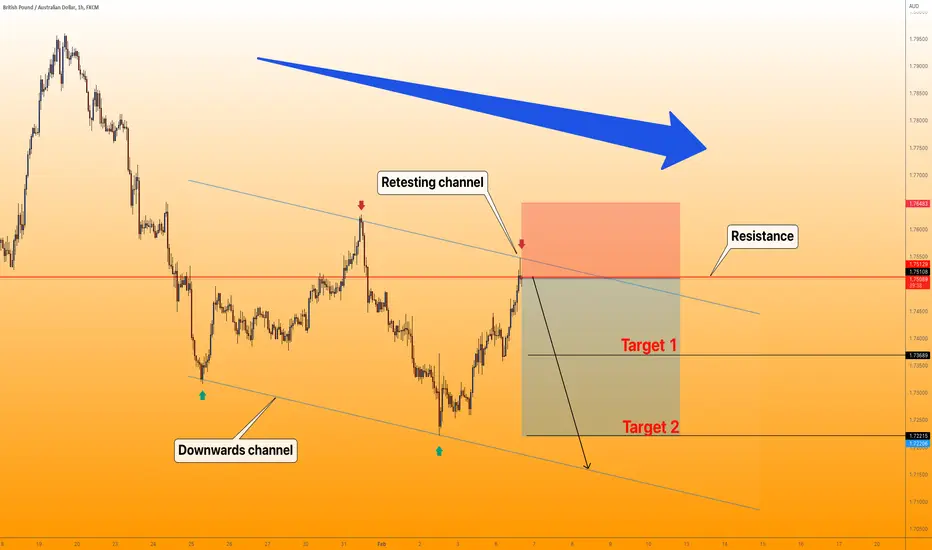

Real World Traders--> GBPAUD Retesting top of the channel

GBPAUD is a currency pair that is currently in a downtrend channel and traders are anticipating a retest of the bottom of the channel.

In addition to the technical analysis, the fundamental factors that are driving the GBPAUD lower include the weakness of the British pound and the strength of the Australian dollar. The pound has been impacted by Brexit uncertainty, which has been a major drag on the currency. On the other hand, the Australian dollar has been boosted by a strong economy and a rise in commodity prices, which has boosted the currency's value.

These factors combined make it likely that the GBPAUD will continue to fall, and traders are taking advantage of this by shorting the pair. It is possible that the pair may retest the bottom of the channel before continuing its downward trend, making it an attractive opportunity for traders looking to take advantage of the trend.

In addition to the technical analysis, the fundamental factors that are driving the GBPAUD lower include the weakness of the British pound and the strength of the Australian dollar. The pound has been impacted by Brexit uncertainty, which has been a major drag on the currency. On the other hand, the Australian dollar has been boosted by a strong economy and a rise in commodity prices, which has boosted the currency's value.

These factors combined make it likely that the GBPAUD will continue to fall, and traders are taking advantage of this by shorting the pair. It is possible that the pair may retest the bottom of the channel before continuing its downward trend, making it an attractive opportunity for traders looking to take advantage of the trend.

Trade closed: target reached

Target 1 reached, take profit and set SL at breakevenNote

200 pipsDisclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.