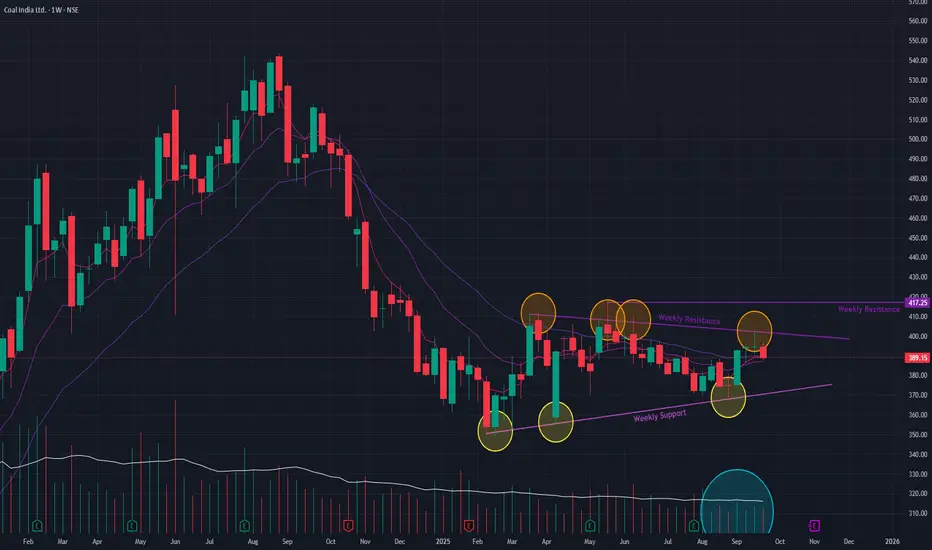

Following a significant downtrend that began in August 2024, Coal India has entered a sideways consolidation phase, which has been in place since December 2024. This prolonged period of consolidation after a downtrend is forming what appears to be a Bear Flag, a classic continuation pattern that typically resolves to the downside.

The stock is currently trading within this pattern, approaching a critical juncture.

Bearish Indicators to Note 📉

The negative outlook is supported by key observations:

- Continuation Pattern: The formation of a Bear Flag itself suggests that the pause is likely a prelude to resuming the prior downtrend.

- Declining Volume: Trading volume has been noticeably drying up during this consolidation phase, which often indicates a lack of buying conviction and can precede a breakdown.

Outlook and Key Levels

The price action in the coming weeks will be crucial.

- Bearish Case: A breakdown below the lower trendline of the flag pattern, especially on a spike in volume, would confirm the continuation of the downtrend.

- Bullish Reversal: To invalidate the bearish pattern, the stock must stage a decisive breakout above the upper resistance trendline of the flag, supported by a massive surge in volume. Until such a breakout occurs, the prevailing technical bias remains bearish.

The stock is currently trading within this pattern, approaching a critical juncture.

Bearish Indicators to Note 📉

The negative outlook is supported by key observations:

- Continuation Pattern: The formation of a Bear Flag itself suggests that the pause is likely a prelude to resuming the prior downtrend.

- Declining Volume: Trading volume has been noticeably drying up during this consolidation phase, which often indicates a lack of buying conviction and can precede a breakdown.

Outlook and Key Levels

The price action in the coming weeks will be crucial.

- Bearish Case: A breakdown below the lower trendline of the flag pattern, especially on a spike in volume, would confirm the continuation of the downtrend.

- Bullish Reversal: To invalidate the bearish pattern, the stock must stage a decisive breakout above the upper resistance trendline of the flag, supported by a massive surge in volume. Until such a breakout occurs, the prevailing technical bias remains bearish.

Disclaimer: This analysis is my personal view & for educational purposes only. They shall not be construed as trade or investment advice. Before making any financial decision, it is imperative that you consult with a qualified financial professional.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer: This analysis is my personal view & for educational purposes only. They shall not be construed as trade or investment advice. Before making any financial decision, it is imperative that you consult with a qualified financial professional.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.