Medico Remedies Ltd. (NSE: MEDICO) is currently priced at 58.75 INR. The company specializes in manufacturing and marketing pharmaceutical formulations across various therapeutic segments.

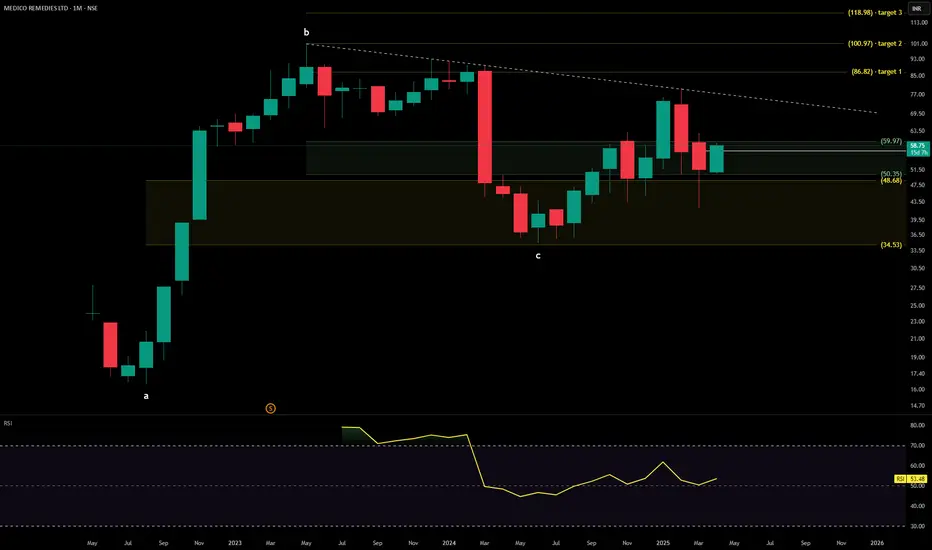

Key Levels: Support levels are identified at 50.23 INR and 34.53 INR, suggesting potential price stabilization at these thresholds. The upside swing zone lies between 59.97 INR and 62.00 INR, indicating an area of possible upward momentum. Key upside levels are noted at 86.82 INR, 100.97 INR, and 118.98 INR, which could act as benchmarks for further price movements.

Technical Indicators: The Relative Strength Index (RSI) currently stands at 53.48, reflecting neutral momentum. RSI gauges the speed and magnitude of price changes, with levels above 70 indicating overbought conditions and below 30 signifying oversold conditions. Recent trading volume is recorded at 7.86 million, showcasing moderate activity that suggests the presence of investor interest and the potential for confirming price trends.

Sector and Market Context: Medico Remedies operates in the pharmaceutical sector, known for its resilience and strong demand. Recent trends in the pharmaceutical industry highlight growth potential due to heightened focus on health and wellness globally. While broader market volatility has influenced stocks across sectors, the pharmaceutical industry has demonstrated relative stability, outperforming several other sectors.

Risk Considerations: The stock faces risks such as regulatory changes, market competition, and dependency on global economic health. Factors like adverse clinical outcomes or shifts in healthcare policies could disrupt growth. Additionally, broader market risks, including interest rate fluctuations, inflation, and geopolitical developments, remain influential.

Analysis Summary: Medico Remedies Ltd. portrays a balanced technical outlook with neutral momentum and moderate upside potential if it surpasses the swing zone. The stock's alignment with a stable and resilient pharmaceutical sector supports growth prospects, although caution is warranted due to regulatory and market risks. Overall, the analysis suggests monitoring its progression for further insights without leaning towards a specific buy/sell directive.

Key Levels: Support levels are identified at 50.23 INR and 34.53 INR, suggesting potential price stabilization at these thresholds. The upside swing zone lies between 59.97 INR and 62.00 INR, indicating an area of possible upward momentum. Key upside levels are noted at 86.82 INR, 100.97 INR, and 118.98 INR, which could act as benchmarks for further price movements.

Technical Indicators: The Relative Strength Index (RSI) currently stands at 53.48, reflecting neutral momentum. RSI gauges the speed and magnitude of price changes, with levels above 70 indicating overbought conditions and below 30 signifying oversold conditions. Recent trading volume is recorded at 7.86 million, showcasing moderate activity that suggests the presence of investor interest and the potential for confirming price trends.

Sector and Market Context: Medico Remedies operates in the pharmaceutical sector, known for its resilience and strong demand. Recent trends in the pharmaceutical industry highlight growth potential due to heightened focus on health and wellness globally. While broader market volatility has influenced stocks across sectors, the pharmaceutical industry has demonstrated relative stability, outperforming several other sectors.

Risk Considerations: The stock faces risks such as regulatory changes, market competition, and dependency on global economic health. Factors like adverse clinical outcomes or shifts in healthcare policies could disrupt growth. Additionally, broader market risks, including interest rate fluctuations, inflation, and geopolitical developments, remain influential.

Analysis Summary: Medico Remedies Ltd. portrays a balanced technical outlook with neutral momentum and moderate upside potential if it surpasses the swing zone. The stock's alignment with a stable and resilient pharmaceutical sector supports growth prospects, although caution is warranted due to regulatory and market risks. Overall, the analysis suggests monitoring its progression for further insights without leaning towards a specific buy/sell directive.

Sucrit.D.Patil

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Sucrit.D.Patil

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.