Short term Nifty 50 Technical Outlook is Bullish towards 25300 levels.

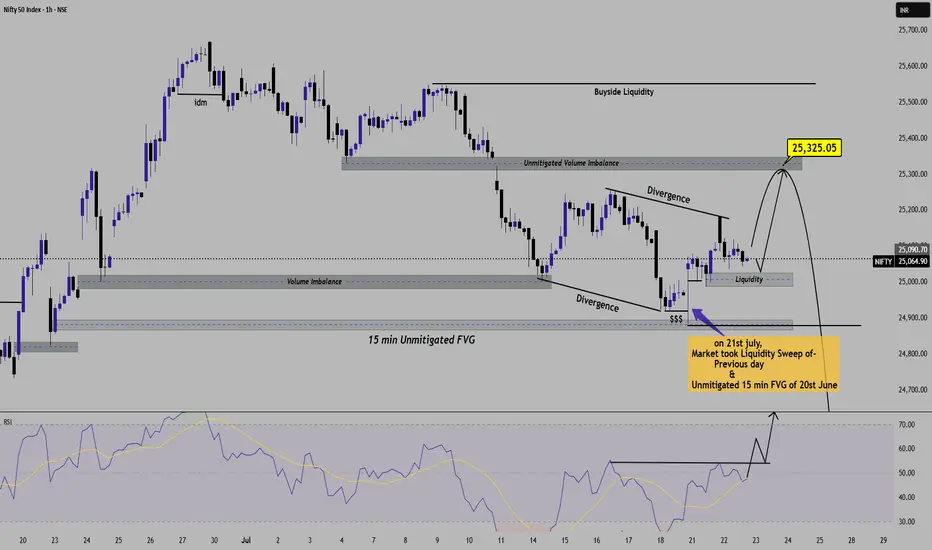

Nifty50 -- 1h Timeframe

nifty current close -- 25060

Short term Outlook -- Bullish towards 25300 Volume Imbalance zone.

Key Observation --

1. Liquidity sweep & FVG Mitigation

--on 21st june,Price has swept previous day's low liquidity.

--Also tapped the unmitigated 15 min FVg zone of 20th june which helped for strong upside reaction.

2. Bullish RSI Divergence

-- Clear bullish divergence seen both in price and RSI, which confirms trend change.

3. Volume Imbalance zone

-- Price is going towards unmitigated Volume Imbalance and Liquidity zone of 25300 25350 levels.

-- Clear buy-side Liquidity is resting near 25300 levels which may act as strong resistance levels.

Main Target ---25300-25325 (Buyside Liquidity zone.)

If price fails to support below 24920, then setup gets invalid.

Longer term Outlook ---- (After short term 25300 levels done)

-- Price to reject upside move above 25400 levels and give downside view.

-- Confirmation to be with Market structure shift and Imbalance.

-- lONG-term Is again 24400-24000 levels to be seen after 1st target 25300 liquidity is taken.

Your views or comments are most welcome.

Disclaimer -- This idea is published only for an Education purpose. I'm not SEBI Registered Research Analyst.

Do not consider it as any investment idea.

Consult your financial advisor before investments.

Nifty50 -- 1h Timeframe

nifty current close -- 25060

Short term Outlook -- Bullish towards 25300 Volume Imbalance zone.

Key Observation --

1. Liquidity sweep & FVG Mitigation

--on 21st june,Price has swept previous day's low liquidity.

--Also tapped the unmitigated 15 min FVg zone of 20th june which helped for strong upside reaction.

2. Bullish RSI Divergence

-- Clear bullish divergence seen both in price and RSI, which confirms trend change.

3. Volume Imbalance zone

-- Price is going towards unmitigated Volume Imbalance and Liquidity zone of 25300 25350 levels.

-- Clear buy-side Liquidity is resting near 25300 levels which may act as strong resistance levels.

Main Target ---25300-25325 (Buyside Liquidity zone.)

If price fails to support below 24920, then setup gets invalid.

Longer term Outlook ---- (After short term 25300 levels done)

-- Price to reject upside move above 25400 levels and give downside view.

-- Confirmation to be with Market structure shift and Imbalance.

-- lONG-term Is again 24400-24000 levels to be seen after 1st target 25300 liquidity is taken.

Your views or comments are most welcome.

Disclaimer -- This idea is published only for an Education purpose. I'm not SEBI Registered Research Analyst.

Do not consider it as any investment idea.

Consult your financial advisor before investments.

Note

i would like to give one more clue that, Whevere there is Gap up or Gap down in market, follow this conditions----If according to Bias, market is bullish and There is Gapup opening, always mark Fibonacci from previous day close to next day opening, and take buy setup entry in Discount zone (50% to 61.8% or 70.5%), you will have better Buy entry.

If according to Bias, market is bearish and There is Gap down opening, always mark Fibonacci from previous day close to next day opening, and take sell setup entry in Discount zone (50% to 61.8% or 70.5%), you will have better Sell entry.

See image for an Example.

Note

So, If tomorrow nifty opens some Gap down then do not hesitate , Nifty to open between 25170-25190 range, and for some mitigation range if goes down to 25150, it will take reverse move from there and will continue upside 25300 rally, till that, nifty not gonna hit range below 25148, lets see tomorrow,

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.