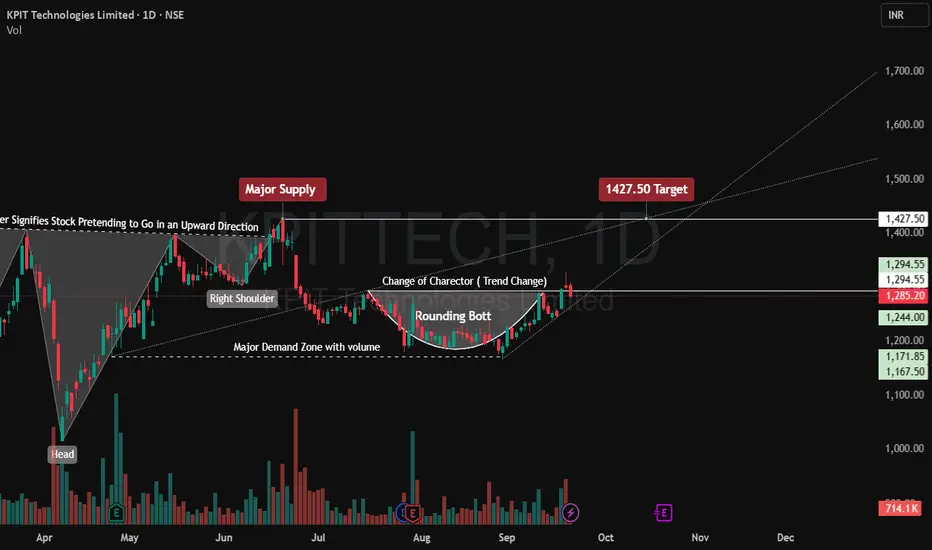

Logical Buy Projection

Trend Context

Trend Context

- Strong trend change confirmation after Rounding Bottom.(Near Term)

- Inverse H&S pattern indicates a bullish reversal structure.(Failed to breakout)

- Volume supports accumulation in the demand zone.

Entry Zone - Around ₹1,280–₹1,300 (CMP, near breakout of rounding bottom neckline).

- Safer entry on retest of ₹1,244–₹1,260 (demand-supported zone).

Targets

Target 1: ₹1,350 (near-term supply retest)

Target 2: ₹1,427.50 (chart projection / neckline breakout target)

Extended Target: ₹1,500+ if momentum sustains (continuation after H&S breakout).

Stop-Loss (SL) - Conservative SL: Below ₹1,167 (demand invalidation).

- Tight SL (for traders): Below ₹1,244 (last support zone).

Summary Projection - Buy Zone: ₹1,280–₹1,300

- Stop-Loss: ₹1,167 (safe) / ₹1,244 (tight)

- Targets: ₹1,350 → ₹1,427.50 → ₹1,500+

Disclaimer:tinyurl.com/59ypbsrh

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.