RRP Exhaustion and TGA Rebuild Signal a Tightening Cycle

1. Overview

Liquidity conditions across the U.S. financial system have entered a tightening phase once again.

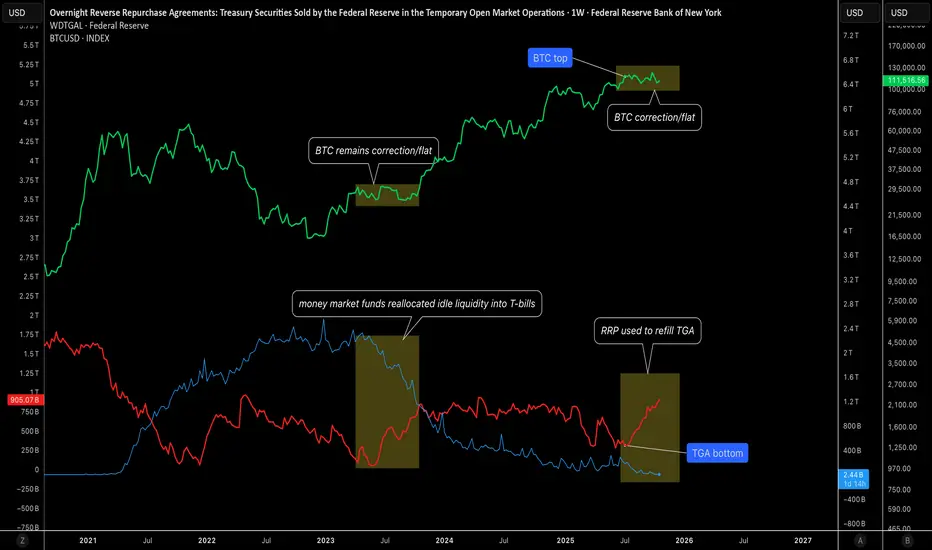

The U.S. Treasury General Account (TGA) has surged from its June low of around $200 billion to roughly $905 billion today, while the Federal Reserve’s Reverse Repo Facility (RRP) has collapsed to just $2 billion, effectively empty.

This shift marks the end of the liquidity buffer that had supported markets over the past year, and the consequences are now visible across risk assets, particularly Bitcoin, which has been trending lower since the TGA bottomed in June.

2. Liquidity Mechanics

The interaction between the TGA and RRP is central to understanding current market dynamics.

- When the Treasury rebuilds its TGA, it issues short-term bills and absorbs cash from the financial system.

- During 2023 and early 2024, this liquidity drain was largely offset by reductions in the RRP balance, as money market funds reallocated idle liquidity into T-bills.

- That mechanism kept overall market liquidity relatively stable — the RRP served as a shock absorber.

Today, that buffer is gone. With RRP nearly depleted, any additional TGA build now draws directly from the banking system’s reserves, tightening liquidity conditions beneath the surface.

3. Liquidity Inflection and Market Correlation

The TGA bottomed in June at around $200 billion, a point that coincided almost perfectly with the Bitcoin top near its recent cycle highs.

This correlation is not coincidental, it reflects the direct relationship between system liquidity and speculative risk demand.

As Treasury began rebuilding its cash balance, liquidity was redirected away from markets and into government accounts.

That liquidity drain aligns with the ongoing weakness in high-beta assets such as crypto and small caps, despite relatively stable macro data and policy expectations.

4. Current Liquidity Regime: Neutral in Level, Tight in Flow

At the aggregate level, liquidity may appear neutral — the increase in TGA has been offset by the decline in RRP, keeping the total size of Fed liabilities roughly unchanged.

However, the composition of that liquidity has deteriorated.

- The RRP is now empty, meaning the system no longer has an easy liquidity source to fund further Treasury accumulation.

- TGA is high and rising, effectively absorbing capital that could have supported credit or speculative flows.

- The bank reserve base is beginning to feel the pressure, tightening funding conditions quietly but steadily.

The result is a liquidity regime that is not collapsing but no longer expanding, which explains why risk assets are stagnant. There is no incremental liquidity flowing down the risk curve.

5. Fiscal and Structural Headwinds

The current U.S. government shutdown further complicates the outlook.

It restricts Treasury operations, delays issuance flexibility, and slows the recycling of liquidity back into the private sector. This prevents the RRP from being refilled and reinforces the liquidity stasis across markets.

In other words, the system is locked:

- The TGA is high and still rising.

- The RRP is empty.

- Reserves are now the adjustment variable, meaning further tightening could emerge if the Treasury continues to absorb cash.

6. Market Implications

- Liquidity exhaustion is becoming visible in market behavior.

- The TGA rebuild represents a clear liquidity drain as it is no longer offset by RRP balances.

- BTC’s reversal from its June peak reinforces the correlation between Treasury liquidity cycles and speculative risk performance.

The neutral aggregate liquidity masks an underlying structural tightening, there is no new money reaching markets.

Until the TGA begins to decline again, releasing liquidity back into the system, the bias for risk assets remains constrained. Markets are likely to remain choppy, with limited upside momentum due to the absence of fresh liquidity inflows.

7. Conclusion

Liquidity conditions are neutral in total but tight in structure. The RRP’s depletion removes the last line of defense against Treasury-driven liquidity absorption.

With the TGA near $905 billion and still rising, risk assets are operating in an environment where no new liquidity is entering the system, only being recycled internally.

The correlation between June’s TGA low and Bitcoin’s top highlights just how sensitive speculative assets are to liquidity cycles.

Until Treasury spending or Federal Reserve policy shifts inject new reserves into the system, market liquidity will remain capped and so will risk appetite.

Liquidity conditions across the U.S. financial system have entered a tightening phase once again.

The U.S. Treasury General Account (TGA) has surged from its June low of around $200 billion to roughly $905 billion today, while the Federal Reserve’s Reverse Repo Facility (RRP) has collapsed to just $2 billion, effectively empty.

This shift marks the end of the liquidity buffer that had supported markets over the past year, and the consequences are now visible across risk assets, particularly Bitcoin, which has been trending lower since the TGA bottomed in June.

2. Liquidity Mechanics

The interaction between the TGA and RRP is central to understanding current market dynamics.

- When the Treasury rebuilds its TGA, it issues short-term bills and absorbs cash from the financial system.

- During 2023 and early 2024, this liquidity drain was largely offset by reductions in the RRP balance, as money market funds reallocated idle liquidity into T-bills.

- That mechanism kept overall market liquidity relatively stable — the RRP served as a shock absorber.

Today, that buffer is gone. With RRP nearly depleted, any additional TGA build now draws directly from the banking system’s reserves, tightening liquidity conditions beneath the surface.

3. Liquidity Inflection and Market Correlation

The TGA bottomed in June at around $200 billion, a point that coincided almost perfectly with the Bitcoin top near its recent cycle highs.

This correlation is not coincidental, it reflects the direct relationship between system liquidity and speculative risk demand.

As Treasury began rebuilding its cash balance, liquidity was redirected away from markets and into government accounts.

That liquidity drain aligns with the ongoing weakness in high-beta assets such as crypto and small caps, despite relatively stable macro data and policy expectations.

4. Current Liquidity Regime: Neutral in Level, Tight in Flow

At the aggregate level, liquidity may appear neutral — the increase in TGA has been offset by the decline in RRP, keeping the total size of Fed liabilities roughly unchanged.

However, the composition of that liquidity has deteriorated.

- The RRP is now empty, meaning the system no longer has an easy liquidity source to fund further Treasury accumulation.

- TGA is high and rising, effectively absorbing capital that could have supported credit or speculative flows.

- The bank reserve base is beginning to feel the pressure, tightening funding conditions quietly but steadily.

The result is a liquidity regime that is not collapsing but no longer expanding, which explains why risk assets are stagnant. There is no incremental liquidity flowing down the risk curve.

5. Fiscal and Structural Headwinds

The current U.S. government shutdown further complicates the outlook.

It restricts Treasury operations, delays issuance flexibility, and slows the recycling of liquidity back into the private sector. This prevents the RRP from being refilled and reinforces the liquidity stasis across markets.

In other words, the system is locked:

- The TGA is high and still rising.

- The RRP is empty.

- Reserves are now the adjustment variable, meaning further tightening could emerge if the Treasury continues to absorb cash.

6. Market Implications

- Liquidity exhaustion is becoming visible in market behavior.

- The TGA rebuild represents a clear liquidity drain as it is no longer offset by RRP balances.

- BTC’s reversal from its June peak reinforces the correlation between Treasury liquidity cycles and speculative risk performance.

The neutral aggregate liquidity masks an underlying structural tightening, there is no new money reaching markets.

Until the TGA begins to decline again, releasing liquidity back into the system, the bias for risk assets remains constrained. Markets are likely to remain choppy, with limited upside momentum due to the absence of fresh liquidity inflows.

7. Conclusion

Liquidity conditions are neutral in total but tight in structure. The RRP’s depletion removes the last line of defense against Treasury-driven liquidity absorption.

With the TGA near $905 billion and still rising, risk assets are operating in an environment where no new liquidity is entering the system, only being recycled internally.

The correlation between June’s TGA low and Bitcoin’s top highlights just how sensitive speculative assets are to liquidity cycles.

Until Treasury spending or Federal Reserve policy shifts inject new reserves into the system, market liquidity will remain capped and so will risk appetite.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.