Here is a detailed overview of the **Persistent Systems Ltd (Persistent Technologies) Business Model**:

---

## 🔷 **Persistent Systems Ltd – Business Model Overview**

### 🏢 **Company Overview**

* **Name:** Persistent Systems Ltd

* **Founded:** 1990

* **Headquarters:** Pune, Maharashtra, India

* **CEO & MD:** Dr. Anand Deshpande (Founder), current CEO: Sandeep Kalra

* **Industry:** IT Services & Software Engineering

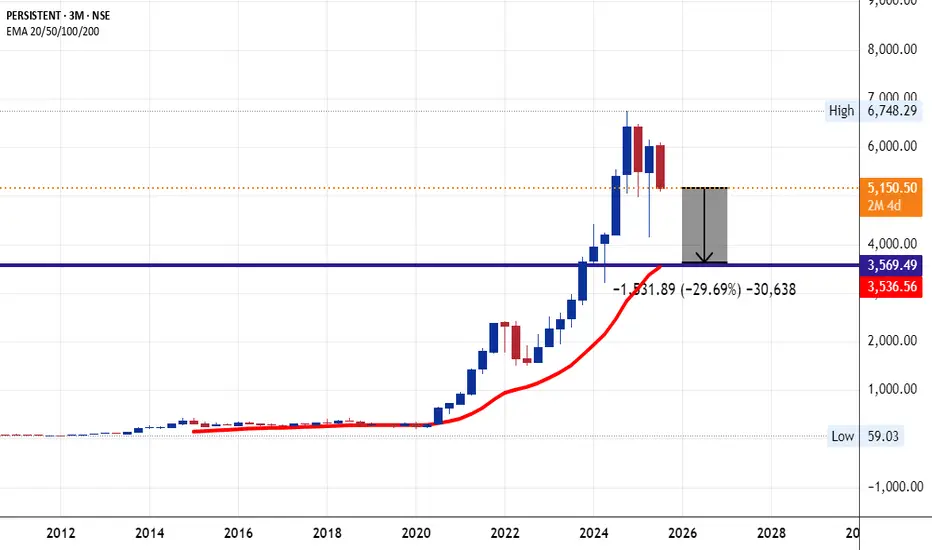

* **Stock Listing:** NSE: PERSISTENT | BSE: 533179

---

## 🔑 **Core Business Segments**

### 1. **Digital Engineering (Product Engineering Services)**

* Builds software products and platforms for clients

* End-to-end product lifecycle services (design to support)

* Focused on ISVs (Independent Software Vendors) and tech-driven enterprises

* Strong reputation in **outsourced product development (OPD)**

### 2. **Digital Transformation & Enterprise Services**

* Modernizing enterprise applications and infrastructure

* Cloud migration, DevOps, agile development, and modernization

* Implements CRM, ERP, and data platforms

* Strong partnerships with **Salesforce, Microsoft Azure, AWS, IBM, Snowflake**

### 3. **Data & AI**

* AI/ML integration into business processes

* Big data analytics, data lakes, predictive analytics

* Decision intelligence platforms for financial, healthcare, and industrial clients

### 4. **Cloud & Infrastructure Services**

* Cloud engineering and managed cloud services

* Kubernetes, containers, hybrid and multi-cloud solutions

* Cloud security, migration, and optimization

---

## 💰 **Revenue Model**

* **Time & Material (T\&M)** based billing – per hour billing for resources

* **Fixed-Price Contracts** – milestone-based project delivery

* **Subscription-Based Models** – recurring revenue for managed services or platforms

* **Consulting & Licensing Fees** – for implementation and integration of third-party solutions (e.g., Salesforce)

---

## 🌍 **Geographic Revenue Mix**

* **North America:** \~80%

* **Europe:** \~10%

* **India & RoW:** \~10%

> North America is the largest market, especially the US tech sector.

---

## 👥 **Client Focus**

* Technology Companies (ISVs)

* Banking, Financial Services & Insurance (BFSI)

* Healthcare & Life Sciences

* Industrial & Manufacturing

* Hi-Tech and Telecom

---

## 🤝 **Strategic Partnerships**

* **Salesforce:** Leading partner for CRM solutions

* **Microsoft Azure & AWS:** For cloud infrastructure & DevOps

* **IBM:** AI, Watson, and hybrid cloud solutions

* **Snowflake, Google Cloud, Oracle, and ServiceNow**

---

## 📈 **Recent Financial Snapshot (FY24)**

*(Approximate values)*

* **Revenue:** ₹9,000+ Cr (\~\$1.1 Billion USD)

* **Net Profit:** ₹1,100+ Cr

* **EBITDA Margin:** \~17-19%

* **Employee Count:** 24,000+ globally

---

## 🚀 **Growth Strategy**

### 1. **Client Mining + New Logo Acquisition**

* Expand wallet share from existing enterprise clients

* Add new Fortune 1000 clients with digital needs

### 2. **Acquisitions**

* Acquired companies like CAPIOT, Data Glove, SCI (Software Corporation International), and MediaAgility to expand capabilities in cloud, AI, and BFSI domains

### 3. **Specialization in Vertical Solutions**

* Custom solutions for healthcare (patient engagement platforms)

* BFSI platforms (risk, payments, compliance systems)

* Smart industry tools for manufacturing & IoT

---

## 📊 SWOT Analysis

| Strengths | Weaknesses |

| --------------------------------------- | ----------------------------------------- |

| Strong niche in digital engineering | High client concentration in the US |

| Deep Salesforce, cloud, AI capabilities | Relatively smaller scale than TCS/Infosys |

| Good operating margins and ROE | Low brand visibility globally |

| Opportunities | Threats |

| ------------------------------------- | ----------------------------------- |

| Growing digital transformation demand | Talent attrition & wage inflation |

| AI-driven enterprise transformation | Rising global competition |

| Expansion in Europe & BFSI domain | Client budget cuts during slowdowns |

---

## 🧩 Summary Points:

* **Specialist in digital product engineering & transformation services**

* Focus on **niche verticals (BFSI, healthcare, ISVs)**

* **Fast-growing mid-cap IT player** with strong partnerships and M\&A activity

* Agile, innovation-led approach and focus on **cloud + AI + data** technologies

---

Thanks

---

## 🔷 **Persistent Systems Ltd – Business Model Overview**

### 🏢 **Company Overview**

* **Name:** Persistent Systems Ltd

* **Founded:** 1990

* **Headquarters:** Pune, Maharashtra, India

* **CEO & MD:** Dr. Anand Deshpande (Founder), current CEO: Sandeep Kalra

* **Industry:** IT Services & Software Engineering

* **Stock Listing:** NSE: PERSISTENT | BSE: 533179

---

## 🔑 **Core Business Segments**

### 1. **Digital Engineering (Product Engineering Services)**

* Builds software products and platforms for clients

* End-to-end product lifecycle services (design to support)

* Focused on ISVs (Independent Software Vendors) and tech-driven enterprises

* Strong reputation in **outsourced product development (OPD)**

### 2. **Digital Transformation & Enterprise Services**

* Modernizing enterprise applications and infrastructure

* Cloud migration, DevOps, agile development, and modernization

* Implements CRM, ERP, and data platforms

* Strong partnerships with **Salesforce, Microsoft Azure, AWS, IBM, Snowflake**

### 3. **Data & AI**

* AI/ML integration into business processes

* Big data analytics, data lakes, predictive analytics

* Decision intelligence platforms for financial, healthcare, and industrial clients

### 4. **Cloud & Infrastructure Services**

* Cloud engineering and managed cloud services

* Kubernetes, containers, hybrid and multi-cloud solutions

* Cloud security, migration, and optimization

---

## 💰 **Revenue Model**

* **Time & Material (T\&M)** based billing – per hour billing for resources

* **Fixed-Price Contracts** – milestone-based project delivery

* **Subscription-Based Models** – recurring revenue for managed services or platforms

* **Consulting & Licensing Fees** – for implementation and integration of third-party solutions (e.g., Salesforce)

---

## 🌍 **Geographic Revenue Mix**

* **North America:** \~80%

* **Europe:** \~10%

* **India & RoW:** \~10%

> North America is the largest market, especially the US tech sector.

---

## 👥 **Client Focus**

* Technology Companies (ISVs)

* Banking, Financial Services & Insurance (BFSI)

* Healthcare & Life Sciences

* Industrial & Manufacturing

* Hi-Tech and Telecom

---

## 🤝 **Strategic Partnerships**

* **Salesforce:** Leading partner for CRM solutions

* **Microsoft Azure & AWS:** For cloud infrastructure & DevOps

* **IBM:** AI, Watson, and hybrid cloud solutions

* **Snowflake, Google Cloud, Oracle, and ServiceNow**

---

## 📈 **Recent Financial Snapshot (FY24)**

*(Approximate values)*

* **Revenue:** ₹9,000+ Cr (\~\$1.1 Billion USD)

* **Net Profit:** ₹1,100+ Cr

* **EBITDA Margin:** \~17-19%

* **Employee Count:** 24,000+ globally

---

## 🚀 **Growth Strategy**

### 1. **Client Mining + New Logo Acquisition**

* Expand wallet share from existing enterprise clients

* Add new Fortune 1000 clients with digital needs

### 2. **Acquisitions**

* Acquired companies like CAPIOT, Data Glove, SCI (Software Corporation International), and MediaAgility to expand capabilities in cloud, AI, and BFSI domains

### 3. **Specialization in Vertical Solutions**

* Custom solutions for healthcare (patient engagement platforms)

* BFSI platforms (risk, payments, compliance systems)

* Smart industry tools for manufacturing & IoT

---

## 📊 SWOT Analysis

| Strengths | Weaknesses |

| --------------------------------------- | ----------------------------------------- |

| Strong niche in digital engineering | High client concentration in the US |

| Deep Salesforce, cloud, AI capabilities | Relatively smaller scale than TCS/Infosys |

| Good operating margins and ROE | Low brand visibility globally |

| Opportunities | Threats |

| ------------------------------------- | ----------------------------------- |

| Growing digital transformation demand | Talent attrition & wage inflation |

| AI-driven enterprise transformation | Rising global competition |

| Expansion in Europe & BFSI domain | Client budget cuts during slowdowns |

---

## 🧩 Summary Points:

* **Specialist in digital product engineering & transformation services**

* Focus on **niche verticals (BFSI, healthcare, ISVs)**

* **Fast-growing mid-cap IT player** with strong partnerships and M\&A activity

* Agile, innovation-led approach and focus on **cloud + AI + data** technologies

---

Thanks

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.