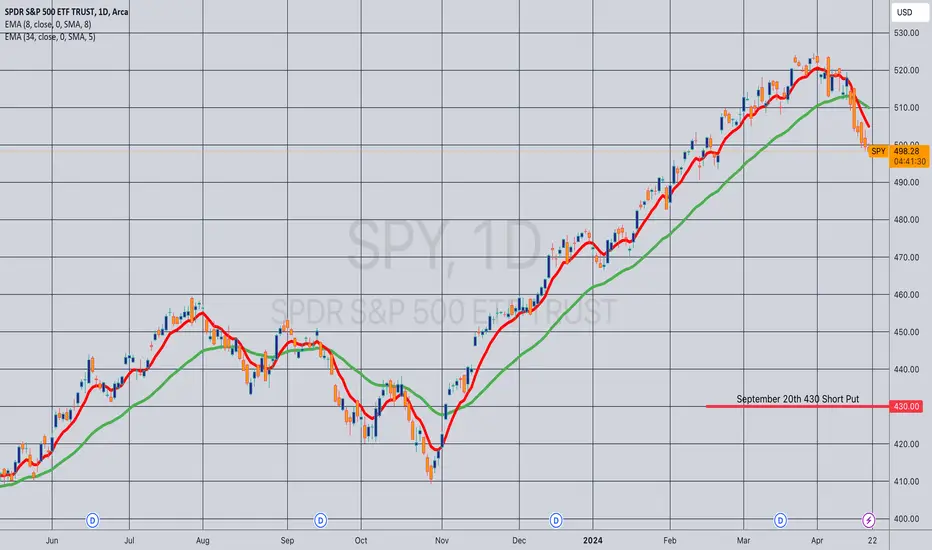

... for a 4.34 credit.

Comments: Targeting the <16 delta strike paying around 1% of the strike price in credit to emulate dollar cost averaging into S&P 500 ETF, adding at a strike better than what I currently have on.

As with my other broad market, will look to generally take profit at 50% max or -- if assigned -- sell call against at the strike price my short put was at.

Comments: Targeting the <16 delta strike paying around 1% of the strike price in credit to emulate dollar cost averaging into S&P 500 ETF, adding at a strike better than what I currently have on.

As with my other broad market, will look to generally take profit at 50% max or -- if assigned -- sell call against at the strike price my short put was at.

Trade closed manually

Just a touch shy of 50% max, but closing it here on this bodice ripper: closed for a 2.18 debit; 2.16 ($216) profit.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.