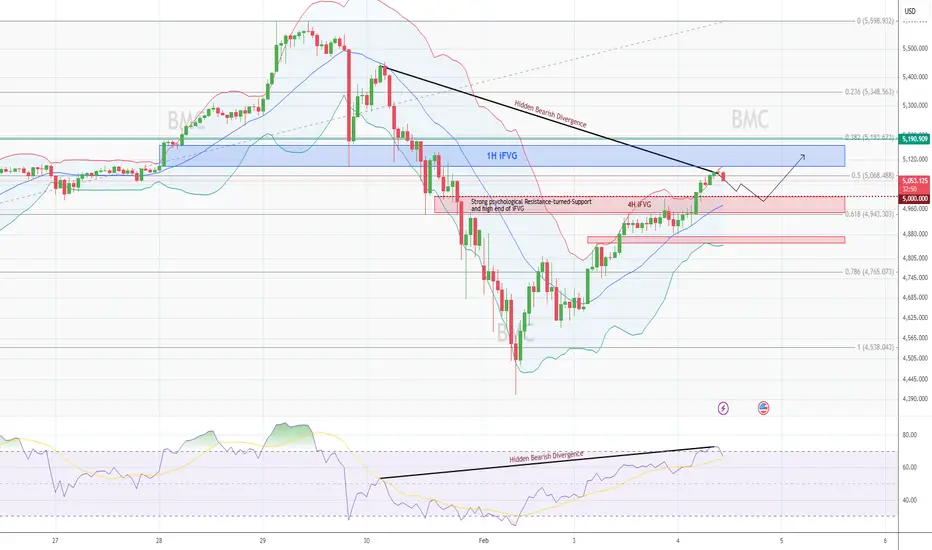

Gold Analysis (1H Chart)

Gold rose more than 2.5% during the early Asian session on Wednesday, and made highs of 5081.25

Although to test the mentioned highs, it has exhausted much of its strength

The bullish price action is getting weak, forming smaller candles than previous, with falling volumes every next candle

And the prices have entered the overbought zone on the 1H chart:

- Prices are testing the upper Bollinger band

- RSI is also trending above 70 levels and turning

- A hidden bearish divergence could also be identified on the 1H chart

Projection

- Thus, a moderate downside correction cannot be neglected towards the marked red zone (5000-4950): The resistance turned support or iFVG

- After which prices might continue the bullish trend towards the blue zone (1H iFVG between 5100-5170).

Gold rose more than 2.5% during the early Asian session on Wednesday, and made highs of 5081.25

Although to test the mentioned highs, it has exhausted much of its strength

The bullish price action is getting weak, forming smaller candles than previous, with falling volumes every next candle

And the prices have entered the overbought zone on the 1H chart:

- Prices are testing the upper Bollinger band

- RSI is also trending above 70 levels and turning

- A hidden bearish divergence could also be identified on the 1H chart

Projection

- Thus, a moderate downside correction cannot be neglected towards the marked red zone (5000-4950): The resistance turned support or iFVG

- After which prices might continue the bullish trend towards the blue zone (1H iFVG between 5100-5170).

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.