Closing Price (Sept 1): 24,527.55 (▲ +0.42%)

Current Session (Intraday – Sept 2): Around 24,425–24,430

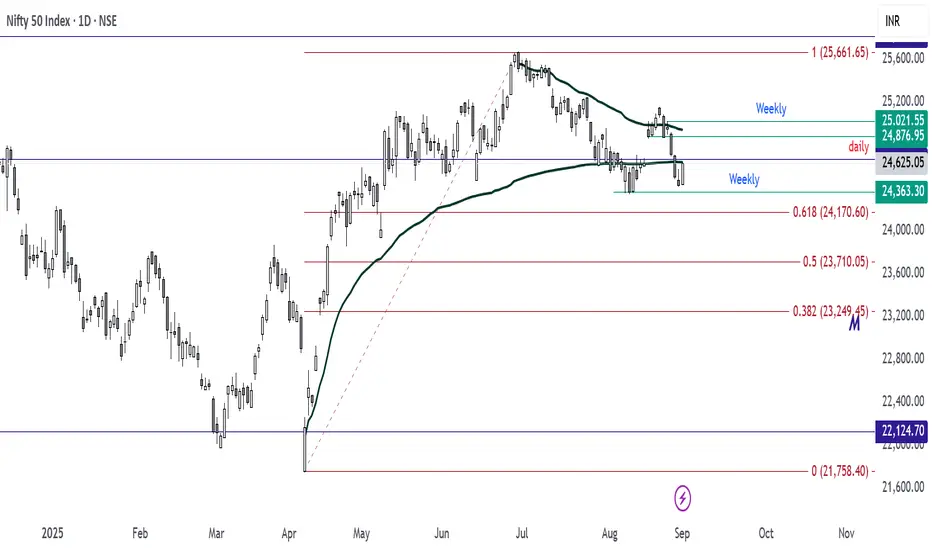

Technical Levels:

Immediate Support: 24,350

Next Support: 24,250

Immediate Resistance: 24,600

Next Resistance: 24,750

🔹 Advanced Levels

Anchored Volume Profile Resistance: 24,626 and 24,930

Fibonacci Daily Resistance (0.618): 25,170

Daily Time Frame Zone: 24,624 – 24,876

🔹 Indicators

RSI (14): Neutral zone (~52)

20-Day SMA: Flat, showing consolidation

50-Day SMA: Uptrend intact, but momentum fading

Candle Setup (Sept 1): Small-bodied with upper wick → selling pressure near highs

🔹 Price Action Notes

On Monday (Sept 1), Nifty broke above Friday’s high which is crucial

If sustained, upside momentum possible toward resistance zones

Seasonal sentiment (festival & marriage season) may provide additional support

🔹 Trade Setup (1H Time Frame)

Bullish Scenario:

If price sustains above 24,664 → go long,

Stop Loss (SL): 1H candle low (confirmed using 15-min chart)

Target: 24,876

Bearish Scenario:

If a Pin Bar forms near 24,624 on 1H → go short

Stop Loss (SL): Pin Bar candle high (confirmed on 15-min chart)

Target 1: 24,550 Target 2: Trail using 15-min candles down to 24,500 → 24,400

🔹 Chart View

Range: 24,350 – 24,600 (critical breakout zone)

Upside expansion possible if 24,626/24,664 holds

Downside risk if rejection occurs at 24,624 zone

🔖 Disclaimer: This is a technical chart-based study for educational purposes only. Not financial advice.

Current Session (Intraday – Sept 2): Around 24,425–24,430

Technical Levels:

Immediate Support: 24,350

Next Support: 24,250

Immediate Resistance: 24,600

Next Resistance: 24,750

🔹 Advanced Levels

Anchored Volume Profile Resistance: 24,626 and 24,930

Fibonacci Daily Resistance (0.618): 25,170

Daily Time Frame Zone: 24,624 – 24,876

🔹 Indicators

RSI (14): Neutral zone (~52)

20-Day SMA: Flat, showing consolidation

50-Day SMA: Uptrend intact, but momentum fading

Candle Setup (Sept 1): Small-bodied with upper wick → selling pressure near highs

🔹 Price Action Notes

On Monday (Sept 1), Nifty broke above Friday’s high which is crucial

If sustained, upside momentum possible toward resistance zones

Seasonal sentiment (festival & marriage season) may provide additional support

🔹 Trade Setup (1H Time Frame)

Bullish Scenario:

If price sustains above 24,664 → go long,

Stop Loss (SL): 1H candle low (confirmed using 15-min chart)

Target: 24,876

Bearish Scenario:

If a Pin Bar forms near 24,624 on 1H → go short

Stop Loss (SL): Pin Bar candle high (confirmed on 15-min chart)

Target 1: 24,550 Target 2: Trail using 15-min candles down to 24,500 → 24,400

🔹 Chart View

Range: 24,350 – 24,600 (critical breakout zone)

Upside expansion possible if 24,626/24,664 holds

Downside risk if rejection occurs at 24,624 zone

🔖 Disclaimer: This is a technical chart-based study for educational purposes only. Not financial advice.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.