Long

Food for Thought

This idea is pure conjecture and should not be construed as investment advice.

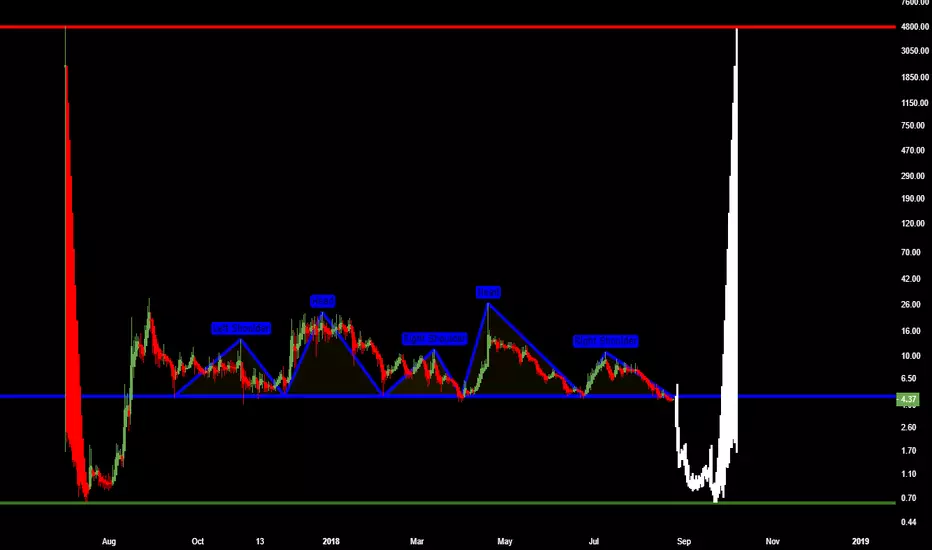

Notice the bearish head and shoulders pattern. If the neckline ($4.65) is violently broken and capitulation occurs then we may see MCO at 63 cents.

An Ethereum whale is dumping his coins on the open market which could act as a catalyst to drive the price of Ether down. This in turn could cause ERC20 tokens to plummet to the floor.

Source: cryptoglobe.com/latest/2018/08/5-5-million-ethereum-genesis-block-recipient-moves-nearly-20000-eth-to-bitfinex/

It would be absolutely foolish to dump your tokens to short the market at current price level. Why? The market can go in either direction. The market could reverse from the demand zone and head towards $28.99 and beyond. If you short now, and you are wrong, then you will be out of the game. You may be shorting the bottom. You need not gamble.

The wiser play (in my opinion) is to hold your coins and add to your position if the market tanks. In this manner, you will average down the cost of each token and feel a sense of satisfaction when your purchase price is at a severe discount.

This is the safest way to play this game. Hold long term and buy when everything is on clearance.

Eventually, in theory, the price should return to the high of $4,704.97. When will this happen? No one knows. It could be 3 months, 3 years, or 10 years.

There is no guarantee that this will happen but it does occur quite often in the crypto space.

Therefore, don't be weak minded. Hold onto your coins. Don't be so eager to give them to whales at these low levels.

If you are in crypto for quick profits then you are doing it absolutely wrong. Change your perspective and go long. Grow your portfolio by adding to your position during clearance sales. Short the market at $4,705 not at $4.09.

Notice the bearish head and shoulders pattern. If the neckline ($4.65) is violently broken and capitulation occurs then we may see MCO at 63 cents.

An Ethereum whale is dumping his coins on the open market which could act as a catalyst to drive the price of Ether down. This in turn could cause ERC20 tokens to plummet to the floor.

Source: cryptoglobe.com/latest/2018/08/5-5-million-ethereum-genesis-block-recipient-moves-nearly-20000-eth-to-bitfinex/

It would be absolutely foolish to dump your tokens to short the market at current price level. Why? The market can go in either direction. The market could reverse from the demand zone and head towards $28.99 and beyond. If you short now, and you are wrong, then you will be out of the game. You may be shorting the bottom. You need not gamble.

The wiser play (in my opinion) is to hold your coins and add to your position if the market tanks. In this manner, you will average down the cost of each token and feel a sense of satisfaction when your purchase price is at a severe discount.

This is the safest way to play this game. Hold long term and buy when everything is on clearance.

Eventually, in theory, the price should return to the high of $4,704.97. When will this happen? No one knows. It could be 3 months, 3 years, or 10 years.

There is no guarantee that this will happen but it does occur quite often in the crypto space.

Therefore, don't be weak minded. Hold onto your coins. Don't be so eager to give them to whales at these low levels.

If you are in crypto for quick profits then you are doing it absolutely wrong. Change your perspective and go long. Grow your portfolio by adding to your position during clearance sales. Short the market at $4,705 not at $4.09.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.