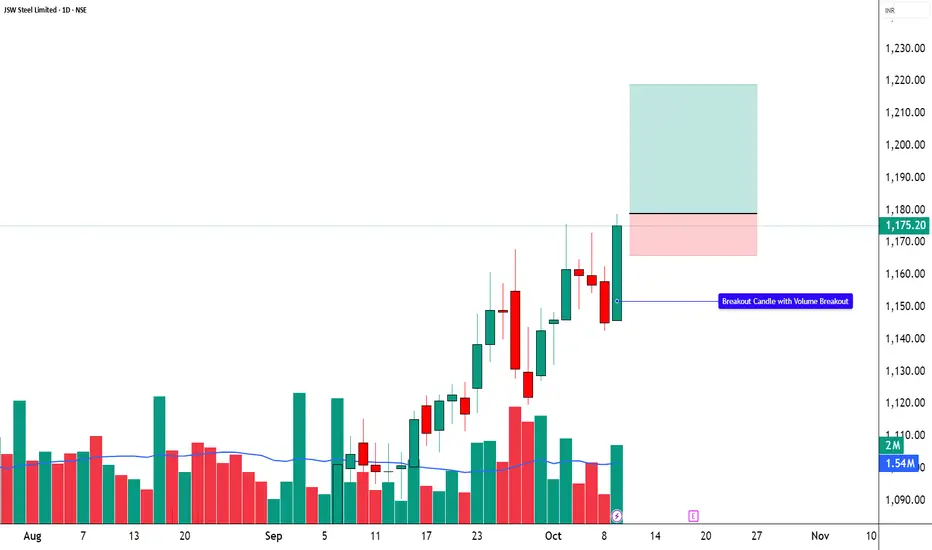

📈 JSW STEEL LTD | Bullish Momentum + 52-Week Breakout 🚀

🔹 Entry Zone: ₹1,175 – ₹1,180

🔹 Stop Loss: ₹1,141 (Risk ~₹34)

🔹 Supports: 1,154 / 1,134 / 1,122

🔹 Resistances: 1,187 / 1,199 / 1,220

🔑 Key Highlights

✅ Strong Bullish Candle — Open equals Low, confirming buyer dominance

✅ 52-Week Breakout Zone — Fresh upside strength visible

✅ Bullish VWAP Alignment — institutional accumulation signals continuation

✅ BB Squeeze-Off → Breakout Momentum Expected

🎯 STWP Trade View

📊 Price has broken through a major resistance zone with above-average volume, indicating renewed momentum and a shift toward strength.

A sustained close above ₹1,187 could accelerate upside towards ₹1,199–₹1,220 levels in the short term.

⚠️ Supports at ₹1,154 and ₹1,134 are crucial for swing structure and position protection.

💡 Learning Note

This setup illustrates the power of multi-signal confluence — when a 52-week breakout, strong bullish candle, and VWAP alignment occur together with volume confirmation, it reflects institutional intent and offers a high-confidence swing opportunity.

⚠️ Disclosure & Disclaimer – Please Read Carefully

The information shared here is meant purely for learning and awareness.

It is not a buy or sell recommendation and should not be taken as investment advice.

I am not a SEBI-registered investment adviser, and all views expressed are based on personal study, chart patterns, and publicly available market data.

Position Status: No active position in JSWSTEEL at the time of analysis.

Data Source: TradingView & NSE India (Past Chart Reference) (Historical levels)

Trading — whether in stocks or options — carries risk. Markets can move unexpectedly, and losses can sometimes exceed the capital you have invested.

Past performance or setups do not guarantee future results.

If you are a beginner, treat this as a learning example and practice with paper trades before risking real money.

If you are experienced, always assess your own risk, position sizing, and strategy suitability before entering trades.

Consult a SEBI-registered financial adviser before making any real trading decision.

By engaging with this content, you acknowledge full responsibility for your trades and investments.

________________________________________

💬 Found this useful?

🔼 Give this post a Boost to help more traders discover structured learning.

✍️ Drop your thoughts, questions, or setups in the comments — let’s grow together!

🔁 Share with fellow traders and beginners to spread awareness.

👉 “If you liked this breakdown, follow for more clean, structured setups with discipline at the core.”

🚀 Stay Calm. Stay Clean. Trade With Patience.

Trade Smart | Learn Zones | Be Self-Reliant 📊

________________________________________

🔹 Entry Zone: ₹1,175 – ₹1,180

🔹 Stop Loss: ₹1,141 (Risk ~₹34)

🔹 Supports: 1,154 / 1,134 / 1,122

🔹 Resistances: 1,187 / 1,199 / 1,220

🔑 Key Highlights

✅ Strong Bullish Candle — Open equals Low, confirming buyer dominance

✅ 52-Week Breakout Zone — Fresh upside strength visible

✅ Bullish VWAP Alignment — institutional accumulation signals continuation

✅ BB Squeeze-Off → Breakout Momentum Expected

🎯 STWP Trade View

📊 Price has broken through a major resistance zone with above-average volume, indicating renewed momentum and a shift toward strength.

A sustained close above ₹1,187 could accelerate upside towards ₹1,199–₹1,220 levels in the short term.

⚠️ Supports at ₹1,154 and ₹1,134 are crucial for swing structure and position protection.

💡 Learning Note

This setup illustrates the power of multi-signal confluence — when a 52-week breakout, strong bullish candle, and VWAP alignment occur together with volume confirmation, it reflects institutional intent and offers a high-confidence swing opportunity.

⚠️ Disclosure & Disclaimer – Please Read Carefully

The information shared here is meant purely for learning and awareness.

It is not a buy or sell recommendation and should not be taken as investment advice.

I am not a SEBI-registered investment adviser, and all views expressed are based on personal study, chart patterns, and publicly available market data.

Position Status: No active position in JSWSTEEL at the time of analysis.

Data Source: TradingView & NSE India (Past Chart Reference) (Historical levels)

Trading — whether in stocks or options — carries risk. Markets can move unexpectedly, and losses can sometimes exceed the capital you have invested.

Past performance or setups do not guarantee future results.

If you are a beginner, treat this as a learning example and practice with paper trades before risking real money.

If you are experienced, always assess your own risk, position sizing, and strategy suitability before entering trades.

Consult a SEBI-registered financial adviser before making any real trading decision.

By engaging with this content, you acknowledge full responsibility for your trades and investments.

________________________________________

💬 Found this useful?

🔼 Give this post a Boost to help more traders discover structured learning.

✍️ Drop your thoughts, questions, or setups in the comments — let’s grow together!

🔁 Share with fellow traders and beginners to spread awareness.

👉 “If you liked this breakdown, follow for more clean, structured setups with discipline at the core.”

🚀 Stay Calm. Stay Clean. Trade With Patience.

Trade Smart | Learn Zones | Be Self-Reliant 📊

________________________________________

Order cancelled

STWP | Mentor & Demand-Supply Specialist | Empowering traders through structured learning |

simpletradewithpatience.com

Community: chat.whatsapp.com/BEYz0tkqP0fJPBCWf59uel

wa.me/message/6IOPHGOXMGZ4N1

Educational Only

simpletradewithpatience.com

Community: chat.whatsapp.com/BEYz0tkqP0fJPBCWf59uel

wa.me/message/6IOPHGOXMGZ4N1

Educational Only

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

STWP | Mentor & Demand-Supply Specialist | Empowering traders through structured learning |

simpletradewithpatience.com

Community: chat.whatsapp.com/BEYz0tkqP0fJPBCWf59uel

wa.me/message/6IOPHGOXMGZ4N1

Educational Only

simpletradewithpatience.com

Community: chat.whatsapp.com/BEYz0tkqP0fJPBCWf59uel

wa.me/message/6IOPHGOXMGZ4N1

Educational Only

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.