The Macro View:

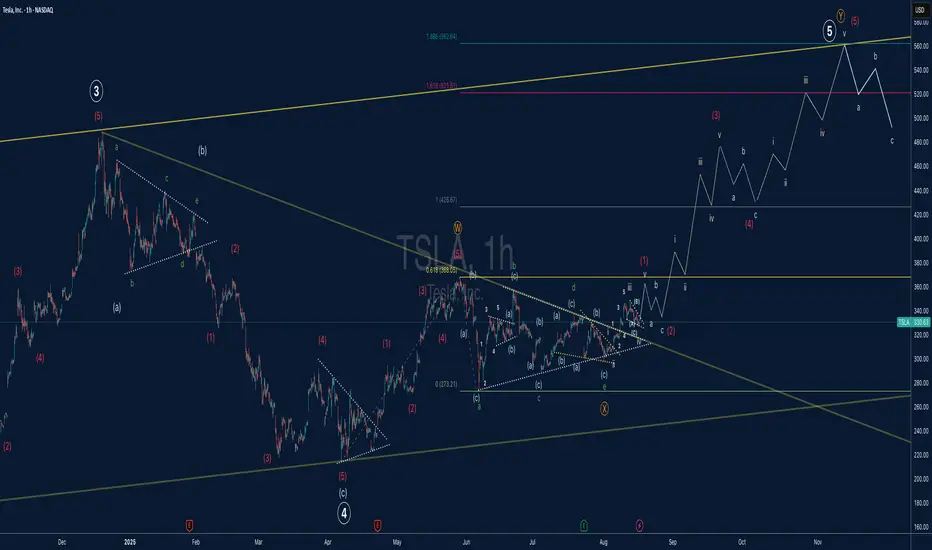

The broader structure indicates that the peak in late 2024 marked the completion of a primary Wave ③. The subsequent decline into the April 2025 low was a standard a-b-c zigzag correction, successfully completing the large-degree Wave ④. This has set the stage for the next and final impulse wave of the entire sequence.

The Micro View & The Key Pattern:

The rally from the April 2025 low marks the beginning of our primary Wave ⑤. This wave will itself subdivide into five smaller waves. The key to this entire count is the complex Wave (2) of ⑤ that took place from June to August. This was not a simple pullback but a W-X-Y complex "double three" correction.

Wave W was the initial rally from the April low to the June high.

Wave X manifested as a classic contracting triangle, consolidating energy and building cause for the next major move.

Wave Y is the current breakout we are witnessing now, marking the end of the entire corrective phase and the resumption of the primary uptrend.

Future Projection:

With the W-X-Y correction now complete, TSLA appears to have begun its powerful Wave (3) of ⑤. This is typically the strongest and most extended part of an impulse.

Short-term: We expect the initial breakout to continue, finish forming Wave v of (1).

Mid-term: Initial price targets for the completion of the entire Wave ⑤ sequence point towards the $520 - $560 zone, which aligns with the 1.618 - 1.886 Fibonacci extension levels of the preceding impulse.

Invalidation: This bullish outlook remains valid as long as the price stays above the low of Wave (2) of ⑤, established at the end of the triangle around the $310 level. A break below this point would invalidate this specific count.

The broader structure indicates that the peak in late 2024 marked the completion of a primary Wave ③. The subsequent decline into the April 2025 low was a standard a-b-c zigzag correction, successfully completing the large-degree Wave ④. This has set the stage for the next and final impulse wave of the entire sequence.

The Micro View & The Key Pattern:

The rally from the April 2025 low marks the beginning of our primary Wave ⑤. This wave will itself subdivide into five smaller waves. The key to this entire count is the complex Wave (2) of ⑤ that took place from June to August. This was not a simple pullback but a W-X-Y complex "double three" correction.

Wave W was the initial rally from the April low to the June high.

Wave X manifested as a classic contracting triangle, consolidating energy and building cause for the next major move.

Wave Y is the current breakout we are witnessing now, marking the end of the entire corrective phase and the resumption of the primary uptrend.

Future Projection:

With the W-X-Y correction now complete, TSLA appears to have begun its powerful Wave (3) of ⑤. This is typically the strongest and most extended part of an impulse.

Short-term: We expect the initial breakout to continue, finish forming Wave v of (1).

Mid-term: Initial price targets for the completion of the entire Wave ⑤ sequence point towards the $520 - $560 zone, which aligns with the 1.618 - 1.886 Fibonacci extension levels of the preceding impulse.

Invalidation: This bullish outlook remains valid as long as the price stays above the low of Wave (2) of ⑤, established at the end of the triangle around the $310 level. A break below this point would invalidate this specific count.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.