Oracle (ORCL) Stock Price Pulls Back After Historic Surge

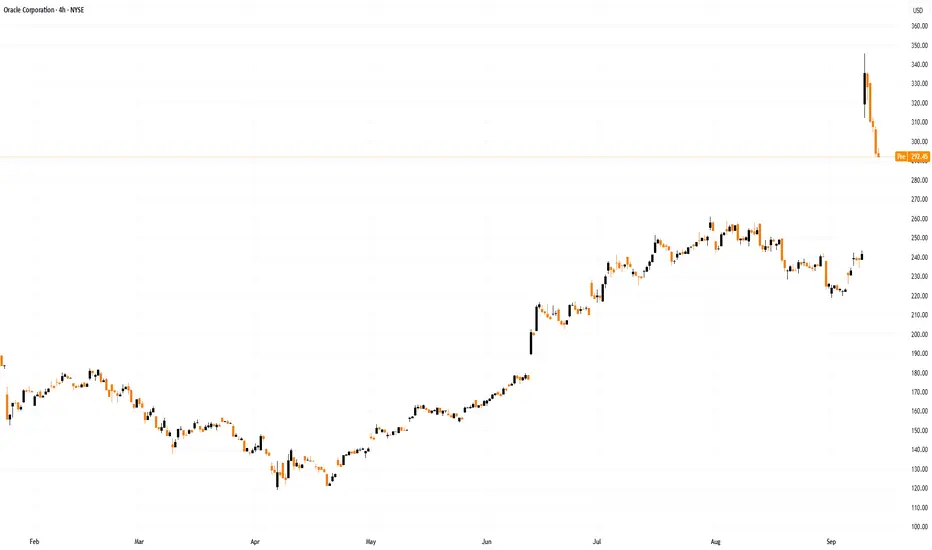

On 10 September 2025, ORCL shares soared by 36% in a single trading session:

→ the price reached an all-time high above $340;

→ Oracle’s co-founder and chairman, Larry Ellison, briefly became the world’s richest individual.

Why Did ORCL Shares Surge?

The rally was triggered by announcements of several multibillion-dollar deals in cloud infrastructure for artificial intelligence. Oracle revealed contracts worth a total of $300 billion, with clients including OpenAI, Nvidia, SoftBank, Meta, and Elon Musk’s xAI.

According to media reports:

→ CEO Safra Catz stated that the company’s Remaining Performance Obligations (RPO) could soon exceed $500 billion;

→ analysts and investors began drawing comparisons between Oracle and Nvidia, positioning Oracle as a key player in the AI ecosystem by providing essential cloud infrastructure.

However, by the end of the week, ORCL shares had retreated by roughly 15% from their peak.

Technical Analysis of ORCL

After such a steep rally, many holders likely took profits, contributing to the pullback. In addition, strong overbought signals emerged following last week’s bullish gap, indicated by:

→ the RSI indicator;

→ a price breakout above the upper boundary of the long-term channel (shown in blue);

→ the advance beyond the psychological $300 level.

Although Oracle’s long-term outlook remains highly promising, the company still holds a smaller share of the cloud services market compared with Amazon Web Services, Microsoft Azure, and Google Cloud.

At present, we could assume that the market has entered a corrective phase, with ORCL potentially retracing to the $270–280 area, where a cluster of support levels is located:

→ the median line of the medium-term (orange) channel;

→ the 50% Fibonacci retracement of the A→B impulse;

→ the upper boundary of the blue channel, which may switch its role to act as support.

Additional support could be found at $260 and at the lower edge of the gap near $240 if the correction deepens. Overall, however, given the long-term impact of the recently secured contracts, Oracle’s prospects in cloud computing and AI remain robust.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

On 10 September 2025, ORCL shares soared by 36% in a single trading session:

→ the price reached an all-time high above $340;

→ Oracle’s co-founder and chairman, Larry Ellison, briefly became the world’s richest individual.

Why Did ORCL Shares Surge?

The rally was triggered by announcements of several multibillion-dollar deals in cloud infrastructure for artificial intelligence. Oracle revealed contracts worth a total of $300 billion, with clients including OpenAI, Nvidia, SoftBank, Meta, and Elon Musk’s xAI.

According to media reports:

→ CEO Safra Catz stated that the company’s Remaining Performance Obligations (RPO) could soon exceed $500 billion;

→ analysts and investors began drawing comparisons between Oracle and Nvidia, positioning Oracle as a key player in the AI ecosystem by providing essential cloud infrastructure.

However, by the end of the week, ORCL shares had retreated by roughly 15% from their peak.

Technical Analysis of ORCL

After such a steep rally, many holders likely took profits, contributing to the pullback. In addition, strong overbought signals emerged following last week’s bullish gap, indicated by:

→ the RSI indicator;

→ a price breakout above the upper boundary of the long-term channel (shown in blue);

→ the advance beyond the psychological $300 level.

Although Oracle’s long-term outlook remains highly promising, the company still holds a smaller share of the cloud services market compared with Amazon Web Services, Microsoft Azure, and Google Cloud.

At present, we could assume that the market has entered a corrective phase, with ORCL potentially retracing to the $270–280 area, where a cluster of support levels is located:

→ the median line of the medium-term (orange) channel;

→ the 50% Fibonacci retracement of the A→B impulse;

→ the upper boundary of the blue channel, which may switch its role to act as support.

Additional support could be found at $260 and at the lower edge of the gap near $240 if the correction deepens. Overall, however, given the long-term impact of the recently secured contracts, Oracle’s prospects in cloud computing and AI remain robust.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.