# NIFTY 50 Technical Analysis: Comprehensive Multi-Timeframe Trading Strategy

Executive Summary

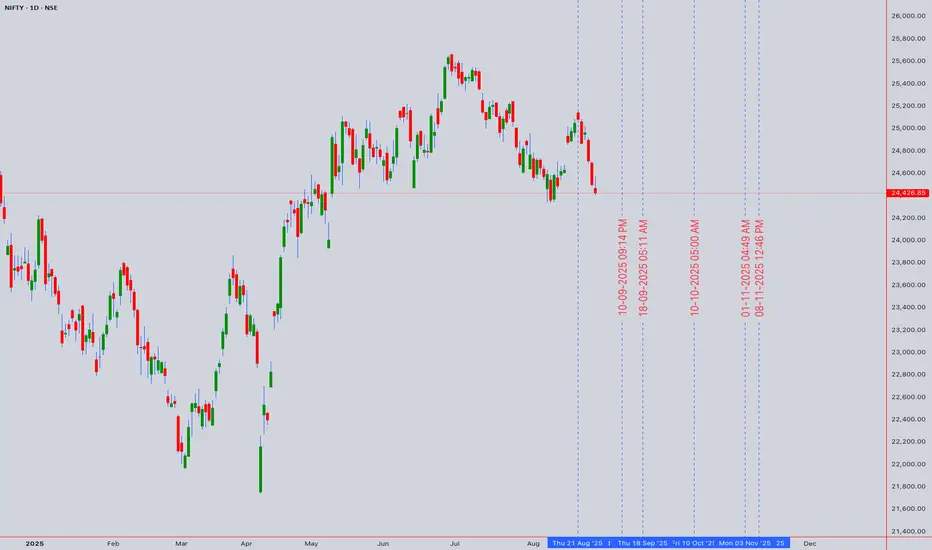

Current Price: 24,433.65 (August 29, 2025, 1:5 PM UTC+4)

Market Sentiment: Cautiously Bullish with Consolidation Bias

Primary Trend: Uptrend with potential for continued advancement

Key Resistance: 25,000 (psychological level and technical confluence)

The NIFTY 50 continues to demonstrate resilience in the face of global uncertainties, maintaining its position above key support levels while approaching significant psychological resistance. The index benefits from accommodative monetary policy with the RBI's recent rate cuts and strong domestic fundamentals, though valuations warrant selective positioning.

Market Context & Fundamental Backdrop

Monetary Policy Environment

The Reserve Bank of India has cut its repo rate by 0.25%, which now stands at 6.25%, marking a significant shift in policy stance. Markets expect the RBI may implement one more 25-bps rate cut in August 2025, especially ahead of the festive season which historically shows multiplier effects on consumer demand.

Economic Fundamentals

India's GDP expanded 7.80 percent in the second quarter of 2025 over the same quarter of the previous year, demonstrating robust economic growth. The RBI expects real GDP to grow 6.5% in FY 2025-26, supported by strong domestic demand and government capital expenditures.

Inflation and Growth Balance

Headline inflation in India is expected to average 4.2% year-on-year in the 2025 calendar year, with food inflation at 4.6% — much lower than estimates of 7%-plus for 2024, thanks to adequate rainfall and good sowing.

Earnings Outlook

Consensus expects 11-12% earnings growth for the Nifty 50 in FY26, with the index trading below 20x price-earnings on FY26 estimates, suggesting reasonable valuations at current levels.

Technical Analysis Framework

Japanese Candlestick Analysis

Weekly Pattern: Spinning top formation indicating indecision at current levels

Daily Pattern: Small-bodied candles with narrow ranges suggesting consolidation

Intraday Patterns: Hammer and doji formations prevalent in 1H and 4H timeframes

Volume Confirmation: Average volume during consolidation phase

Elliott Wave Analysis

Primary Wave Count:

Major Degree: Wave 5 of larger bull market cycle potentially in progress

Intermediate Degree: Subwave 3 of 5 showing extension characteristics

Minor Degree: Currently in subwave 4 correction of intermediate wave 3

Alternative Count: Complex correction (WXY) completion targeting 25,200-25,500

Critical Support: Wave 4 support at 23,800-24,000 maintains bullish structure

Harmonic Pattern Analysis

Active Patterns:

Bullish Gartley: Potential completion zone at 23,950-24,100

ABCD Pattern: Current formation targeting 24,800-25,000

Potential Cypher: Formation developing with D point near 25,100

Fibonacci Analysis:

- 50% retracement of major swing: 24,200

- 38.2% retracement: 24,500 (current consolidation area)

- 1.618 extension target: 24,900-25,000

Wyckoff Method Analysis

Phase Assessment: Accumulation Phase C - Testing supply

Characteristics:

- Volume patterns showing accumulation on weakness

- Price holding above composite operator accumulation zone

- Sign of Strength (SOS) evident on recent advances

Distribution Risk: Monitor for climactic volume above 25,000

W.D. Gann Technical Analysis

# Square of 9 Application

Current Position: 24,433.65 = 156.31° on the Gann wheel

Key Resistance Levels:

- 24,481 (156.5°) - immediate minor resistance

- 24,649 (157°) - intermediate resistance

- 25,000 (158.11°) - major psychological and geometric resistance

Support Levels:

- 24,336 (156°) - immediate support

- 24,025 (155°) - strong support zone

- 23,716 (154°) - major support level

# Time Theory Application

Critical Time Windows:

- September 9-12: 45-degree time angle from recent high

- September 23: Autumn equinox - natural market turning point

- October 8-15: 90-degree time cycle completion

# Price and Time Squaring

Square Root Analysis: √24,433.65 = 156.31

Next Square Levels:

- 157² = 24,649 (key resistance)

- 158² = 24,964 (approaching 25,000)

- 160² = 25,600 (extended target)

Ichimoku Kinko Hyo Analysis

Cloud Configuration:

Tenkan-sen (9): 24,445 - Price slightly below, neutral

Kijun-sen (26): 24,380 - Price above, mild bullish bias

Senkou Span A: 24,412 (cloud top)

Senkou Span B: 24,100 (cloud bottom)

Assessment: Price trading within cloud, indicating consolidation phase with neutral bias pending breakout direction.

Multi-Timeframe Technical Indicator Analysis

5-Minute Chart (Scalping Focus)

RSI(14): 49.2 - Neutral territory with no momentum bias

VWAP: 24,428 - Price oscillating around VWAP

Bollinger Bands: Middle band at 24,430, bands contracting (low volatility period)

Moving Averages: EMA(20) = 24,435, SMA(20) = 24,440

15-Minute Chart (Scalping Focus)

MACD: Near zero line, histogram flat - no clear momentum

Stochastic(14,3,3): 52.1 in neutral zone

Williams %R: -48% indicating no extreme conditions

Volume: Below average, typical for consolidation

Key Intraday Levels:

Resistance: 24,460, 24,490, 24,520

Support: 24,400, 24,370, 24,340

1-Hour Chart (Day Trading)

RSI(14): 54.3 - Slight bullish bias but not overbought

VWAP: 24,415 providing dynamic support

ADX(14): 22.1 indicating weak trend strength (consolidation)

Volume Profile: High volume node at 24,380-24,450

Trading Range:

Upper Boundary: 24,520-24,550

Lower Boundary: 24,320-24,350

Breakout Levels: Above 24,580 (bullish) / Below 24,280 (bearish)

4-Hour Chart (Swing Trading)

RSI(14): 57.8 showing mild bullish momentum

MACD: Positive but flattening, momentum slowing

Bollinger Bands: Price near middle band, bands parallel (range-bound)

Moving Averages: All short-term MAs converging around current price

Swing Levels:

Primary Resistance: 24,650-24,700

Secondary Resistance: 24,900-25,000

Primary Support: 24,200-24,250

Secondary Support: 24,000-24,050

Daily Chart (Position Trading)

RSI(14): 59.4 in bullish territory but not extreme

MACD: Positive with slight bullish divergence

Volume: Consolidation pattern with below-average volume

Pattern: Symmetrical triangle formation approaching apex

Key Daily Levels:

Triangle Resistance: 24,700-24,750 (declining)

Triangle Support: 24,150-24,200 (rising)

Breakout Targets: 25,200 (upside) / 23,600 (downside)

Weekly Chart (Long-term Analysis)

RSI(14): 63.2 showing healthy bullish momentum

MACD: Positive momentum but rate of change slowing

Long-term Trend: Intact uptrend since March 2020 low

Major Resistance: 25,000-25,200 zone

Monthly Chart (Strategic Perspective)

RSI(14): 68.1 approaching overbought levels

Long-term Pattern: Multi-year ascending triangle completion

Major Support: 22,000-22,500 zone

Extended Targets: 26,000-27,000 on sustained breakout

Comprehensive Support and Resistance Analysis

Primary Support Zones

1. 24,380-24,420: Kijun-sen and VWAP confluence zone

2. 24,320-24,350: Previous consolidation low and volume support

3. 24,200-24,250: 50% Fibonacci retracement and psychological level

4. 24,100-24,150: Cloud bottom and structural support

5. 24,000-24,050: Major psychological level and trend line support

6. 23,800-23,900: Elliott Wave 4 support and major trend line

7. 23,600-23,700: Extended support and breakout failure target

Primary Resistance Zones

1. 24,460-24,490: Immediate intraday resistance

2. 24,520-24,580: Short-term resistance and breakout level

3. 24,650-24,700: Triangle resistance and swing high

4. 24,850-24,900: Intermediate resistance zone

5. 24,950-25,000: Major psychological resistance and Square of 9

6. 25,100-25,200: Extended targets and measured moves

7. 25,500-25,800: Long-term bull market targets

Weekly Trading Strategy (September 2-6, 2025)

Monday, September 2, 2025

Market Environment: Post-weekend consolidation, range-bound expected

Primary Strategy: Range trading within established boundaries

Volatility: Low to moderate, typical Monday characteristics

Intraday Setup:

Range: 24,380-24,480

Long Entry: 24,390-24,410

- Stop Loss: 24,360

- Target 1: 24,450 (1:1.5 R/R)

- Target 2: 24,480 (1:2.5 R/R)

Short Entry: 24,470-24,490

- Stop Loss: 24,520

- Target 1: 24,430 (1:1.5 R/R)

- Target 2: 24,400 (1:2.5 R/R)

Swing Consideration: Monitor for breakout preparation above 24,500

Tuesday, September 3, 2025

Market Environment: Increased activity expected, potential trending day

Primary Strategy: Momentum trading with breakout preparation

Key Focus: Volume analysis for sustained directional moves

Trading Scenarios:

Bullish Breakout: Above 24,520 with volume

- Entry: 24,530-24,550

- Stop: 24,480

- Targets: 24,600, 24,650, 24,700

Bearish Breakdown: Below 24,360 with volume

- Entry: 24,350-24,330

- Stop: 24,390

- Targets: 24,280, 24,250, 24,200

Risk Management: Reduce position size by 25% on breakout trades

Wednesday, September 4, 2025

Market Environment: Mid-week volatility, economic data focus

Primary Strategy: News-driven trading with technical confirmation

Event Risk: Monitor for any economic announcements

Scalping Strategy:

High-Frequency Range: 24,400-24,460

Long Scalps: 24,405-24,415, Target: 24,445-24,455

Short Scalps: 24,450-24,460, Target: 24,415-24,425

Stop Loss: Maximum 20 points for scalp trades

Swing Setup: Prepare for potential triangle breakout

Thursday, September 5, 2025

Market Environment: Potential high-volatility day

Primary Strategy: Breakout trading with strong risk management

Focus: Triangle resolution expected

Triangle Breakout Strategy:

Upside Breakout: Above 24,580

- Confirmation: Volume > 1.3x average

- Initial Target: 24,700

- Extended Target: 24,850-24,900

Downside Breakdown: Below 24,280

- Confirmation: Volume > 1.2x average

- Initial Target: 24,150

- Extended Target: 24,000-24,050

Position Management: Trail stops after 50% of target achieved

Friday, September 6, 2025

Market Environment: Weekly settlement, profit-taking likely

Primary Strategy: End-of-week positioning and profit-taking

Focus: Weekly close levels for next week setup

Settlement Strategy:

Bullish Close: Above 24,500 supports next week advance

Neutral Close: 24,350-24,500 maintains consolidation

Bearish Close: Below 24,350 suggests correction risk

Day Trading Approach:

Morning: Follow Thursday's direction initially

Afternoon: Expect consolidation and position adjustments

Last Hour: Avoid large new positions

Risk Management Framework

Position Sizing Guidelines

Risk Per Trade by Timeframe:

5M Scalping: 0.25-0.5% of capital

15M Scalping: 0.5-0.75% of capital

1H Day Trading: 1-1.5% of capital

4H Swing Trading: 1.5-2% of capital

Daily Position Trading: 2-2.5% of capital

Stop Loss Framework

Timeframe-Specific Stops:

5-Minute: 15-25 points maximum

15-Minute: 25-40 points maximum

1-Hour: 40-60 points maximum

4-Hour: 80-120 points maximum

Daily: 150-250 points maximum

Profit-Taking Strategy

Systematic Approach:

Target 1 (40%): 1:1 Risk/Reward

Target 2 (35%): 1:2 Risk/Reward

Target 3 (25%): 1:3+ Risk/Reward

Trailing Stops: Activate after Target 1

Maximum Drawdown Limits

Daily Loss Limit: 3% of trading capital

Weekly Loss Limit: 7% of trading capital

Monthly Loss Limit: 15% of trading capital

Geopolitical and Economic Risk Assessment

Domestic Risk Factors

Monetary Policy:

- RBI rate cut cycle supporting liquidity

- Inflation targeting maintaining credibility

- Banking system stability considerations

Fiscal Policy:

- Government capex supporting growth

- Festive season spending boost expected

- Budget allocation efficiency focus

Corporate Earnings:

- Q2 FY26 earnings season approaching

- Margin pressure from input costs

- Sectoral rotation opportunities

Global Risk Factors

US Federal Reserve Policy:

- Rate cut expectations supporting EM flows

- Dollar weakness benefiting Indian markets

- Global liquidity conditions favorable

China Economic Impact:

- Trade relationship developments

- Commodity price implications

- Regional growth spillover effects

Geopolitical Considerations:

- Regional security stability

- Energy security and pricing

- Trade policy developments

Sector-Specific Risks

Banking & Financial Services:

- Credit growth sustainability

- NPA cycle management

- Interest rate sensitivity

Information Technology:

- Global demand patterns

- Currency hedging strategies

- AI and automation impact

Consumer Discretionary:

- Rural demand recovery

- Festive season performance

- Inflation impact on spending

Sectoral Analysis and Rotation Themes

Outperforming Sectors

1. Banking & Financial Services: Rate cut cycle benefits

2. FMCG: Festive season demand and rural recovery

3. Infrastructure: Government capex and policy support

4. Pharmaceuticals: Export competitiveness and domestic growth

Underperforming Sectors

1. Information Technology: Global demand concerns

2. Metals & Mining: Commodity price volatility

3. Real Estate: Interest rate sensitivity despite cuts

4. Telecommunications: Competitive pressure and capex burden

Rotation Indicators

Growth vs Value: Favoring quality growth at reasonable prices

Large Cap vs Mid/Small Cap: Large cap leadership maintained

Domestic vs Export: Domestic consumption themes outperforming

Advanced Technical Patterns

Ichimoku Trading Signals

Current Setup: Price within cloud, neutral bias

Bullish Trigger: Break above Tenkan-sen with volume

Bearish Trigger: Break below cloud with momentum

Long-term View: Future cloud remains bullish

Gann-Based Strategies

Square of 9 Trades:

- Long: 155° (24,025) targeting 158° (24,964)

- Short: 158° (24,964) targeting 155° (24,025)

- Time Cycles: September 9-12 reversal window

Wyckoff Phase Trading

Current Phase: Accumulation Phase C

Next Phase: Markup expected on successful test

Volume Confirmation: Key for phase transition

Distribution Risk: Monitor above 25,200

Market Microstructure Analysis

Algorithmic Trading Impact

High-Activity Zones: 24,000, 24,500, 25,000 levels

Optimal Entry Times: 9:15-9:45 and 14:30-15:15 IST

Liquidity Patterns: Reduced depth during lunch hours

Order Flow Considerations

Institutional Activity: Accumulation evident below 24,400

FII Flows: Recent buying supporting current levels

DII Participation: Consistent buying on weakness

Technology and Tools Integration

Recommended Platforms

1. TradingView: Advanced charting and technical analysis

2. Zerodha Kite: Real-time execution and portfolio management

3. Bloomberg Terminal: Comprehensive market data and news

4. Refinitiv Workspace: Fundamental analysis integration

Alert Configuration

Price Alerts:

- Triangle breakout: 24,580 (up) / 24,280 (down)

- Psychological levels: 24,500, 25,000

- Support/resistance: 24,200, 24,700

Volume Alerts:

- Unusual volume spikes (>150% average)

- Block deal notifications

- Institutional flow changes

Seasonal and Calendar Considerations

Festive Season Impact

Indian markets are entering the 4-month-long festive season from September, which historically shows positive performance. This period typically sees:

- Increased consumer spending

- Corporate bonus distributions

- Portfolio rebalancing by institutions

- Higher retail participation

Economic Calendar

Key Events:

- RBI Monetary Policy (likely September 17)

- Q2 FY26 GDP data (October/November)

- Inflation data (monthly releases)

- FII/DII flow data (weekly)

Holiday Calendar

- Ganesh Chaturthi (September 7) - Market closed

- Dussehra (October 12) - Market closed

- Diwali (November 1) - Market closed

- Guru Nanak Jayanti (November 15) - Market closed

Conclusion and Strategic Outlook

The NIFTY 50 stands at a critical juncture, consolidating near significant resistance levels while benefiting from supportive monetary and fiscal policies. The technical picture suggests a healthy consolidation phase that could resolve in favor of further upside, particularly given the approaching festive season and improving economic fundamentals.

Key Investment Themes:

1. Triangle Resolution: Current consolidation likely to resolve with directional clarity

2. Festive Season Tailwinds: Historical patterns favor bullish bias into year-end

3. Rate Cut Benefits: Lower rates supporting equity valuations and credit growth

4. Earnings Growth: Expected double-digit growth supporting index advancement

Trading Strategy Priorities:

- Focus on triangle breakout trades with volume confirmation

- Favor range trading until clear directional break

- Maintain disciplined risk management given elevated levels

- Prepare for increased volatility around key events

Medium-term Outlook (1-3 months):

The combination of accommodative monetary policy, strong GDP growth, controlled inflation, and seasonal tailwinds provides a constructive backdrop for Indian equities. Technical analysis suggests potential for advancement toward 25,500-26,000 on sustained breakout above current resistance.

Risk Management Focus:

- Triangle breakdown below 24,280 could target 24,000-23,800

- Global risk-off sentiment remains key external risk

- Valuation concerns at higher levels warrant selectivity

- Currency stability important for FII flow continuation

The analysis incorporates multiple technical methodologies while acknowledging the strong fundamental backdrop supporting Indian markets. Traders should remain flexible and prepared for both continuation and reversal scenarios while maintaining strict adherence to risk management protocols.

---

*This comprehensive analysis combines technical and fundamental factors to provide actionable trading strategies. All recommendations should be implemented within individual risk tolerance parameters and current market conditions. Market dynamics can change rapidly, requiring continuous monitoring and strategy adjustments.*

Executive Summary

Current Price: 24,433.65 (August 29, 2025, 1:5 PM UTC+4)

Market Sentiment: Cautiously Bullish with Consolidation Bias

Primary Trend: Uptrend with potential for continued advancement

Key Resistance: 25,000 (psychological level and technical confluence)

The NIFTY 50 continues to demonstrate resilience in the face of global uncertainties, maintaining its position above key support levels while approaching significant psychological resistance. The index benefits from accommodative monetary policy with the RBI's recent rate cuts and strong domestic fundamentals, though valuations warrant selective positioning.

Market Context & Fundamental Backdrop

Monetary Policy Environment

The Reserve Bank of India has cut its repo rate by 0.25%, which now stands at 6.25%, marking a significant shift in policy stance. Markets expect the RBI may implement one more 25-bps rate cut in August 2025, especially ahead of the festive season which historically shows multiplier effects on consumer demand.

Economic Fundamentals

India's GDP expanded 7.80 percent in the second quarter of 2025 over the same quarter of the previous year, demonstrating robust economic growth. The RBI expects real GDP to grow 6.5% in FY 2025-26, supported by strong domestic demand and government capital expenditures.

Inflation and Growth Balance

Headline inflation in India is expected to average 4.2% year-on-year in the 2025 calendar year, with food inflation at 4.6% — much lower than estimates of 7%-plus for 2024, thanks to adequate rainfall and good sowing.

Earnings Outlook

Consensus expects 11-12% earnings growth for the Nifty 50 in FY26, with the index trading below 20x price-earnings on FY26 estimates, suggesting reasonable valuations at current levels.

Technical Analysis Framework

Japanese Candlestick Analysis

Weekly Pattern: Spinning top formation indicating indecision at current levels

Daily Pattern: Small-bodied candles with narrow ranges suggesting consolidation

Intraday Patterns: Hammer and doji formations prevalent in 1H and 4H timeframes

Volume Confirmation: Average volume during consolidation phase

Elliott Wave Analysis

Primary Wave Count:

Major Degree: Wave 5 of larger bull market cycle potentially in progress

Intermediate Degree: Subwave 3 of 5 showing extension characteristics

Minor Degree: Currently in subwave 4 correction of intermediate wave 3

Alternative Count: Complex correction (WXY) completion targeting 25,200-25,500

Critical Support: Wave 4 support at 23,800-24,000 maintains bullish structure

Harmonic Pattern Analysis

Active Patterns:

Bullish Gartley: Potential completion zone at 23,950-24,100

ABCD Pattern: Current formation targeting 24,800-25,000

Potential Cypher: Formation developing with D point near 25,100

Fibonacci Analysis:

- 50% retracement of major swing: 24,200

- 38.2% retracement: 24,500 (current consolidation area)

- 1.618 extension target: 24,900-25,000

Wyckoff Method Analysis

Phase Assessment: Accumulation Phase C - Testing supply

Characteristics:

- Volume patterns showing accumulation on weakness

- Price holding above composite operator accumulation zone

- Sign of Strength (SOS) evident on recent advances

Distribution Risk: Monitor for climactic volume above 25,000

W.D. Gann Technical Analysis

# Square of 9 Application

Current Position: 24,433.65 = 156.31° on the Gann wheel

Key Resistance Levels:

- 24,481 (156.5°) - immediate minor resistance

- 24,649 (157°) - intermediate resistance

- 25,000 (158.11°) - major psychological and geometric resistance

Support Levels:

- 24,336 (156°) - immediate support

- 24,025 (155°) - strong support zone

- 23,716 (154°) - major support level

# Time Theory Application

Critical Time Windows:

- September 9-12: 45-degree time angle from recent high

- September 23: Autumn equinox - natural market turning point

- October 8-15: 90-degree time cycle completion

# Price and Time Squaring

Square Root Analysis: √24,433.65 = 156.31

Next Square Levels:

- 157² = 24,649 (key resistance)

- 158² = 24,964 (approaching 25,000)

- 160² = 25,600 (extended target)

Ichimoku Kinko Hyo Analysis

Cloud Configuration:

Tenkan-sen (9): 24,445 - Price slightly below, neutral

Kijun-sen (26): 24,380 - Price above, mild bullish bias

Senkou Span A: 24,412 (cloud top)

Senkou Span B: 24,100 (cloud bottom)

Assessment: Price trading within cloud, indicating consolidation phase with neutral bias pending breakout direction.

Multi-Timeframe Technical Indicator Analysis

5-Minute Chart (Scalping Focus)

RSI(14): 49.2 - Neutral territory with no momentum bias

VWAP: 24,428 - Price oscillating around VWAP

Bollinger Bands: Middle band at 24,430, bands contracting (low volatility period)

Moving Averages: EMA(20) = 24,435, SMA(20) = 24,440

15-Minute Chart (Scalping Focus)

MACD: Near zero line, histogram flat - no clear momentum

Stochastic(14,3,3): 52.1 in neutral zone

Williams %R: -48% indicating no extreme conditions

Volume: Below average, typical for consolidation

Key Intraday Levels:

Resistance: 24,460, 24,490, 24,520

Support: 24,400, 24,370, 24,340

1-Hour Chart (Day Trading)

RSI(14): 54.3 - Slight bullish bias but not overbought

VWAP: 24,415 providing dynamic support

ADX(14): 22.1 indicating weak trend strength (consolidation)

Volume Profile: High volume node at 24,380-24,450

Trading Range:

Upper Boundary: 24,520-24,550

Lower Boundary: 24,320-24,350

Breakout Levels: Above 24,580 (bullish) / Below 24,280 (bearish)

4-Hour Chart (Swing Trading)

RSI(14): 57.8 showing mild bullish momentum

MACD: Positive but flattening, momentum slowing

Bollinger Bands: Price near middle band, bands parallel (range-bound)

Moving Averages: All short-term MAs converging around current price

Swing Levels:

Primary Resistance: 24,650-24,700

Secondary Resistance: 24,900-25,000

Primary Support: 24,200-24,250

Secondary Support: 24,000-24,050

Daily Chart (Position Trading)

RSI(14): 59.4 in bullish territory but not extreme

MACD: Positive with slight bullish divergence

Volume: Consolidation pattern with below-average volume

Pattern: Symmetrical triangle formation approaching apex

Key Daily Levels:

Triangle Resistance: 24,700-24,750 (declining)

Triangle Support: 24,150-24,200 (rising)

Breakout Targets: 25,200 (upside) / 23,600 (downside)

Weekly Chart (Long-term Analysis)

RSI(14): 63.2 showing healthy bullish momentum

MACD: Positive momentum but rate of change slowing

Long-term Trend: Intact uptrend since March 2020 low

Major Resistance: 25,000-25,200 zone

Monthly Chart (Strategic Perspective)

RSI(14): 68.1 approaching overbought levels

Long-term Pattern: Multi-year ascending triangle completion

Major Support: 22,000-22,500 zone

Extended Targets: 26,000-27,000 on sustained breakout

Comprehensive Support and Resistance Analysis

Primary Support Zones

1. 24,380-24,420: Kijun-sen and VWAP confluence zone

2. 24,320-24,350: Previous consolidation low and volume support

3. 24,200-24,250: 50% Fibonacci retracement and psychological level

4. 24,100-24,150: Cloud bottom and structural support

5. 24,000-24,050: Major psychological level and trend line support

6. 23,800-23,900: Elliott Wave 4 support and major trend line

7. 23,600-23,700: Extended support and breakout failure target

Primary Resistance Zones

1. 24,460-24,490: Immediate intraday resistance

2. 24,520-24,580: Short-term resistance and breakout level

3. 24,650-24,700: Triangle resistance and swing high

4. 24,850-24,900: Intermediate resistance zone

5. 24,950-25,000: Major psychological resistance and Square of 9

6. 25,100-25,200: Extended targets and measured moves

7. 25,500-25,800: Long-term bull market targets

Weekly Trading Strategy (September 2-6, 2025)

Monday, September 2, 2025

Market Environment: Post-weekend consolidation, range-bound expected

Primary Strategy: Range trading within established boundaries

Volatility: Low to moderate, typical Monday characteristics

Intraday Setup:

Range: 24,380-24,480

Long Entry: 24,390-24,410

- Stop Loss: 24,360

- Target 1: 24,450 (1:1.5 R/R)

- Target 2: 24,480 (1:2.5 R/R)

Short Entry: 24,470-24,490

- Stop Loss: 24,520

- Target 1: 24,430 (1:1.5 R/R)

- Target 2: 24,400 (1:2.5 R/R)

Swing Consideration: Monitor for breakout preparation above 24,500

Tuesday, September 3, 2025

Market Environment: Increased activity expected, potential trending day

Primary Strategy: Momentum trading with breakout preparation

Key Focus: Volume analysis for sustained directional moves

Trading Scenarios:

Bullish Breakout: Above 24,520 with volume

- Entry: 24,530-24,550

- Stop: 24,480

- Targets: 24,600, 24,650, 24,700

Bearish Breakdown: Below 24,360 with volume

- Entry: 24,350-24,330

- Stop: 24,390

- Targets: 24,280, 24,250, 24,200

Risk Management: Reduce position size by 25% on breakout trades

Wednesday, September 4, 2025

Market Environment: Mid-week volatility, economic data focus

Primary Strategy: News-driven trading with technical confirmation

Event Risk: Monitor for any economic announcements

Scalping Strategy:

High-Frequency Range: 24,400-24,460

Long Scalps: 24,405-24,415, Target: 24,445-24,455

Short Scalps: 24,450-24,460, Target: 24,415-24,425

Stop Loss: Maximum 20 points for scalp trades

Swing Setup: Prepare for potential triangle breakout

Thursday, September 5, 2025

Market Environment: Potential high-volatility day

Primary Strategy: Breakout trading with strong risk management

Focus: Triangle resolution expected

Triangle Breakout Strategy:

Upside Breakout: Above 24,580

- Confirmation: Volume > 1.3x average

- Initial Target: 24,700

- Extended Target: 24,850-24,900

Downside Breakdown: Below 24,280

- Confirmation: Volume > 1.2x average

- Initial Target: 24,150

- Extended Target: 24,000-24,050

Position Management: Trail stops after 50% of target achieved

Friday, September 6, 2025

Market Environment: Weekly settlement, profit-taking likely

Primary Strategy: End-of-week positioning and profit-taking

Focus: Weekly close levels for next week setup

Settlement Strategy:

Bullish Close: Above 24,500 supports next week advance

Neutral Close: 24,350-24,500 maintains consolidation

Bearish Close: Below 24,350 suggests correction risk

Day Trading Approach:

Morning: Follow Thursday's direction initially

Afternoon: Expect consolidation and position adjustments

Last Hour: Avoid large new positions

Risk Management Framework

Position Sizing Guidelines

Risk Per Trade by Timeframe:

5M Scalping: 0.25-0.5% of capital

15M Scalping: 0.5-0.75% of capital

1H Day Trading: 1-1.5% of capital

4H Swing Trading: 1.5-2% of capital

Daily Position Trading: 2-2.5% of capital

Stop Loss Framework

Timeframe-Specific Stops:

5-Minute: 15-25 points maximum

15-Minute: 25-40 points maximum

1-Hour: 40-60 points maximum

4-Hour: 80-120 points maximum

Daily: 150-250 points maximum

Profit-Taking Strategy

Systematic Approach:

Target 1 (40%): 1:1 Risk/Reward

Target 2 (35%): 1:2 Risk/Reward

Target 3 (25%): 1:3+ Risk/Reward

Trailing Stops: Activate after Target 1

Maximum Drawdown Limits

Daily Loss Limit: 3% of trading capital

Weekly Loss Limit: 7% of trading capital

Monthly Loss Limit: 15% of trading capital

Geopolitical and Economic Risk Assessment

Domestic Risk Factors

Monetary Policy:

- RBI rate cut cycle supporting liquidity

- Inflation targeting maintaining credibility

- Banking system stability considerations

Fiscal Policy:

- Government capex supporting growth

- Festive season spending boost expected

- Budget allocation efficiency focus

Corporate Earnings:

- Q2 FY26 earnings season approaching

- Margin pressure from input costs

- Sectoral rotation opportunities

Global Risk Factors

US Federal Reserve Policy:

- Rate cut expectations supporting EM flows

- Dollar weakness benefiting Indian markets

- Global liquidity conditions favorable

China Economic Impact:

- Trade relationship developments

- Commodity price implications

- Regional growth spillover effects

Geopolitical Considerations:

- Regional security stability

- Energy security and pricing

- Trade policy developments

Sector-Specific Risks

Banking & Financial Services:

- Credit growth sustainability

- NPA cycle management

- Interest rate sensitivity

Information Technology:

- Global demand patterns

- Currency hedging strategies

- AI and automation impact

Consumer Discretionary:

- Rural demand recovery

- Festive season performance

- Inflation impact on spending

Sectoral Analysis and Rotation Themes

Outperforming Sectors

1. Banking & Financial Services: Rate cut cycle benefits

2. FMCG: Festive season demand and rural recovery

3. Infrastructure: Government capex and policy support

4. Pharmaceuticals: Export competitiveness and domestic growth

Underperforming Sectors

1. Information Technology: Global demand concerns

2. Metals & Mining: Commodity price volatility

3. Real Estate: Interest rate sensitivity despite cuts

4. Telecommunications: Competitive pressure and capex burden

Rotation Indicators

Growth vs Value: Favoring quality growth at reasonable prices

Large Cap vs Mid/Small Cap: Large cap leadership maintained

Domestic vs Export: Domestic consumption themes outperforming

Advanced Technical Patterns

Ichimoku Trading Signals

Current Setup: Price within cloud, neutral bias

Bullish Trigger: Break above Tenkan-sen with volume

Bearish Trigger: Break below cloud with momentum

Long-term View: Future cloud remains bullish

Gann-Based Strategies

Square of 9 Trades:

- Long: 155° (24,025) targeting 158° (24,964)

- Short: 158° (24,964) targeting 155° (24,025)

- Time Cycles: September 9-12 reversal window

Wyckoff Phase Trading

Current Phase: Accumulation Phase C

Next Phase: Markup expected on successful test

Volume Confirmation: Key for phase transition

Distribution Risk: Monitor above 25,200

Market Microstructure Analysis

Algorithmic Trading Impact

High-Activity Zones: 24,000, 24,500, 25,000 levels

Optimal Entry Times: 9:15-9:45 and 14:30-15:15 IST

Liquidity Patterns: Reduced depth during lunch hours

Order Flow Considerations

Institutional Activity: Accumulation evident below 24,400

FII Flows: Recent buying supporting current levels

DII Participation: Consistent buying on weakness

Technology and Tools Integration

Recommended Platforms

1. TradingView: Advanced charting and technical analysis

2. Zerodha Kite: Real-time execution and portfolio management

3. Bloomberg Terminal: Comprehensive market data and news

4. Refinitiv Workspace: Fundamental analysis integration

Alert Configuration

Price Alerts:

- Triangle breakout: 24,580 (up) / 24,280 (down)

- Psychological levels: 24,500, 25,000

- Support/resistance: 24,200, 24,700

Volume Alerts:

- Unusual volume spikes (>150% average)

- Block deal notifications

- Institutional flow changes

Seasonal and Calendar Considerations

Festive Season Impact

Indian markets are entering the 4-month-long festive season from September, which historically shows positive performance. This period typically sees:

- Increased consumer spending

- Corporate bonus distributions

- Portfolio rebalancing by institutions

- Higher retail participation

Economic Calendar

Key Events:

- RBI Monetary Policy (likely September 17)

- Q2 FY26 GDP data (October/November)

- Inflation data (monthly releases)

- FII/DII flow data (weekly)

Holiday Calendar

- Ganesh Chaturthi (September 7) - Market closed

- Dussehra (October 12) - Market closed

- Diwali (November 1) - Market closed

- Guru Nanak Jayanti (November 15) - Market closed

Conclusion and Strategic Outlook

The NIFTY 50 stands at a critical juncture, consolidating near significant resistance levels while benefiting from supportive monetary and fiscal policies. The technical picture suggests a healthy consolidation phase that could resolve in favor of further upside, particularly given the approaching festive season and improving economic fundamentals.

Key Investment Themes:

1. Triangle Resolution: Current consolidation likely to resolve with directional clarity

2. Festive Season Tailwinds: Historical patterns favor bullish bias into year-end

3. Rate Cut Benefits: Lower rates supporting equity valuations and credit growth

4. Earnings Growth: Expected double-digit growth supporting index advancement

Trading Strategy Priorities:

- Focus on triangle breakout trades with volume confirmation

- Favor range trading until clear directional break

- Maintain disciplined risk management given elevated levels

- Prepare for increased volatility around key events

Medium-term Outlook (1-3 months):

The combination of accommodative monetary policy, strong GDP growth, controlled inflation, and seasonal tailwinds provides a constructive backdrop for Indian equities. Technical analysis suggests potential for advancement toward 25,500-26,000 on sustained breakout above current resistance.

Risk Management Focus:

- Triangle breakdown below 24,280 could target 24,000-23,800

- Global risk-off sentiment remains key external risk

- Valuation concerns at higher levels warrant selectivity

- Currency stability important for FII flow continuation

The analysis incorporates multiple technical methodologies while acknowledging the strong fundamental backdrop supporting Indian markets. Traders should remain flexible and prepared for both continuation and reversal scenarios while maintaining strict adherence to risk management protocols.

---

*This comprehensive analysis combines technical and fundamental factors to provide actionable trading strategies. All recommendations should be implemented within individual risk tolerance parameters and current market conditions. Market dynamics can change rapidly, requiring continuous monitoring and strategy adjustments.*

I am nothing

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

I am nothing

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.