In the fast-paced world of cryptocurrencies, few events garner as much attention and speculation as the Bitcoin halving. This pre-programmed event, occurring roughly every four years, has become a cornerstone of Bitcoin's monetary policy. However, beneath the hype and excitement lies an uncomfortable truth that every investor should be aware of.

Let's delve into the nuances of Bitcoin halving and uncover some lesser-known truths:

What it is:

💡Bitcoin halving is an event programmed into the Bitcoin protocol that occurs approximately every four years.

⛏️It involves cutting the reward for Bitcoin miners in half, reducing the rate at which new Bitcoins are created.

💰This reduction in supply typically leads to increased scarcity of Bitcoin.

📈The halving is a crucial aspect of Bitcoin's deflationary monetary policy, designed to mimic the scarcity of finite resources like gold.

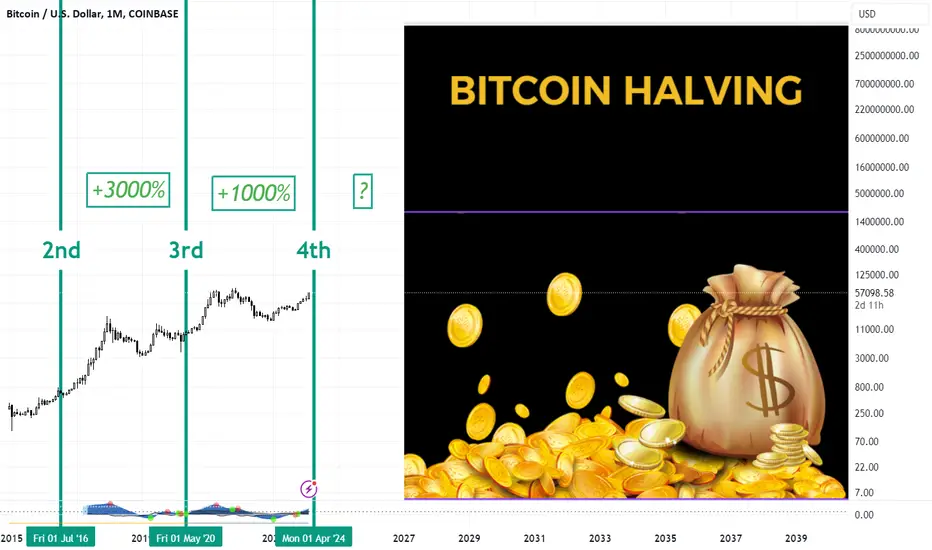

🔄Historically, Bitcoin halvings have been associated with significant price rallies, as the reduced supply often triggers increased demand.

⏳It creates a predictable supply schedule, making Bitcoin less susceptible to inflationary pressures compared to fiat currencies.

What are the effects:

Diminishing Returns: While the halving is often hailed as a catalyst for price surges, the reality is more nuanced. With each halving, the impact on price tends to diminish. The first halving in 2012 saw astronomical price increases, but subsequent halvings have yielded more modest gains. Investors should temper their expectations accordingly.

Market Overreaction: The lead-up to a halving is often characterized by frenzied speculation and anticipation. However, these periods of exuberance can lead to overvalued markets and subsequent corrections. It's essential to navigate these volatile waters with caution and avoid being swept up in the hype.

Mining Centralization: While the halving is intended to preserve Bitcoin's scarcity, it also exacerbates the centralization of mining power. As block rewards diminish, smaller miners may find it increasingly challenging to remain profitable, leading to further consolidation of mining operations. This concentration of power runs counter to Bitcoin's ethos of decentralization.

Environmental Impact: Bitcoin mining already consumes a significant amount of energy, and the halving exacerbates this issue. As block rewards shrink, miners may resort to more energy-intensive methods to maintain profitability. This has raised concerns about Bitcoin's environmental footprint and its sustainability in the long term.

Technological Innovation: The halving serves as a natural incentive for technological innovation in the mining sector. As margins tighten, miners are compelled to seek out more efficient hardware and practices to remain competitive. While this drive for innovation is positive, it also underscores the relentless arms race inherent in Bitcoin mining.

Long-Term Stability: Ultimately, the halving is a crucial mechanism for maintaining Bitcoin's long-term stability and scarcity. While short-term fluctuations may be volatile, the halving reinforces Bitcoin's position as a deflationary asset with a finite supply. This inherent scarcity is fundamental to its value proposition as digital gold.

In conclusion, while the Bitcoin halving is undoubtedly a pivotal event in the cryptocurrency calendar, it's essential to approach it with a balanced perspective. While it may bring short-term price excitement, it also poses challenges and uncertainties that investors must consider. By understanding the uncomfortable truths surrounding the halving, you can navigate the crypto landscape with greater clarity and foresight.

Follow for more insight.

Let's delve into the nuances of Bitcoin halving and uncover some lesser-known truths:

What it is:

💡Bitcoin halving is an event programmed into the Bitcoin protocol that occurs approximately every four years.

⛏️It involves cutting the reward for Bitcoin miners in half, reducing the rate at which new Bitcoins are created.

💰This reduction in supply typically leads to increased scarcity of Bitcoin.

📈The halving is a crucial aspect of Bitcoin's deflationary monetary policy, designed to mimic the scarcity of finite resources like gold.

🔄Historically, Bitcoin halvings have been associated with significant price rallies, as the reduced supply often triggers increased demand.

⏳It creates a predictable supply schedule, making Bitcoin less susceptible to inflationary pressures compared to fiat currencies.

What are the effects:

Diminishing Returns: While the halving is often hailed as a catalyst for price surges, the reality is more nuanced. With each halving, the impact on price tends to diminish. The first halving in 2012 saw astronomical price increases, but subsequent halvings have yielded more modest gains. Investors should temper their expectations accordingly.

Market Overreaction: The lead-up to a halving is often characterized by frenzied speculation and anticipation. However, these periods of exuberance can lead to overvalued markets and subsequent corrections. It's essential to navigate these volatile waters with caution and avoid being swept up in the hype.

Mining Centralization: While the halving is intended to preserve Bitcoin's scarcity, it also exacerbates the centralization of mining power. As block rewards diminish, smaller miners may find it increasingly challenging to remain profitable, leading to further consolidation of mining operations. This concentration of power runs counter to Bitcoin's ethos of decentralization.

Environmental Impact: Bitcoin mining already consumes a significant amount of energy, and the halving exacerbates this issue. As block rewards shrink, miners may resort to more energy-intensive methods to maintain profitability. This has raised concerns about Bitcoin's environmental footprint and its sustainability in the long term.

Technological Innovation: The halving serves as a natural incentive for technological innovation in the mining sector. As margins tighten, miners are compelled to seek out more efficient hardware and practices to remain competitive. While this drive for innovation is positive, it also underscores the relentless arms race inherent in Bitcoin mining.

Long-Term Stability: Ultimately, the halving is a crucial mechanism for maintaining Bitcoin's long-term stability and scarcity. While short-term fluctuations may be volatile, the halving reinforces Bitcoin's position as a deflationary asset with a finite supply. This inherent scarcity is fundamental to its value proposition as digital gold.

In conclusion, while the Bitcoin halving is undoubtedly a pivotal event in the cryptocurrency calendar, it's essential to approach it with a balanced perspective. While it may bring short-term price excitement, it also poses challenges and uncertainties that investors must consider. By understanding the uncomfortable truths surrounding the halving, you can navigate the crypto landscape with greater clarity and foresight.

Follow for more insight.

🎯BOOK 121 TRAINING MASTERCLASS: tradejournal.co.uk/book-1-to-1-master-class/

🎯JOIN ONLINE BOOTCAMP:

WHEN? Last Sunday each month!

tradejournal.co.uk/bootcamp/

🎯Join Discord Community: discord.gg/SFmbjseS89

🎯JOIN ONLINE BOOTCAMP:

WHEN? Last Sunday each month!

tradejournal.co.uk/bootcamp/

🎯Join Discord Community: discord.gg/SFmbjseS89

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🎯BOOK 121 TRAINING MASTERCLASS: tradejournal.co.uk/book-1-to-1-master-class/

🎯JOIN ONLINE BOOTCAMP:

WHEN? Last Sunday each month!

tradejournal.co.uk/bootcamp/

🎯Join Discord Community: discord.gg/SFmbjseS89

🎯JOIN ONLINE BOOTCAMP:

WHEN? Last Sunday each month!

tradejournal.co.uk/bootcamp/

🎯Join Discord Community: discord.gg/SFmbjseS89

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.