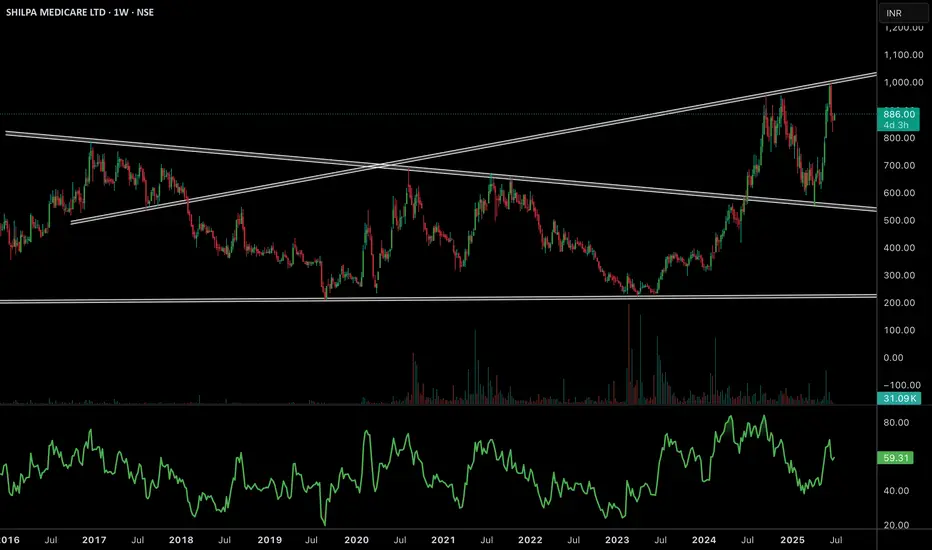

✅ The stock has made a strong reversal from its long-term base near 500 and is now retesting the upper boundary of its rising channel after a sharp rally.

✅ Historical price action shows a clean breakout above multi-year trendline resistances, which now act as major support zones. This structure indicates that any dip towards 800–820 could attract buyers.

✅ Weekly RSI is around 59, suggesting healthy momentum but not yet overbought, leaving room for a potential push towards 1000–1100 if the stock holds above trendline support.

✅ Volume spikes in recent weeks signal accumulation, supporting the case for trend continuation in this pharma name.

With the healthcare sector remaining strong and Shilpa Medicare’s focus on oncology and niche pharma segments, this breakout structure remains attractive for medium-term upside. Watch for follow-through buying above 900 for confirmation.

✅ Historical price action shows a clean breakout above multi-year trendline resistances, which now act as major support zones. This structure indicates that any dip towards 800–820 could attract buyers.

✅ Weekly RSI is around 59, suggesting healthy momentum but not yet overbought, leaving room for a potential push towards 1000–1100 if the stock holds above trendline support.

✅ Volume spikes in recent weeks signal accumulation, supporting the case for trend continuation in this pharma name.

With the healthcare sector remaining strong and Shilpa Medicare’s focus on oncology and niche pharma segments, this breakout structure remains attractive for medium-term upside. Watch for follow-through buying above 900 for confirmation.

Join our community in telegram for real time updates --- telegram.me/marketiik

Telegram- telegram.me/marketiik

A simple trader, distancing from the fake crowd. Simplifying complexity, I prioritize genuine insights over trends.

Telegram- telegram.me/marketiik

A simple trader, distancing from the fake crowd. Simplifying complexity, I prioritize genuine insights over trends.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Join our community in telegram for real time updates --- telegram.me/marketiik

Telegram- telegram.me/marketiik

A simple trader, distancing from the fake crowd. Simplifying complexity, I prioritize genuine insights over trends.

Telegram- telegram.me/marketiik

A simple trader, distancing from the fake crowd. Simplifying complexity, I prioritize genuine insights over trends.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.