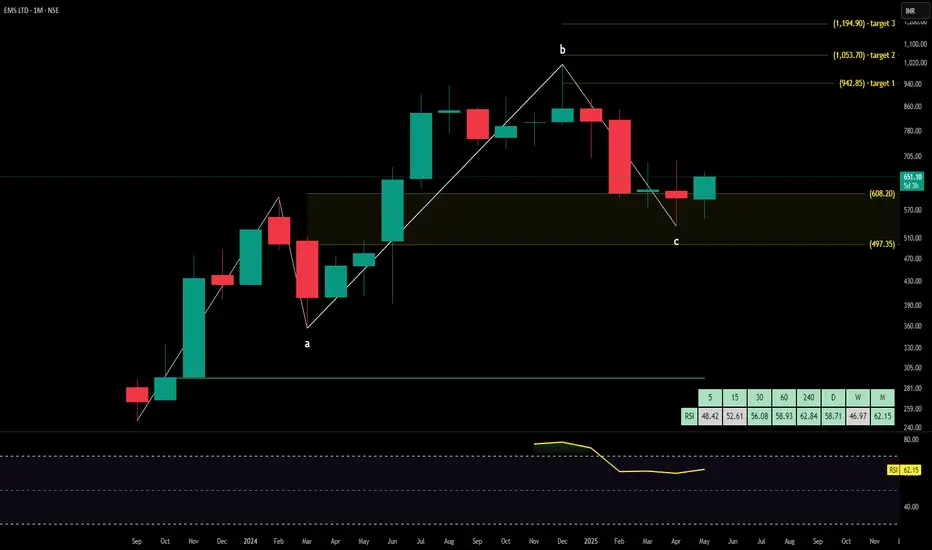

EMS Ltd. (NSE: EMS) is currently trading at INR 651.10. The company operates in the engineering and infrastructure sector, specializing in water and wastewater management solutions, catering to industrial and municipal needs.

Key Levels

Support Level: INR 497.35

Swing Level: INR 718.75

Possible Upside Levels: INR 942.85, INR 1,053.70, INR 1,194.90

Technical Indicators

RSI: The Relative Strength Index (RSI) is at 62.15 (monthly timeframe), reflecting strong momentum yet staying below the overbought threshold, suggesting continued strength with potential upside movement.

Volume: Trading volume is 4.06M, showing steady investor interest. Increased volume near breakout levels may confirm potential price movement toward higher levels.

Sector and Market Context

EMS Ltd. operates in a high-demand sector, benefiting from India’s push for sustainable water management and smart city projects. Government spending in water infrastructure continues to grow, supporting long-term revenue stability for firms in this industry. However, sector volatility due to raw material costs, contract execution challenges, and policy shifts remains a consideration. Broad market indicators suggest favorable conditions, with investors closely watching companies aligned with infrastructure modernization.

Latest News and Developments

Market Trends: Institutional investors show growing interest in infrastructure stocks amid increased government contracts for urban water management.

Analyst Ratings: Positive outlook backed by strong order execution and expanding pipeline of municipal projects.

Quarterly Results: Recent financial disclosures indicate steady revenue growth, aided by higher project completions and increased government tenders.

Dividend Update: No recent dividend declarations, signaling continued reinvestment into scaling operations and project fulfillment.

Analysis Summary

EMS Ltd. shows bullish technical trends, supported by strong momentum and sector tailwinds. The RSI reflects continued price strength, while volume indicates steady investor engagement. Sector dynamics remain favorable, driven by policy support and expanding market opportunities. Investors should monitor price action near swing levels, volume trends, and broader economic developments before making informed decisions.

Key Levels

Support Level: INR 497.35

Swing Level: INR 718.75

Possible Upside Levels: INR 942.85, INR 1,053.70, INR 1,194.90

Technical Indicators

RSI: The Relative Strength Index (RSI) is at 62.15 (monthly timeframe), reflecting strong momentum yet staying below the overbought threshold, suggesting continued strength with potential upside movement.

Volume: Trading volume is 4.06M, showing steady investor interest. Increased volume near breakout levels may confirm potential price movement toward higher levels.

Sector and Market Context

EMS Ltd. operates in a high-demand sector, benefiting from India’s push for sustainable water management and smart city projects. Government spending in water infrastructure continues to grow, supporting long-term revenue stability for firms in this industry. However, sector volatility due to raw material costs, contract execution challenges, and policy shifts remains a consideration. Broad market indicators suggest favorable conditions, with investors closely watching companies aligned with infrastructure modernization.

Latest News and Developments

Market Trends: Institutional investors show growing interest in infrastructure stocks amid increased government contracts for urban water management.

Analyst Ratings: Positive outlook backed by strong order execution and expanding pipeline of municipal projects.

Quarterly Results: Recent financial disclosures indicate steady revenue growth, aided by higher project completions and increased government tenders.

Dividend Update: No recent dividend declarations, signaling continued reinvestment into scaling operations and project fulfillment.

Analysis Summary

EMS Ltd. shows bullish technical trends, supported by strong momentum and sector tailwinds. The RSI reflects continued price strength, while volume indicates steady investor engagement. Sector dynamics remain favorable, driven by policy support and expanding market opportunities. Investors should monitor price action near swing levels, volume trends, and broader economic developments before making informed decisions.

Sucrit.D.Patil

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Sucrit.D.Patil

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.