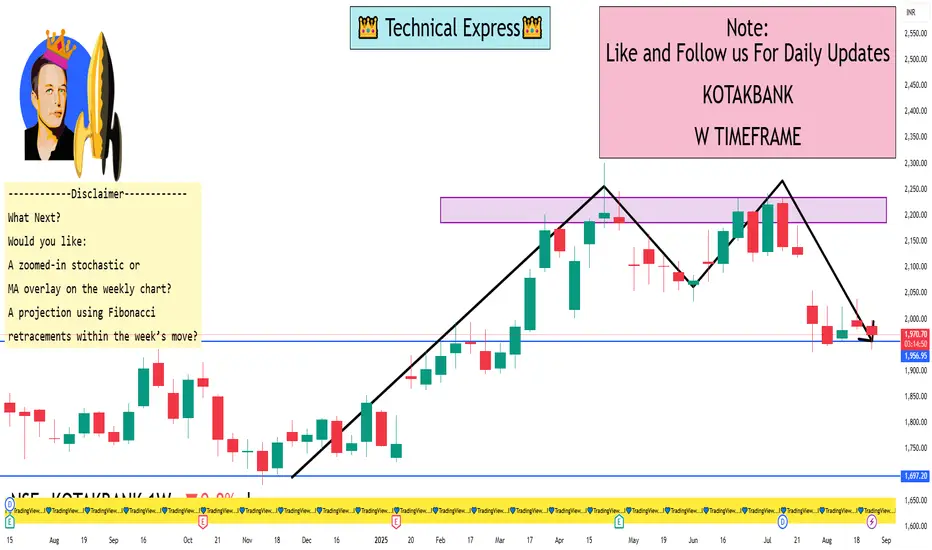

Weekly Technical Levels & Analysis

Pivot-Based Levels (from TopStockResearch)

Weekly Support Zones (Standard pivots):

S1: ₹1,964.87

S2: ₹1,943.13

S3: ₹1,906.07

Weekly Resistance Zones:

R1: ₹2,001.93

R2: ₹2,060.73

R3: ₹2,082.47

These pivot levels often act as short-term barriers and support and can help anticipate price behavior within the current weekly range.

Elliott Wave Analysis (from FXStreet)

The stock appears to be beginning Wave 3 in an Elliott Wave count—typically the strongest impulse phase.

The invalidating level for this bullish count is pegged at ₹1,681. As long as the price stays above this, the bullish structure remains valid.

This suggests strong upward potential in the medium term.

Pivot-Based Levels (from TopStockResearch)

Weekly Support Zones (Standard pivots):

S1: ₹1,964.87

S2: ₹1,943.13

S3: ₹1,906.07

Weekly Resistance Zones:

R1: ₹2,001.93

R2: ₹2,060.73

R3: ₹2,082.47

These pivot levels often act as short-term barriers and support and can help anticipate price behavior within the current weekly range.

Elliott Wave Analysis (from FXStreet)

The stock appears to be beginning Wave 3 in an Elliott Wave count—typically the strongest impulse phase.

The invalidating level for this bullish count is pegged at ₹1,681. As long as the price stays above this, the bullish structure remains valid.

This suggests strong upward potential in the medium term.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.