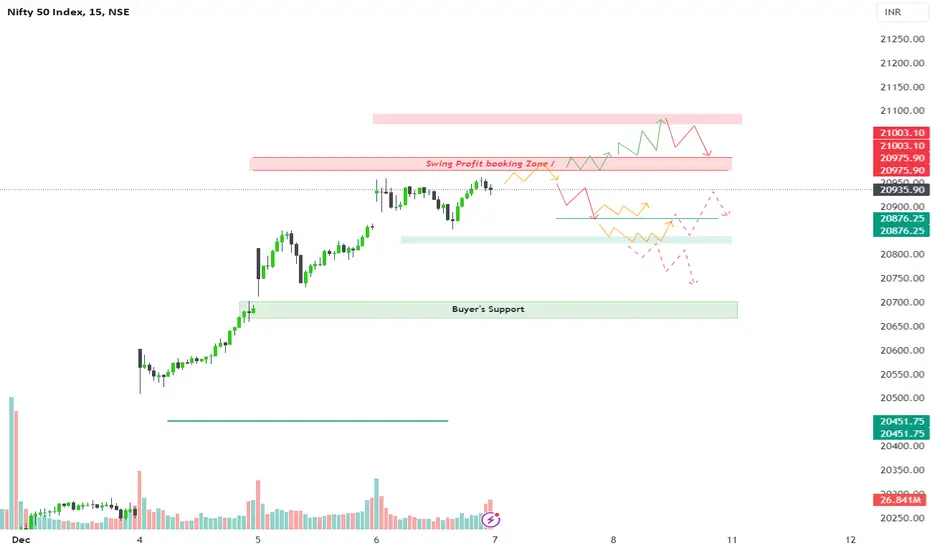

In the Nifty chart, there are indications of a potential double top formation near the swing profit booking zone of 21003-20975. If prices decline from these levels without dwelling for an extended period, it raises the likelihood of exhaustion, potentially leading to profit booking and a descent to around 20875. Subsequently, a consolidation phase between 20875 and 20920 may occur. A breach below 20870 could trigger a further decline to the range of 20820-20800.

If prices open lower and trade beneath 20875, traders are advised to wait for a test of the 20838-20822 range before initiating a buying trade, with a stop loss at 20800. The target for this trade is set at 20900-20930. Should prices dip below 20800 and linger, refraining from trade is recommended until an upward retracement occurs. Look for a short trade near 20850-20875 with a stop loss at 20900 if such a retracement takes place (position trade).

If prices open lower and trade beneath 20875, traders are advised to wait for a test of the 20838-20822 range before initiating a buying trade, with a stop loss at 20800. The target for this trade is set at 20900-20930. Should prices dip below 20800 and linger, refraining from trade is recommended until an upward retracement occurs. Look for a short trade near 20850-20875 with a stop loss at 20900 if such a retracement takes place (position trade).

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.