In this brief article, I aim to throw some light upon a typical trader's psychology, which is often swayed by greed and fear, and the constant battle between careful analysis and impulsive decisions.

Traders who actually trade and not just analyze understand that the stock market is not merely a game of numbers- it’s a psychological battlefield where your own mind can turn into your sneakiest opponent.

You’ve got your charts, your indicators, and your gut screaming at you, but many a times, your prediction could be a game spoiler. That little voice in your head saying, “I’ve got this figured out,” can lead you straight into a trap.

Let’s break this down with two classic trader blunders (of course there are more) and sprinkle in some brain science to see why we keep doing this to ourselves and how to fight back.

Situation 1: The Pullback That Never Came

Imagine a situation when you’ve been watching a stock like a hawk, waiting for that sweet dip to jump in. But the price keeps climbing, and you’re sitting there, twisting your hands, grunting, “It’s going to pull back soon”.

Then, your patience snaps and you say, “screw it, this thing’s not dropping anytime soon- I’m calling it”. You hit the buy button at what turns out to be the tippy-top, proudly predicting endless upside. Perfect moment when the whole universe starts laughing in your face while the price tanks the second your order fills, and you’re left holding a bag heavier than your ego.

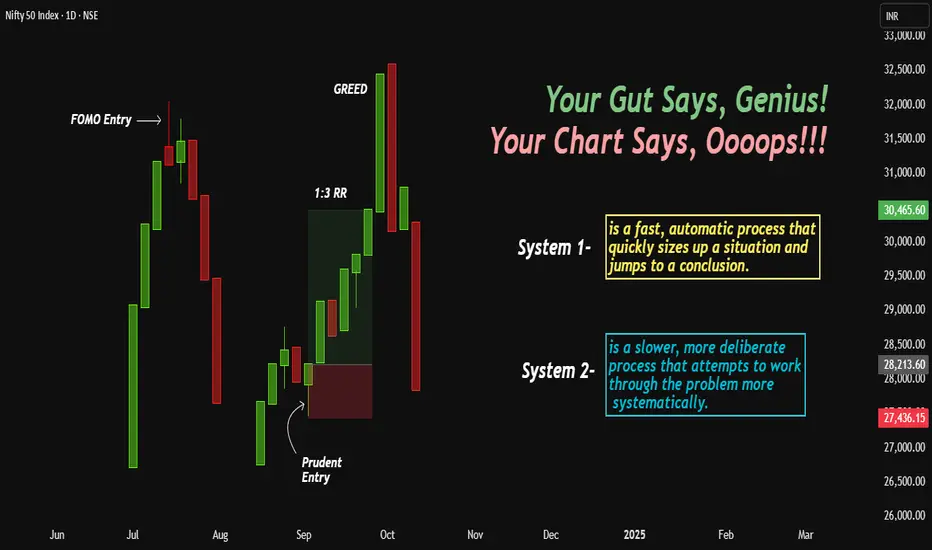

What happened here? System 1 of your brain- the impulsive hotshot- got tired of waiting and convinced you the pullback was a myth. Meanwhile, System 2, the slow-mo logical analyst- was napping on the job, too lazy to double-check the trend or your risk plan.

The result? A prediction born from frustration, not facts, and a bruised trading account to show for it (see the first figure on chart)

Situation 2: Going to the Moon Call

Now imagine when you nail a trade with a solid 1:3 risk-reward setup. The price hits your target and you are high-fiving yourself in your head. But wait, the momentum is insane! The chart’s practically vertical, and your inner fortune-teller pops up saying: “this is just the beginning, it’s going way higher.”

So, you ignore the initial 1:3 profit button, predicting a jackpot just around the corner. But caution- the market doesn’t care about your crystal ball. The price may fall faster than the Adam's apple, and you will be booking a loss instead of sipping champagne (see figure 2 in the chart).

Here’s the brain glitch:

System 1, that greedy adrenaline hotshot, saw the momentum and screamed, “More, more, more!”.

System 2, the voice of reason, should’ve stepped in with, “Hey, dummy, take the win- you hit your target.” But nope, Mr.1 is drowned in the thrill of that chase. Your prediction wasn’t analysis, it was hope dressed up as logic.

The Psychology Behind the Madness

Our brains are wired into two systems, straight out of Daniel Kahneman’s book.

System 1 is the lightning bolt- emotional, instinctive, and prone to jumping the gun.

System 2 is the nerdy analytical- slow, deliberate, and obsessed with data.

Trading is tough because the market moves fast and System 1 loves to take on the wheel, especially when predictions feel like a superpower. Problem is, it’s usually guessing and not knowing. System 2, meanwhile, gets lazy unless you force it to wake up and do the math.

How to Outsmart Yourself

So, how do you stop your predictions from stabbing you in the back?

Lean harder on System 2. Build a trading plan with clear rules—entry points, exits, profit targets—and stick to it religiously. When your senses are itching to predict the next big move, pause!!! Ask yourself, “Is this my gut talking, or my chart?”

Needless to mention, the market doesn’t care what you think, and it will do what it is going to do anyway. Your job is not to outguess or outsmart it, your job is to outthink yourself. So, next time you’re about to bet on a hunch, give System 2 its fair chance. Your trading account will thank you and you might just sleep better at night 🙂

I hope you like the writeup.

Do like and comment if you feel necessary.

Traders who actually trade and not just analyze understand that the stock market is not merely a game of numbers- it’s a psychological battlefield where your own mind can turn into your sneakiest opponent.

You’ve got your charts, your indicators, and your gut screaming at you, but many a times, your prediction could be a game spoiler. That little voice in your head saying, “I’ve got this figured out,” can lead you straight into a trap.

Let’s break this down with two classic trader blunders (of course there are more) and sprinkle in some brain science to see why we keep doing this to ourselves and how to fight back.

Situation 1: The Pullback That Never Came

Imagine a situation when you’ve been watching a stock like a hawk, waiting for that sweet dip to jump in. But the price keeps climbing, and you’re sitting there, twisting your hands, grunting, “It’s going to pull back soon”.

Then, your patience snaps and you say, “screw it, this thing’s not dropping anytime soon- I’m calling it”. You hit the buy button at what turns out to be the tippy-top, proudly predicting endless upside. Perfect moment when the whole universe starts laughing in your face while the price tanks the second your order fills, and you’re left holding a bag heavier than your ego.

What happened here? System 1 of your brain- the impulsive hotshot- got tired of waiting and convinced you the pullback was a myth. Meanwhile, System 2, the slow-mo logical analyst- was napping on the job, too lazy to double-check the trend or your risk plan.

The result? A prediction born from frustration, not facts, and a bruised trading account to show for it (see the first figure on chart)

Situation 2: Going to the Moon Call

Now imagine when you nail a trade with a solid 1:3 risk-reward setup. The price hits your target and you are high-fiving yourself in your head. But wait, the momentum is insane! The chart’s practically vertical, and your inner fortune-teller pops up saying: “this is just the beginning, it’s going way higher.”

So, you ignore the initial 1:3 profit button, predicting a jackpot just around the corner. But caution- the market doesn’t care about your crystal ball. The price may fall faster than the Adam's apple, and you will be booking a loss instead of sipping champagne (see figure 2 in the chart).

Here’s the brain glitch:

System 1, that greedy adrenaline hotshot, saw the momentum and screamed, “More, more, more!”.

System 2, the voice of reason, should’ve stepped in with, “Hey, dummy, take the win- you hit your target.” But nope, Mr.1 is drowned in the thrill of that chase. Your prediction wasn’t analysis, it was hope dressed up as logic.

The Psychology Behind the Madness

Our brains are wired into two systems, straight out of Daniel Kahneman’s book.

System 1 is the lightning bolt- emotional, instinctive, and prone to jumping the gun.

System 2 is the nerdy analytical- slow, deliberate, and obsessed with data.

Trading is tough because the market moves fast and System 1 loves to take on the wheel, especially when predictions feel like a superpower. Problem is, it’s usually guessing and not knowing. System 2, meanwhile, gets lazy unless you force it to wake up and do the math.

How to Outsmart Yourself

So, how do you stop your predictions from stabbing you in the back?

Lean harder on System 2. Build a trading plan with clear rules—entry points, exits, profit targets—and stick to it religiously. When your senses are itching to predict the next big move, pause!!! Ask yourself, “Is this my gut talking, or my chart?”

Needless to mention, the market doesn’t care what you think, and it will do what it is going to do anyway. Your job is not to outguess or outsmart it, your job is to outthink yourself. So, next time you’re about to bet on a hunch, give System 2 its fair chance. Your trading account will thank you and you might just sleep better at night 🙂

I hope you like the writeup.

Do like and comment if you feel necessary.

JJ Singh

Trader/Investor

Moderator, TradingView

🚀Join t.me/jjsingh_2020 ,

A Free Education channel

🚀Tweet at twitter.com/JaySingh_2020

Trader/Investor

Moderator, TradingView

🚀Join t.me/jjsingh_2020 ,

A Free Education channel

🚀Tweet at twitter.com/JaySingh_2020

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

JJ Singh

Trader/Investor

Moderator, TradingView

🚀Join t.me/jjsingh_2020 ,

A Free Education channel

🚀Tweet at twitter.com/JaySingh_2020

Trader/Investor

Moderator, TradingView

🚀Join t.me/jjsingh_2020 ,

A Free Education channel

🚀Tweet at twitter.com/JaySingh_2020

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.