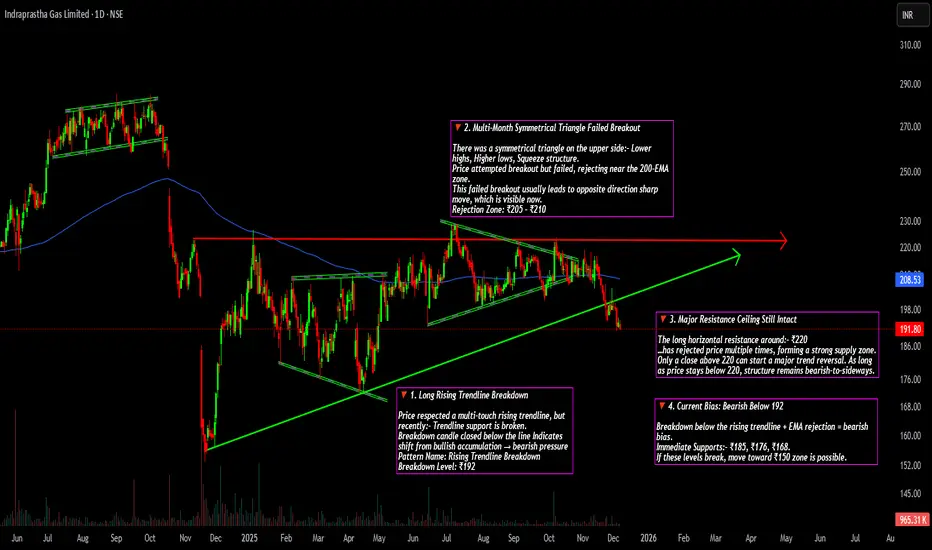

🔻 1. Long Rising Trendline Breakdown

Price respected a multi-touch rising trendline, but recently:- Trendline support is broken.

Breakdown candle closed below the line Indicates shift from bullish accumulation → bearish pressure

Pattern Name: Rising Trendline Breakdown

Breakdown Level: ₹192.

🔻 2. Multi-Month Symmetrical Triangle Failed Breakout

There was a symmetrical triangle on the upper side:- Lower highs, Higher lows, Squeeze structure.

Price attempted breakout but failed, rejecting near the 200-EMA zone.

This failed breakout usually leads to opposite direction sharp move, which is visible now.

Rejection Zone: ₹205 – ₹210.

🔻 3. Major Resistance Ceiling Still Intact

The long horizontal resistance around:- ₹220

…has rejected price multiple times, forming a strong supply zone. Only a close above 220 can start a major trend reversal. As long as price stays below 220, structure remains bearish-to-sideways.

🔻 4. Current Bias: Bearish Below 192

Breakdown below the rising trendline + EMA rejection = bearish bias.

Immediate Supports:- ₹185, ₹176, ₹168.

If these levels break, move toward ₹150 zone is possible.

Price respected a multi-touch rising trendline, but recently:- Trendline support is broken.

Breakdown candle closed below the line Indicates shift from bullish accumulation → bearish pressure

Pattern Name: Rising Trendline Breakdown

Breakdown Level: ₹192.

🔻 2. Multi-Month Symmetrical Triangle Failed Breakout

There was a symmetrical triangle on the upper side:- Lower highs, Higher lows, Squeeze structure.

Price attempted breakout but failed, rejecting near the 200-EMA zone.

This failed breakout usually leads to opposite direction sharp move, which is visible now.

Rejection Zone: ₹205 – ₹210.

🔻 3. Major Resistance Ceiling Still Intact

The long horizontal resistance around:- ₹220

…has rejected price multiple times, forming a strong supply zone. Only a close above 220 can start a major trend reversal. As long as price stays below 220, structure remains bearish-to-sideways.

🔻 4. Current Bias: Bearish Below 192

Breakdown below the rising trendline + EMA rejection = bearish bias.

Immediate Supports:- ₹185, ₹176, ₹168.

If these levels break, move toward ₹150 zone is possible.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.