📊 Improved Allocation Plan

1. Core Holdings (Stable Compounders)

Consistent earnings and defensive traits:

T (AT&T) – steady cash flows, stable telecom exposure.

PM (Philip Morris) – defensive consumer staple, high dividend.

CNP (CenterPoint Energy) – utility stability, defensive ballast.

VRSN (Verisign) – cash-generating monopoly-like business.

➡️ Suggested Weight: 25–30% combined

2. Growth & Innovation Plays

To capture upside from secular themes:

PLTR (Palantir) – data/AI defense and enterprise growth.

APP (AppLovin) – app monetization and gaming ecosystem.

GOOGL (Alphabet) – core tech exposure with AI tailwinds.

NFLX (Netflix) – content moat, global growth.

➡️ Suggested Weight: 25–30% combined

3. Cyclical & Industrial Leaders

These give exposure to economic recovery and capex cycles:

HWM (Howmet Aerospace) – breakout base, aerospace uptrend.

RTX (Raytheon Technologies) – defense/aerospace diversification.

CME (CME Group) – volatility/hedging proxy, strong cash flows.

CBOE (CBOE Global Markets) – options/liquidity boom exposure.

➡️ Suggested Weight: 20–25% combined

4. High Beta / Tactical Rotation

Shorter-term, opportunistic holdings that juice returns:

TPR (Tapestry) – discretionary rebound.

STX (Seagate) – storage cycle, AI demand tie-in.

DG (Dollar General) – consumer resilience.

HOOD (Robinhood) – retail flow capture, optionality.

➡️ Suggested Weight: 15–20% combined

5. Satellite / Alpha Enhancers

Niche names with asymmetric potential:

RPRX (Royalty Pharma) – biopharma royalties, steady income.

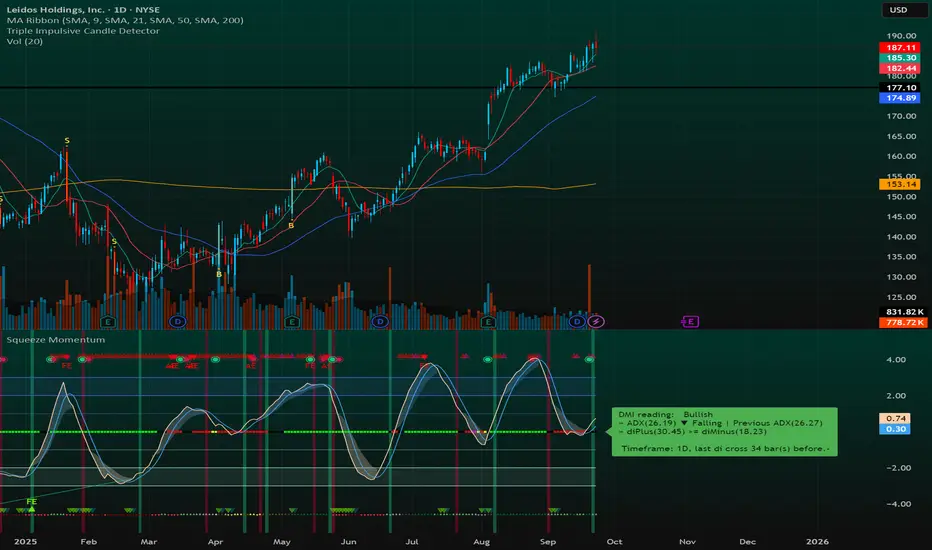

LDOS (Leidos) – government contractor/tech defense.

VST (Vistra) – power utility + renewables angle.

KR (Kroger) – consumer defensive.

MO (Altria) – high yield, value.

AVGO (Broadcom) – semiconductor powerhouse, AI demand.

➡️ Suggested Weight: 10–15% combined

🚀 Adjustments vs Past Allocation

New Adds: HWM (confirmed breakout), RTX (defense exposure), AVGO (AI), or NVDIA.

Keep: PLTR, APP, GOOGL, TPR, STX, T, PM, etc.

Trim/Rotate: Smaller weights to KR, MO, add more CBOE, STX, VST to keep liquidity.

Balance: Defensive core vs. high beta growth.

1. Core Holdings (Stable Compounders)

Consistent earnings and defensive traits:

T (AT&T) – steady cash flows, stable telecom exposure.

PM (Philip Morris) – defensive consumer staple, high dividend.

CNP (CenterPoint Energy) – utility stability, defensive ballast.

VRSN (Verisign) – cash-generating monopoly-like business.

➡️ Suggested Weight: 25–30% combined

2. Growth & Innovation Plays

To capture upside from secular themes:

PLTR (Palantir) – data/AI defense and enterprise growth.

APP (AppLovin) – app monetization and gaming ecosystem.

GOOGL (Alphabet) – core tech exposure with AI tailwinds.

NFLX (Netflix) – content moat, global growth.

➡️ Suggested Weight: 25–30% combined

3. Cyclical & Industrial Leaders

These give exposure to economic recovery and capex cycles:

HWM (Howmet Aerospace) – breakout base, aerospace uptrend.

RTX (Raytheon Technologies) – defense/aerospace diversification.

CME (CME Group) – volatility/hedging proxy, strong cash flows.

CBOE (CBOE Global Markets) – options/liquidity boom exposure.

➡️ Suggested Weight: 20–25% combined

4. High Beta / Tactical Rotation

Shorter-term, opportunistic holdings that juice returns:

TPR (Tapestry) – discretionary rebound.

STX (Seagate) – storage cycle, AI demand tie-in.

DG (Dollar General) – consumer resilience.

HOOD (Robinhood) – retail flow capture, optionality.

➡️ Suggested Weight: 15–20% combined

5. Satellite / Alpha Enhancers

Niche names with asymmetric potential:

RPRX (Royalty Pharma) – biopharma royalties, steady income.

LDOS (Leidos) – government contractor/tech defense.

VST (Vistra) – power utility + renewables angle.

KR (Kroger) – consumer defensive.

MO (Altria) – high yield, value.

AVGO (Broadcom) – semiconductor powerhouse, AI demand.

➡️ Suggested Weight: 10–15% combined

🚀 Adjustments vs Past Allocation

New Adds: HWM (confirmed breakout), RTX (defense exposure), AVGO (AI), or NVDIA.

Keep: PLTR, APP, GOOGL, TPR, STX, T, PM, etc.

Trim/Rotate: Smaller weights to KR, MO, add more CBOE, STX, VST to keep liquidity.

Balance: Defensive core vs. high beta growth.

Gabriel Amadeus

The Real World - Stocks Campus:

Stocks, Options, Futures, Forex, Crypto, this is what we trade.

Learn profitable trading systems or build your own, just like I did.

jointherealworld.com/?a=f7jkjpg8kh

The Real World - Stocks Campus:

Stocks, Options, Futures, Forex, Crypto, this is what we trade.

Learn profitable trading systems or build your own, just like I did.

jointherealworld.com/?a=f7jkjpg8kh

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Gabriel Amadeus

The Real World - Stocks Campus:

Stocks, Options, Futures, Forex, Crypto, this is what we trade.

Learn profitable trading systems or build your own, just like I did.

jointherealworld.com/?a=f7jkjpg8kh

The Real World - Stocks Campus:

Stocks, Options, Futures, Forex, Crypto, this is what we trade.

Learn profitable trading systems or build your own, just like I did.

jointherealworld.com/?a=f7jkjpg8kh

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.