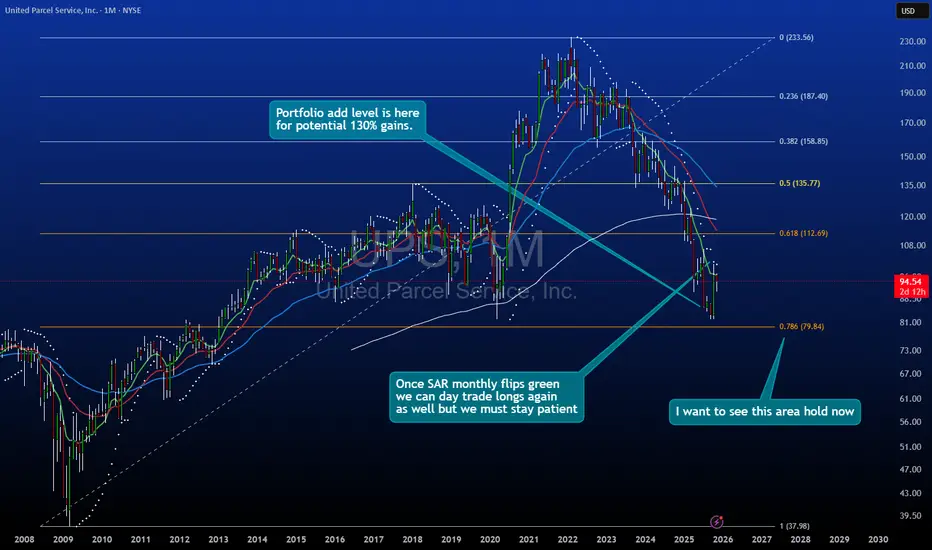

UPS has retraced approximately 65% from its 2022 highs, presenting a potential accumulation zone based on historical price structure and key retracement levels.

Technical Observations:

Price Structure:

Current price: $94.54

Trading near the 0.618 retracement level ($112.69) from the 2020 low to 2022 high

Approaching the 0.786 retracement zone ($79.84), which historically acted as strong support

Key Levels:

Monthly support zone: $78.60 area

Long-term trend line from 2008 lows remains intact

Price action showing signs of stabilization after extended decline

Risk Considerations:

Entry zone: Current levels to $79 area

Invalidation: Break below $70 would negate bullish thesis

Timeframe: Long-term position (12-24+ months)

Potential Upside Targets:

Based on historical swing analysis and fibonacci projections:

First resistance: $135-140 zone (0.5 retracement)

Second target: $158-165 zone (0.382 retracement)

Full recovery: $187-200+ zone (previous highs)

Fundamental Context:

UPS benefits from structural trends in e-commerce and logistics. Current valuation appears compressed relative to historical norms, though macroeconomic headwinds remain a factor.

Position Sizing:

Given the long-term nature and inherent volatility, this would be considered a tier 1 allocation in a diversified portfolio with appropriate risk management.

This is not financial advice. All investments carry risk. Past price action does not guarantee future results. Conduct your own due diligence before making investment decisions.

Technical Observations:

Price Structure:

Current price: $94.54

Trading near the 0.618 retracement level ($112.69) from the 2020 low to 2022 high

Approaching the 0.786 retracement zone ($79.84), which historically acted as strong support

Key Levels:

Monthly support zone: $78.60 area

Long-term trend line from 2008 lows remains intact

Price action showing signs of stabilization after extended decline

Risk Considerations:

Entry zone: Current levels to $79 area

Invalidation: Break below $70 would negate bullish thesis

Timeframe: Long-term position (12-24+ months)

Potential Upside Targets:

Based on historical swing analysis and fibonacci projections:

First resistance: $135-140 zone (0.5 retracement)

Second target: $158-165 zone (0.382 retracement)

Full recovery: $187-200+ zone (previous highs)

Fundamental Context:

UPS benefits from structural trends in e-commerce and logistics. Current valuation appears compressed relative to historical norms, though macroeconomic headwinds remain a factor.

Position Sizing:

Given the long-term nature and inherent volatility, this would be considered a tier 1 allocation in a diversified portfolio with appropriate risk management.

This is not financial advice. All investments carry risk. Past price action does not guarantee future results. Conduct your own due diligence before making investment decisions.

Script Access: DM me on TradingView to request access.

Learn more: rbtrading.substack.com/p/premium-tradingview-indicators-hub

Learn more: rbtrading.substack.com/p/premium-tradingview-indicators-hub

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Script Access: DM me on TradingView to request access.

Learn more: rbtrading.substack.com/p/premium-tradingview-indicators-hub

Learn more: rbtrading.substack.com/p/premium-tradingview-indicators-hub

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.