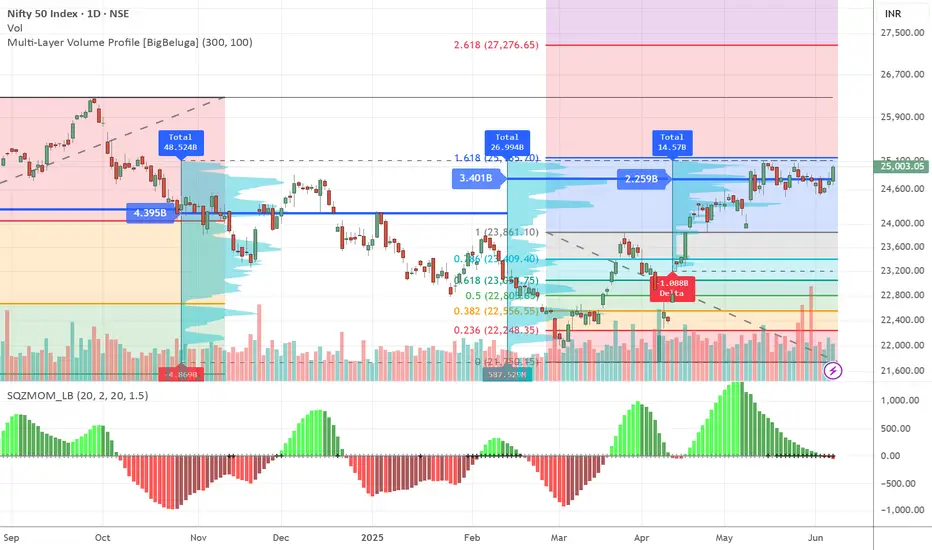

NIFTY Poised for 27,200 and Beyond! 🚀

I’ve always maintained a bullish stance on the Indian markets for the long term, consistently advising investors to buy the dips. Today’s RBI rate cut has further strengthened that conviction.

The surprising strength of the INR amidst global trade tensions gave RBI the room to act decisively — and it did. This rate cut, combined with improving liquidity and macro tailwinds, has added powerful momentum to the NIFTY at 25,000.

From here, a 9–10% upside in NIFTY could translate to an exciting 10–25% rally in Midcap and Smallcap stocks. The risk-reward is skewed in favor of long-term investors.

Stay invested. Add on dips. The journey to 27,200+ has just begun!

I’ve always maintained a bullish stance on the Indian markets for the long term, consistently advising investors to buy the dips. Today’s RBI rate cut has further strengthened that conviction.

The surprising strength of the INR amidst global trade tensions gave RBI the room to act decisively — and it did. This rate cut, combined with improving liquidity and macro tailwinds, has added powerful momentum to the NIFTY at 25,000.

From here, a 9–10% upside in NIFTY could translate to an exciting 10–25% rally in Midcap and Smallcap stocks. The risk-reward is skewed in favor of long-term investors.

Stay invested. Add on dips. The journey to 27,200+ has just begun!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.