Cleveland-Cliffs (NYSE:  CLF) is scheduled to announce its earnings on Tuesday, October 21, 2025.

CLF) is scheduled to announce its earnings on Tuesday, October 21, 2025.

Analyst anticipate the company will reveal quarterly revenues close to $5.2 billion, propelled by rising steel prices and increased shipment volumes.

However, we predict that the company will report a loss of approximately $0.30 per share, as margins continue to be pressured by elevated energy and labor expenses.

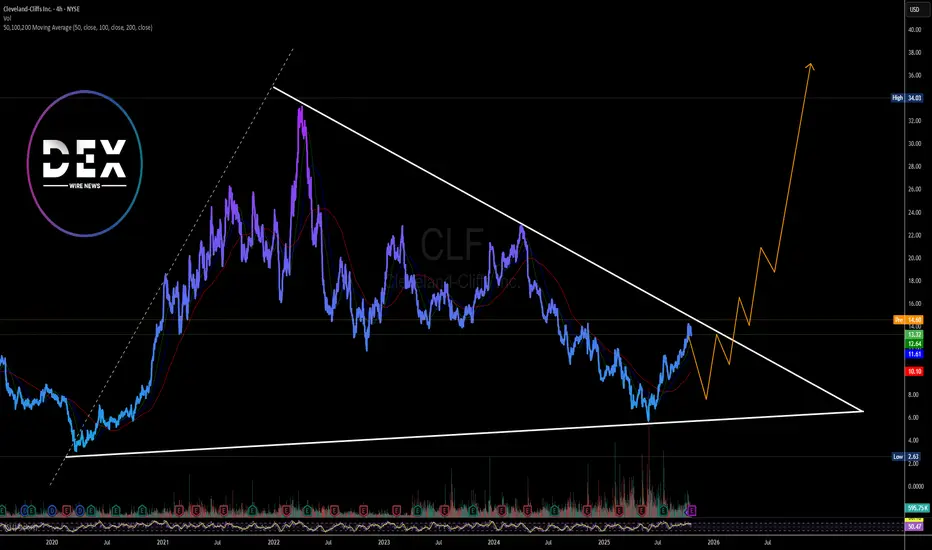

Technically, CLF stock is set to breakout of a bullish symmetrical triangle should favorable reports surface today. additionally, the asset is up 9% in premarket trading on Monday morning.

CLF stock is set to breakout of a bullish symmetrical triangle should favorable reports surface today. additionally, the asset is up 9% in premarket trading on Monday morning.

About CLF

Cleveland-Cliffs Inc. operates as a flat-rolled steel producer in the United States, Canada, and internationally. The company offers hot-rolled, cold-rolled, electrogalvanized, hot-dip galvanized and galvannealed, aluminized, galvalume, enameling, and advanced high-strength steel products.

Total Valuation

CLF has a market cap or net worth of $6.59 billion. The enterprise value is $14.56 billion.

Stock Price Statistics

The stock price has increased by +2.07% in the last 52 weeks. The beta is 1.97, so CLF's price volatility has been higher than the market average.

Analyst anticipate the company will reveal quarterly revenues close to $5.2 billion, propelled by rising steel prices and increased shipment volumes.

However, we predict that the company will report a loss of approximately $0.30 per share, as margins continue to be pressured by elevated energy and labor expenses.

Technically,

About CLF

Cleveland-Cliffs Inc. operates as a flat-rolled steel producer in the United States, Canada, and internationally. The company offers hot-rolled, cold-rolled, electrogalvanized, hot-dip galvanized and galvannealed, aluminized, galvalume, enameling, and advanced high-strength steel products.

Total Valuation

CLF has a market cap or net worth of $6.59 billion. The enterprise value is $14.56 billion.

Stock Price Statistics

The stock price has increased by +2.07% in the last 52 weeks. The beta is 1.97, so CLF's price volatility has been higher than the market average.

⭐⭐⭐ Sign Up for Free ⭐⭐⭐

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Chat Room >> discord.gg/x3EQven3ZY

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Chat Room >> discord.gg/x3EQven3ZY

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⭐⭐⭐ Sign Up for Free ⭐⭐⭐

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Chat Room >> discord.gg/x3EQven3ZY

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Chat Room >> discord.gg/x3EQven3ZY

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.