6:14am EST - I posted my original plan on the 30 min chart and wanted to post on my typical 15 min chart.

------------------------------------------------------------------------------------------------

I wrote a post on August 19th - Big Picture View of Price - You can see it in the related publication section to the right along with yesterday's trade plan that triggered a great short squeeze.

I wrote on August 19th - "6468 was the level that sold off in late July. Could this be the same level that causes another big sell off? I have NO idea, that is not my job.

I find levels that institutions step in and buy/sell at. I follow the institutions footprint and enter trades using my edge at predefined levels." - What happened the past 2 days of trading? We lost 100+ pts and institutions stepped in at 6362 for a short squeeze yesterday.

What will happen today? I have NO Idea, that is not my job. It is to find levels that institutions are accumulating and follow them when price goes up. When ES flushes like yesterday, you have to get out the way and let price reclaim a level above and enter and ride along. Every trader has their own entry and exit strategy. That is more important than just finding levels, unless you are a scalper!

---------------------------------------------------------------------------------------------------------------------

August 21st - Daily Trade Plan - 6am EST

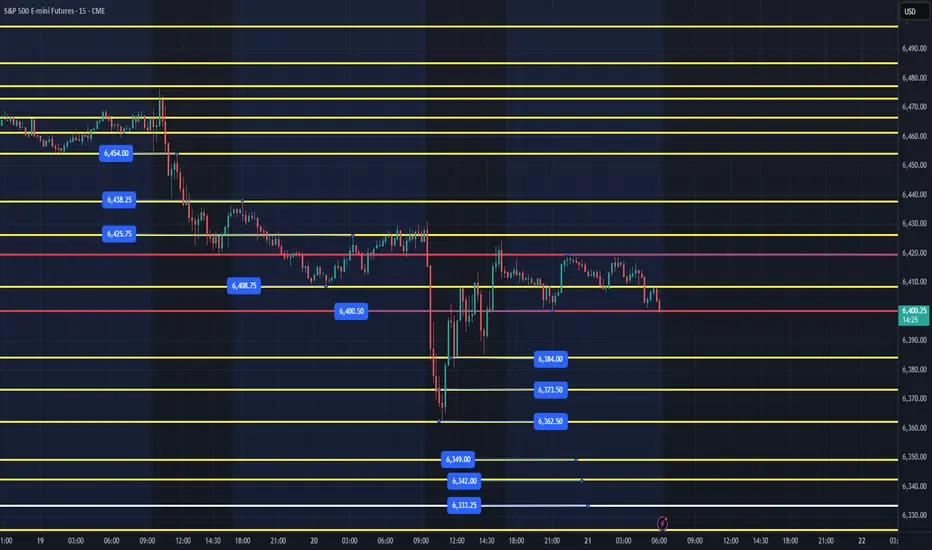

Overnight price has been trading in a tight range between 6400 and 6420. IF, we are going to continue higher we need to reclaim 6420 and work up the levels with 6438, 6454 being the top targets above. Ideally, we see price flush 6400, recover and we can enter to move back up the range. IF, price cannot reclaim 6400-03, we will need to find support below at one of the levels in yellow (6384, 6373, 6362), reclaim and work back up to retest the 6400-03 level.

My lean is that IF, we cannot break above 6420, we have a high probability of retesting yesterday's 6362 low. IF, we cannot clear 6384 from below, I will be looking for reactions at 6349, 6342, 6333, for another squeeze higher.

After yesterday's flush, there will be FOMO from retail traders, and they will think the next short will be another 50+pts. We could easily trap shorts and snap back very fast at any of the levels below.

I will post an update at 10am EST.

------------------------------------------------------------------------------------------------

I wrote a post on August 19th - Big Picture View of Price - You can see it in the related publication section to the right along with yesterday's trade plan that triggered a great short squeeze.

I wrote on August 19th - "6468 was the level that sold off in late July. Could this be the same level that causes another big sell off? I have NO idea, that is not my job.

I find levels that institutions step in and buy/sell at. I follow the institutions footprint and enter trades using my edge at predefined levels." - What happened the past 2 days of trading? We lost 100+ pts and institutions stepped in at 6362 for a short squeeze yesterday.

What will happen today? I have NO Idea, that is not my job. It is to find levels that institutions are accumulating and follow them when price goes up. When ES flushes like yesterday, you have to get out the way and let price reclaim a level above and enter and ride along. Every trader has their own entry and exit strategy. That is more important than just finding levels, unless you are a scalper!

---------------------------------------------------------------------------------------------------------------------

August 21st - Daily Trade Plan - 6am EST

Overnight price has been trading in a tight range between 6400 and 6420. IF, we are going to continue higher we need to reclaim 6420 and work up the levels with 6438, 6454 being the top targets above. Ideally, we see price flush 6400, recover and we can enter to move back up the range. IF, price cannot reclaim 6400-03, we will need to find support below at one of the levels in yellow (6384, 6373, 6362), reclaim and work back up to retest the 6400-03 level.

My lean is that IF, we cannot break above 6420, we have a high probability of retesting yesterday's 6362 low. IF, we cannot clear 6384 from below, I will be looking for reactions at 6349, 6342, 6333, for another squeeze higher.

After yesterday's flush, there will be FOMO from retail traders, and they will think the next short will be another 50+pts. We could easily trap shorts and snap back very fast at any of the levels below.

I will post an update at 10am EST.

Note

9:45am EST - UpdatePrice broke below to 6384 and is struggling to regain the 6400-03 level with 6397 the highest price since my post at 6am. Pretty simple, we either continue lower and lose the 6384 level or we reclaim the 6400-03 level and head higher. IF, we go lower, I will be looking at 6373 and 6362 levels for reactions. This is consistent with the plan I put out at 6am EST.

Note

10:22am EST - UpdateI wrote at 6am today in my daily trade plan - "After yesterday's flush, there will be FOMO from retail traders, and they will think the next short will be another 50+pts. We could easily trap shorts and snap back very fast at any of the levels below."

What happened? We tagged 6375 (my level was 6373) got bought up, tested again and got to 6379 and then took off... most retail traders were thinking it's going to be another flush... and guess what happened? We got a short squeeze and are now testing the 6408 level. We could easily chop around between 6420-6385 for the rest of the day and into tomorrow. Price is trying to figure out which way the next leg is going to be... again, I am not bullish until we reclaim the 6455-60 level, which is where price sold off from 2 days ago. IF, we can reclaim 6360 level, we could see new highs.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.