Hello Traders.. It's been too long.

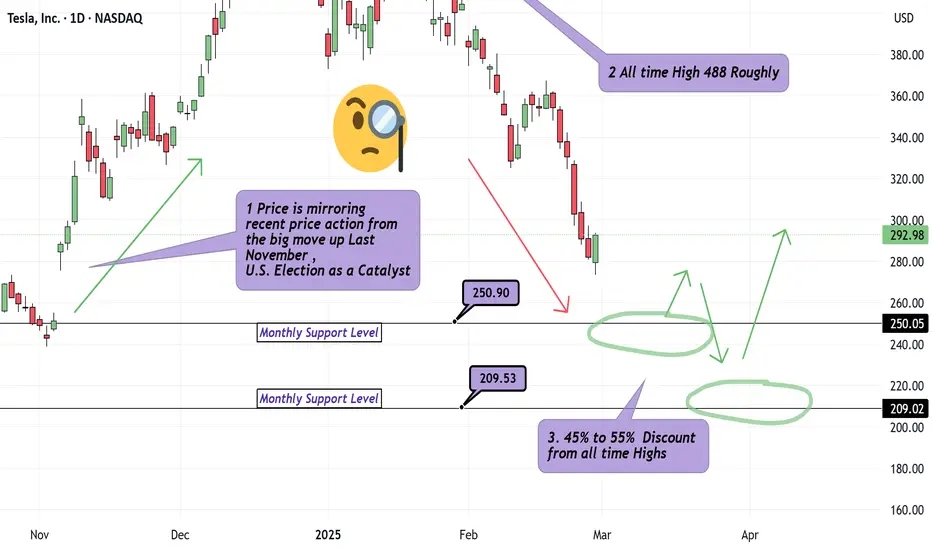

We are back with our first analysis in over 4 months. We answer : What is an appropriate price to either jump on the train or scale into original positions on Tesla? Jumping in around 250, probably decent for at least a 4Hr to Daily Chart Swing. Safer Longs appear to be around 209 as I have outlined with green arrows, labeling the multiple pivots in the recent 5 Year range on Tesla. Tesla is coming down alongside the broader Indices which can be expected. Just because Friday Feb 28th showed us a Solid Hammer looking candle suggesting strong buying power, this does not mean much to me for 3 reasons.

1) This price action has developed in the middle of the move up we observed during Election week late last year.

2) The candle closed without a top wick and so the next daily candle , in theory, has no range to fill moving forward.

3) Momentum at the moment is also Bearish.

Discipline Traders! Leave a comment or Boosted rocket if you'd like to see similar analysis.

We are back with our first analysis in over 4 months. We answer : What is an appropriate price to either jump on the train or scale into original positions on Tesla? Jumping in around 250, probably decent for at least a 4Hr to Daily Chart Swing. Safer Longs appear to be around 209 as I have outlined with green arrows, labeling the multiple pivots in the recent 5 Year range on Tesla. Tesla is coming down alongside the broader Indices which can be expected. Just because Friday Feb 28th showed us a Solid Hammer looking candle suggesting strong buying power, this does not mean much to me for 3 reasons.

1) This price action has developed in the middle of the move up we observed during Election week late last year.

2) The candle closed without a top wick and so the next daily candle , in theory, has no range to fill moving forward.

3) Momentum at the moment is also Bearish.

Discipline Traders! Leave a comment or Boosted rocket if you'd like to see similar analysis.

Trade active

March 4 Update : Tesla Update : Market is still seeping from the bearish carnage out of last week. Bearish momentum continued in this mornings session as Tesla not only gapped down , but offered continuation scalping opportunities on the way down to our swing target , and Tp 2 250$250$ is Safe for Longs given some candlestick closure confirmation on the Daily timeframe. Or , if you wanna be more aggressive, upon probing into the area with tight stop loss and on lower timeframes.

Trade closed manually

March 6th Update : The Market for Tesla is at 263.45. At the Beginning of the week price was higher. We explained that looking for Longs, even after the Friday bullish candle was , most likely, not wise. We offered 3 reasons to support a continued decent towards our Outlined potential Long area 250$. Don't be suprised when the market does what you forecasted! All those hours in front of the charts goes somehwere.. Anyways, The Market has been blessing shorts all week, so long as you aren't trading tilted and wait for the market to come to you...The Market Soldoff at the Market Close on Tuesday from a very clear 1Hr Zone 283.16. Wednesday the market took a breather and popped it's head up , catching overleveraged traders in the headlights. The market just needed to gather some liquidity before tanking once again as we observed a bearish gap to open up Thursday's trading. A bearish continuation followed the gap, offering superb scalping opportunities today. We aren't far off from our 250 Target, but we must mind Trump speeches and NFP on Friday March 7th. Volatility, yes, however we must not rule out a steep correction to the upside . Plan for this as well but otherwise why not a move closer towards 250$ tesla tomorrow. Safe Trading

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.