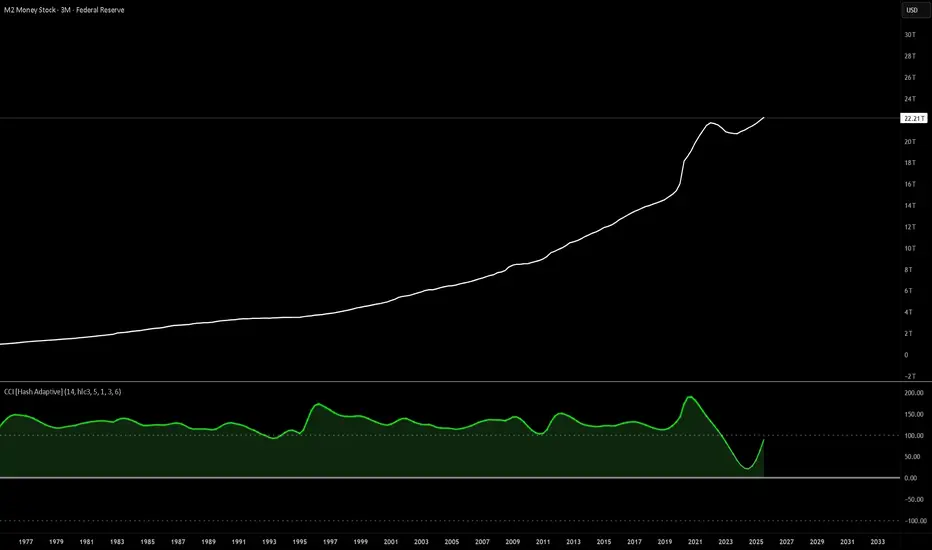

M2 is the bluntest liquidity proxy we’ve got. That white line only really goes one way—and when it accelerates, risk assets don’t argue, they re-rate.

Check the CCI under the chart: triple-digit prints that are frankly absurd for a macro series. That’s the liquidity impulse screaming. When CCI rolls positive and stays there, you tend to get multiple expansion; when it rolled negative in ’22–’23, you got de-rating and chop.

Why it matters (mechanics in one breath):

more dollars chasing the same assets → higher nominal prices, lower real yields → fatter DCFs, easier credit → buybacks/issuance → persistent bid. It’s not about narratives; it’s about liquidity.

Check the CCI under the chart: triple-digit prints that are frankly absurd for a macro series. That’s the liquidity impulse screaming. When CCI rolls positive and stays there, you tend to get multiple expansion; when it rolled negative in ’22–’23, you got de-rating and chop.

Why it matters (mechanics in one breath):

more dollars chasing the same assets → higher nominal prices, lower real yields → fatter DCFs, easier credit → buybacks/issuance → persistent bid. It’s not about narratives; it’s about liquidity.

Quant research firm developing proprietary indicators, trading automation, and risk frameworks for digital & macro markets. Free indicator channel (telegram) t.me/hashcapitalresearchchannel I hashadaptive.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Quant research firm developing proprietary indicators, trading automation, and risk frameworks for digital & macro markets. Free indicator channel (telegram) t.me/hashcapitalresearchchannel I hashadaptive.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.