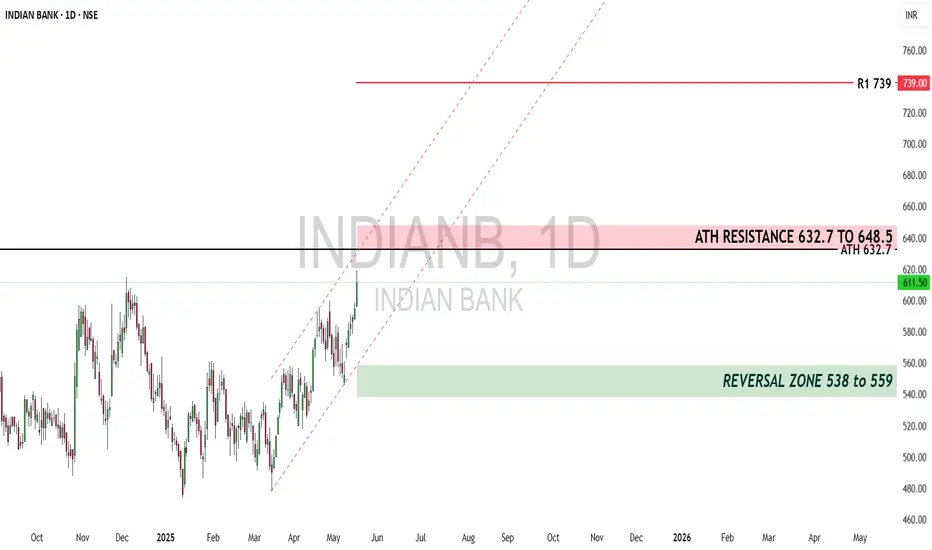

Indian Bank is a fundamentally strong PSU bank stock trading near its All-Time High (ATH) of 632.7. With a bullish technical structure and improving financials, this stock presents an excellent opportunity for both traders and long-term investors. Below, we analyze its fundamentals and technical breakout potential.

Fundamentals

✅ Strong Profit Growth – Net profit up 37% YoY (₹2,119 Cr in FY24).

✅ Improving Asset Quality – Gross NPA ↓ to 3.95% (from 5.95%).

✅ Undervalued – P/B 0.9x, Dividend Yield 2.5%.

✅ Govt-Backed – PSU stability + credit growth tailwinds.

Technical Analysis (Breakout & Momentum Setup)

Potential Targets if Breakout Sustains

Reversal Scenario (If Breakout Fails)

Trade Strategy

For Traders (Breakout Play)

For Investors (Long-Term Accumulation)

Conclusion

Indian Bank is a high-probability breakout candidate with strong fundamentals. A confirmed breakout above 648.5 could lead to a 13-46% rally, while a rejection may offer a buying opportunity near 538-559.

Key Triggers to Watch:

Banking sector momentum (PSU banks in focus).

Q1 FY25 results (Due in July 2025).

Broader market trend (Nifty Bank support).

🚀 Trade Setup:

🔹 Breakout above 648.5 → Momentum to 738+

🔹 Rejection → Buy near 538-559 for long-term

Disclaimer: lnkd.in/gJJDnvn2

Fundamentals

✅ Strong Profit Growth – Net profit up 37% YoY (₹2,119 Cr in FY24).

✅ Improving Asset Quality – Gross NPA ↓ to 3.95% (from 5.95%).

✅ Undervalued – P/B 0.9x, Dividend Yield 2.5%.

✅ Govt-Backed – PSU stability + credit growth tailwinds.

Technical Analysis (Breakout & Momentum Setup)

- Current Price Action (as of May 19, 2025 Close: 611.5)

- Trading near ATH (632.7) within a parallel bullish channel.

- Breakout Zone: 632.7 – 648.5 (ATH resistance band).

- A confirmed daily close above 648.5 before June 2, 2025, could trigger a strong bullish momentum.

Potential Targets if Breakout Sustains

- R1: 738.9 (↑13.96% from ATH)

- R2: 816 (↑23.83% from ATH)

- R3: 948 (↑46.18% from ATH – Extended bullish case)

Reversal Scenario (If Breakout Fails)

- Rejection Zone: If price fails to hold above 648.5, watch for a pullback to 538 – 559 (Key support & averaging zone).

- Break below 538 could indicate a deeper correction.

Trade Strategy

For Traders (Breakout Play)

- Entry: Wait for daily close above 648.5 (confirms breakout).

- Targets: 738.9 → 816 → 948 (Trail SL accordingly).

- Stop Loss: Below 620 (if breakout fails).

For Investors (Long-Term Accumulation)

- Buy on Dips: Accumulate near 559-538 if correction occurs.

- Hold for LT Targets: 950+.

Conclusion

Indian Bank is a high-probability breakout candidate with strong fundamentals. A confirmed breakout above 648.5 could lead to a 13-46% rally, while a rejection may offer a buying opportunity near 538-559.

Key Triggers to Watch:

Banking sector momentum (PSU banks in focus).

Q1 FY25 results (Due in July 2025).

Broader market trend (Nifty Bank support).

🚀 Trade Setup:

🔹 Breakout above 648.5 → Momentum to 738+

🔹 Rejection → Buy near 538-559 for long-term

Disclaimer: lnkd.in/gJJDnvn2

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.