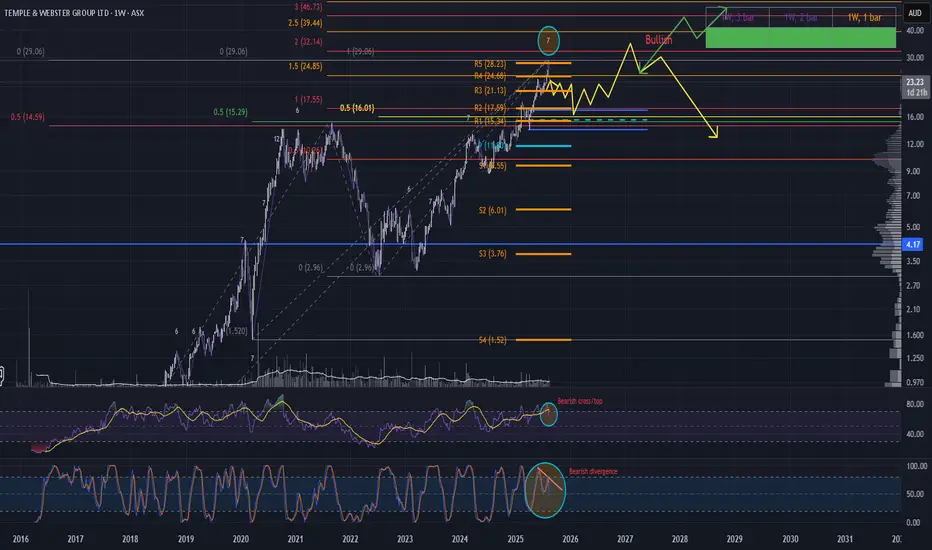

Temple & Webster is flashing short-term bearish signals. We've just seen a 7-week rally culminate in a bearish hammer on a volume spike—a textbook exhaustion move. According to the Gann rule, a trend reversal or pause is often expected after 7–10 consecutive bars in one swing, and this setup fits that criteria.

Adding fuel to the bearish thesis:

Bearish divergence on the Stoch RSI

Bearish cross on the RSI

Despite this, I’m not interested in shorting—price is still in a clear uptrend, and I don’t short rising markets. Discipline over impulse.

Area of Interest (AOI): $15.29 Zone

If price pulls back, the previous ATH zone around $15.29 becomes a high-probability support area. This zone is stacked with confluence:

Major 50% Fib level projected from swing low to ATH

Macro 50% level from July 2022 low to ATH

Large demand wick already printed in this zone

If price reaches this AOI and the broader market remains strong, I wouldn’t expect it to linger here long. But no need to front-run—keep it simple and take it one step at a time.

Potential Scenarios from AOI

If price finds support and rallies from the AOI zone, two paths could unfold:

Slight Higher High + Volume Spike → Significant Pullback This would suggest a final push before a deeper correction—watch volume and candle structure closely.

Bullish Continuation (Green Line Path) Price breaks out cleanly and continues the uptrend. If this plays out, we reassess and ride the momentum.

Either way, we cross that bridge when we get there. For now, eyes on the AOI and let price tell the story.

*please note arrows are not time analysis just expected pathing

Adding fuel to the bearish thesis:

Bearish divergence on the Stoch RSI

Bearish cross on the RSI

Despite this, I’m not interested in shorting—price is still in a clear uptrend, and I don’t short rising markets. Discipline over impulse.

Area of Interest (AOI): $15.29 Zone

If price pulls back, the previous ATH zone around $15.29 becomes a high-probability support area. This zone is stacked with confluence:

Major 50% Fib level projected from swing low to ATH

Macro 50% level from July 2022 low to ATH

Large demand wick already printed in this zone

If price reaches this AOI and the broader market remains strong, I wouldn’t expect it to linger here long. But no need to front-run—keep it simple and take it one step at a time.

Potential Scenarios from AOI

If price finds support and rallies from the AOI zone, two paths could unfold:

Slight Higher High + Volume Spike → Significant Pullback This would suggest a final push before a deeper correction—watch volume and candle structure closely.

Bullish Continuation (Green Line Path) Price breaks out cleanly and continues the uptrend. If this plays out, we reassess and ride the momentum.

Either way, we cross that bridge when we get there. For now, eyes on the AOI and let price tell the story.

*please note arrows are not time analysis just expected pathing

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.