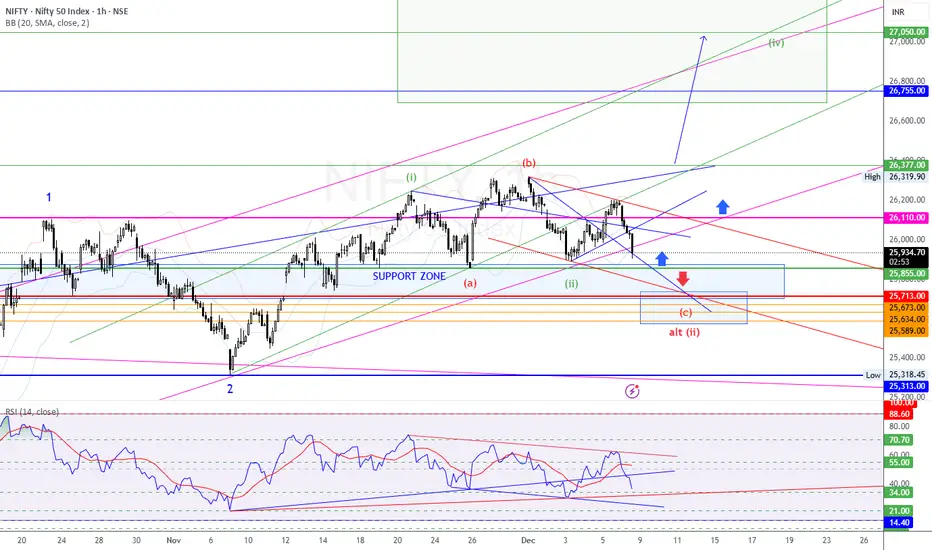

Chart: 1 Hour | 8 Dec 2025

NIFTY is currently inside a corrective Wave (ii) structure following the completion of Wave (i).

The price has pulled back into a strong support confluence zone, aligning with:

Fib support region

Demand structure

Channel lower boundary

RSI oversold support trendline

📍 Wave Count Summary

Wave 1 – Completed at 26,377

Wave 2 – Low at 25,318

Wave (i) – Top at 26,377

Wave (ii) – Corrective pullback in progress (a-b-c)

Possible final c-wave target at 25,855 – 25,634

Two possible scenarios

🅰 Primary View

Wave (ii) finishes inside 25,855 – 25,634 zone → breakout start of Wave (iii) targeting 26,755 – 27,050

🅱 Alternative View

Deeper flush toward 25,589 – 25,473 before strong reversal

🎯 Upside Targets

Target Level

Target 1 26,110

Target 2 26,377

Wave (iii) Major Target 26,755 – 27,050

Extended Target 27,550+

🛑 Invalidation Levels

Level Meaning

25,589 Alt (ii) still valid

25,318 Impulsive bullish structure invalidated

📊 RSI Analysis

RSI approaching trendline support

No bearish divergence near highs → structure supports continuation

Expecting bullish reversal signal soon

🚀 Trade Setup (Educational Only)

Long Setup

Entry Zone: 25,855 – 25,634

Stop-Loss: 25,473

Targets: 26,110 / 26,377 / 26,755 / 27,050

Breakout Entry

Above 26,110 for momentum confirmation

🧠 Conclusion

NIFTY is positioned at a high-probability reversal zone for the start of a potential Wave (iii) rally.

Holding above 25,589 / 25,318 is critical for bullish continuation.

⚠ Disclaimer

This analysis is for educational and research purposes only and is not financial or investment advice.

Trading in financial markets involves risk, and past performance is not indicative of future results.

Please consult your financial advisor before making any investment decisions.

I am not responsible for any profits or losses incurred based on this analysis.

NIFTY is currently inside a corrective Wave (ii) structure following the completion of Wave (i).

The price has pulled back into a strong support confluence zone, aligning with:

Fib support region

Demand structure

Channel lower boundary

RSI oversold support trendline

📍 Wave Count Summary

Wave 1 – Completed at 26,377

Wave 2 – Low at 25,318

Wave (i) – Top at 26,377

Wave (ii) – Corrective pullback in progress (a-b-c)

Possible final c-wave target at 25,855 – 25,634

Two possible scenarios

🅰 Primary View

Wave (ii) finishes inside 25,855 – 25,634 zone → breakout start of Wave (iii) targeting 26,755 – 27,050

🅱 Alternative View

Deeper flush toward 25,589 – 25,473 before strong reversal

🎯 Upside Targets

Target Level

Target 1 26,110

Target 2 26,377

Wave (iii) Major Target 26,755 – 27,050

Extended Target 27,550+

🛑 Invalidation Levels

Level Meaning

25,589 Alt (ii) still valid

25,318 Impulsive bullish structure invalidated

📊 RSI Analysis

RSI approaching trendline support

No bearish divergence near highs → structure supports continuation

Expecting bullish reversal signal soon

🚀 Trade Setup (Educational Only)

Long Setup

Entry Zone: 25,855 – 25,634

Stop-Loss: 25,473

Targets: 26,110 / 26,377 / 26,755 / 27,050

Breakout Entry

Above 26,110 for momentum confirmation

🧠 Conclusion

NIFTY is positioned at a high-probability reversal zone for the start of a potential Wave (iii) rally.

Holding above 25,589 / 25,318 is critical for bullish continuation.

⚠ Disclaimer

This analysis is for educational and research purposes only and is not financial or investment advice.

Trading in financial markets involves risk, and past performance is not indicative of future results.

Please consult your financial advisor before making any investment decisions.

I am not responsible for any profits or losses incurred based on this analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.