Education

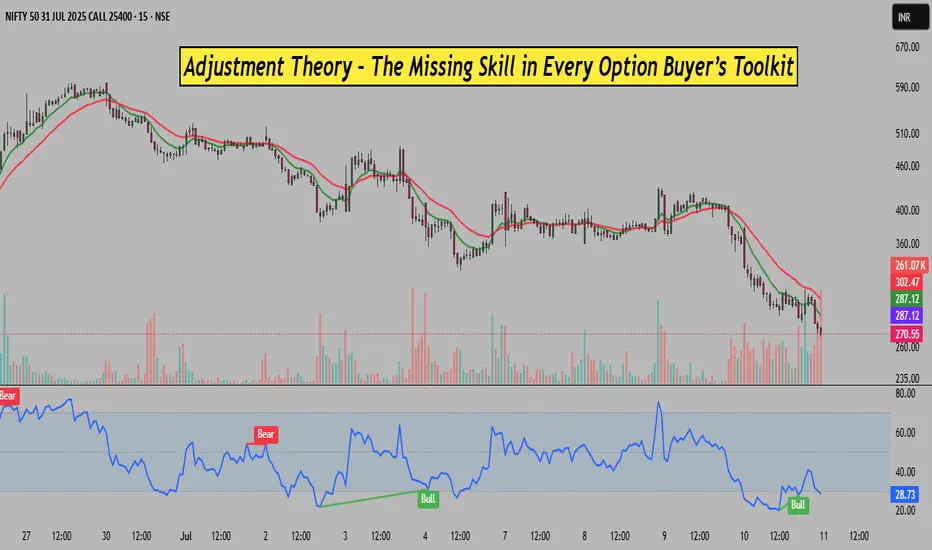

Adjustment Theory-Missing Skill in Every Option Buyer’s Toolkit!

Hello Traders!

Most option buyers enter trades with just one mindset — “It will either hit target or stop-loss.” But in real trading, markets are dynamic, not binary. That’s where Adjustment Theory comes into play. It’s the art of reshaping your trade when things go wrong, rather than simply accepting a loss. Mastering this one skill can separate a consistent trader from a frustrated gambler.

Why Option Buyers Need Adjustment Skills

Simple Adjustments Option Buyers Can Use

Rahul’s Tip

Think like a strategist, not just a trader. The market won’t always go your way — but if you adapt instead of panic, you’ll stay in the game much longer.

Conclusion

Adjustment Theory is like oxygen for option buyers. It gives you control, extends your edge, and prevents one bad entry from becoming a big loss. Learn to adjust with logic and patience — and watch your consistency grow.

Do you use adjustments in your option trades? Let’s discuss some real-world situations in the comments below!

Most option buyers enter trades with just one mindset — “It will either hit target or stop-loss.” But in real trading, markets are dynamic, not binary. That’s where Adjustment Theory comes into play. It’s the art of reshaping your trade when things go wrong, rather than simply accepting a loss. Mastering this one skill can separate a consistent trader from a frustrated gambler.

Why Option Buyers Need Adjustment Skills

- Premium Erodes Quickly: Options lose value fast when markets go sideways. Without adjustments, buyers bleed time decay (theta) daily.

- Direction May Be Right, But Timing Wrong: You could be right eventually — but wrong now. Adjusting gives your view more breathing room.

- Avoid Full Stop-Losses: Instead of letting a position die, adjustments help you salvage or even reverse the trade.

- It Adds Flexibility: You don’t need to exit immediately on red — you can reshape the trade to improve risk-reward.

Simple Adjustments Option Buyers Can Use

- Roll to Next Expiry: If your option is OTM and nearing expiry, roll to next week/month to buy more time for your view to play out.

- Switch to Spreads: Convert naked calls or puts into debit spreads to reduce cost and hedge delta.

- Add Hedge or Contra Position: If the move goes strongly against you, consider a hedge trade — like buying a put when holding a call.

- Exit Partially & Re-enter Better: Book partial loss, wait for price improvement or signal re-entry — smarter than holding blindly.

Rahul’s Tip

Think like a strategist, not just a trader. The market won’t always go your way — but if you adapt instead of panic, you’ll stay in the game much longer.

Conclusion

Adjustment Theory is like oxygen for option buyers. It gives you control, extends your edge, and prevents one bad entry from becoming a big loss. Learn to adjust with logic and patience — and watch your consistency grow.

Do you use adjustments in your option trades? Let’s discuss some real-world situations in the comments below!

Rahul Pal (TV, Moderator)

Telegram: spf.bio/c1lkb

Site: realbullstrading.com

77% Accuracy Signals: wa.me/919560602464

Recommended Broker 👉 tinyurl.com/tradewithrahul

(Open & get my Option Writing & swing Guide–FREE)

Telegram: spf.bio/c1lkb

Site: realbullstrading.com

77% Accuracy Signals: wa.me/919560602464

Recommended Broker 👉 tinyurl.com/tradewithrahul

(Open & get my Option Writing & swing Guide–FREE)

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Rahul Pal (TV, Moderator)

Telegram: spf.bio/c1lkb

Site: realbullstrading.com

77% Accuracy Signals: wa.me/919560602464

Recommended Broker 👉 tinyurl.com/tradewithrahul

(Open & get my Option Writing & swing Guide–FREE)

Telegram: spf.bio/c1lkb

Site: realbullstrading.com

77% Accuracy Signals: wa.me/919560602464

Recommended Broker 👉 tinyurl.com/tradewithrahul

(Open & get my Option Writing & swing Guide–FREE)

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.