentiment is near the historical bottom zone. Amplified negative talks on social media and retail investors’ phased withdrawal are typical signs before repeated market stabilization after stopping declines. The NUP ratio has fallen to 0.476. This range has repeatedly marked short-term bottoms historically, spurring several double-digit rebounds over the past year and offering sufficient room for sentiment recovery.

2.Resonant Technical Support with Strong TenacityAs the 0.618 Fibonacci Retracement of the recent downtrend, $94,200 proved effective as support in Q4 2024. It rebounded sharply after hitting $94,000 this time, forming a solid support. Now the price has firmly held the key short-term support at $95,543. The shrinking MACD Histogram signals fading bearish momentum and emerging bullish counterattacks, laying solid technical ground for a rebound.

3.Latent Upsides in On-Chain Data and Capital FlowOn-chain data reveals mid-and-small BTC holders (1 - 1000 BTC) have kept net accumulation since early October, while "smart money" is positioning via the pullback. Though the market is in the doldrums, the OTC market has stable receiving capacity and no large-scale panic selling, providing basic capital backup for the short-term rebound.

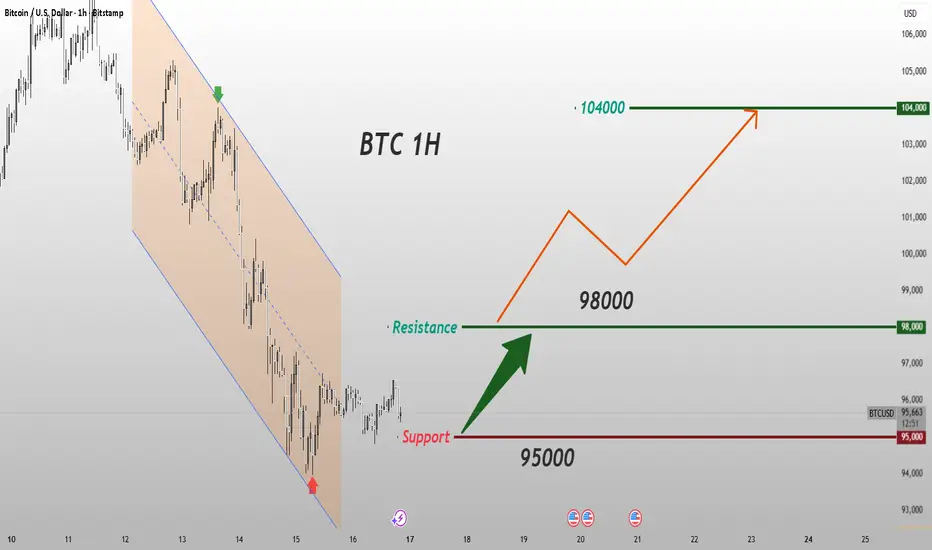

Bitcoin trading strategy

buy:95000-96000

tp:97000-98000

sl:93500

1.Distinct Sentiment Rebound Signals After BottomingMarket sentiment is near the historical bottom zone. Amplified negative talks on social media and retail investors’ phased withdrawal are typical signs before repeated market stabilization after stopping declines. The NUP ratio has fallen to 0.476. This range has repeatedly marked short-term bottoms historically, spurring several double-digit rebounds over the past year and offering sufficient room for sentiment recovery.

2.Resonant Technical Support with Strong TenacityAs the 0.618 Fibonacci Retracement of the recent downtrend, $94,200 proved effective as support in Q4 2024. It rebounded sharply after hitting $94,000 this time, forming a solid support. Now the price has firmly held the key short-term support at $95,543. The shrinking MACD Histogram signals fading bearish momentum and emerging bullish counterattacks, laying solid technical ground for a rebound.

3.Latent Upsides in On-Chain Data and Capital FlowOn-chain data reveals mid-and-small BTC holders (1 - 1000 BTC) have kept net accumulation since early October, while "smart money" is positioning via the pullback. Though the market is in the doldrums, the OTC market has stable receiving capacity and no large-scale panic selling, providing basic capital backup for the short-term rebound.

Bitcoin trading strategy

buy:95000-96000

tp:97000-98000

sl:93500

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.