The past week saw Yo-Yo move between 19330 & 520 with selling pressure every time the Index attempted to cross 19500. Friday’s move matched with India’s pride moment of Chandrayan 3 and the Index scaled a new peak of 19595.

A few observations from the weekly charts are:

Expected scenarios for the ensuing week

The Index has taken sufficient time to consolidate between 19300 &19500 before breaking out which is considered a good sign

Index may find supports at 19420, 19340,19230 and the index could face resistances at multiple levels19670,19770 and beyond 19770 there could be a bout of stops getting triggered

Additional interesting observations

Final Note

#Stay Safe

Disclaimer: The views expressed here are personal and not connected to SYFX Treasury Foundation. The views are for learning and reference purpose only.

A few observations from the weekly charts are:

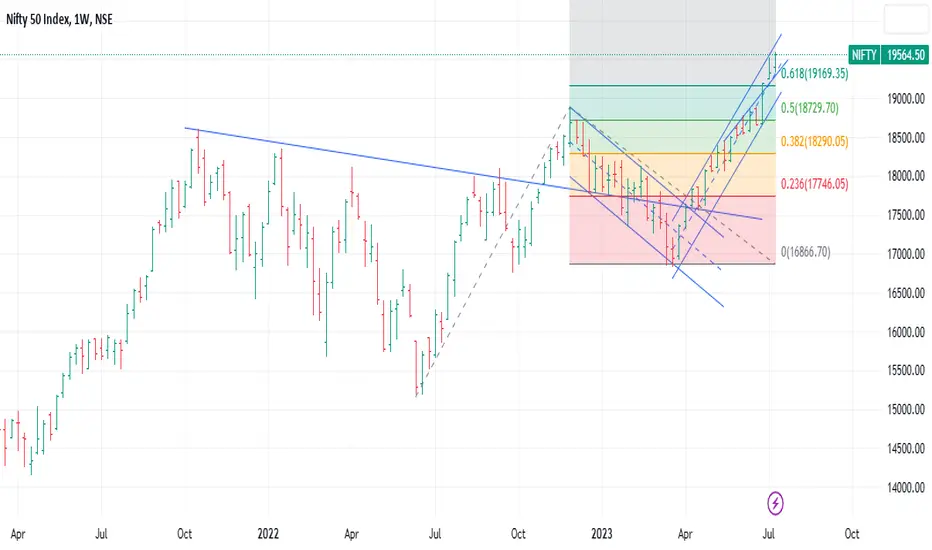

- The index moved in a range of 268 points viz. between 19327 and 19595

- The oscillators of different time frames are showing positive signals

- Option open interest to drive the direction of the market

Expected scenarios for the ensuing week

The Index has taken sufficient time to consolidate between 19300 &19500 before breaking out which is considered a good sign

Index may find supports at 19420, 19340,19230 and the index could face resistances at multiple levels19670,19770 and beyond 19770 there could be a bout of stops getting triggered

Additional interesting observations

- The Index is entering positive territory and may remain positive till we see a weekly close below 19100

- There has been a few Gaps created in this bull run

- 18818-18908 (28th Jun 23)

- 18972-19079 (29th July 23)

- 19189-19246 (3rd July 23)

Final Note

- The Index has stayed well above the long-term trend line and the 200 DMA at 18034 and 55 DMA at 18685

- A word of caution

- Be aware of the Gaps made during the up move

- Index is moving in an ascending channel having a depth of about 700 points. The top of the channel at 19770 and the lower end at 19070 and median at 19420

- Currently the Index is above mid-point of the channel

- For the past 2 weeks the gains are around 275-300 points, which does not support a very big leap forward

- Post Covid 19 crash in Mar 20, we have seen positive candles in the month of July. The story so far has been showing similar trends continuing. Yet, It remains to be seen if this would continue in this year as well when actual closing happens by the end of the month

- The Index has achieved a fresh mile stone and the formation in daily charts appear that of a flag and a W formation in the weekly, the target could be another 600-700 points. When and How is the question

- A consolidation would prove the strength of the move

- Expected to consolidate remain in the range of 19420-19740 and any close outside the range requires re-assessment of risk

- A daily close below 19420 would see the Index drift towards 19130

- Need to remain vigilant as drag can be on both sides

- There could be profit booking ahead of FED during the last week of July

#Stay Safe

Disclaimer: The views expressed here are personal and not connected to SYFX Treasury Foundation. The views are for learning and reference purpose only.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.