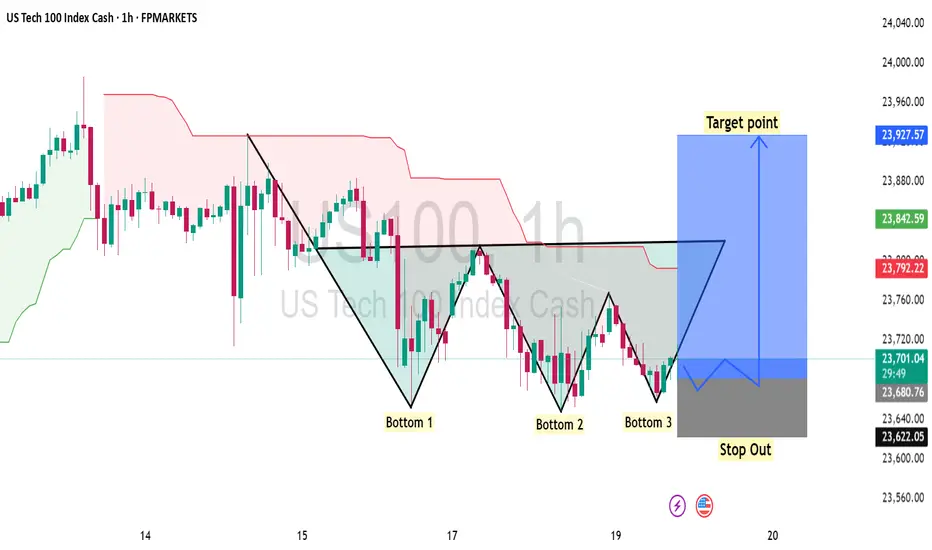

📊 Technical Trend & Pattern

The index is forming a Triple Bottom pattern, signaling strong accumulation and potential bullish reversal from the 23,600 – 23,700 support zone. Price is currently testing neckline resistance around 23,800, and a breakout above this level could confirm upside momentum.

🔎 Key Levels

Support / Stop Out Zone: 23,600 – 23,650

Immediate Resistance: 23,800

Target Zone: 23,920 – 23,950

⚡ Fundamental Outlook

Market sentiment remains cautious but supported by optimism around U.S. tech earnings and macroeconomic stability. If positive catalysts continue, the index could extend gains toward the 23,927 target zone.

📈 Trading Idea

Bullish bias above 23,700 with confirmation on neckline breakout. A sustained move could open room toward 23,927+. Failure to hold support may trigger stop-outs below 23,600.

👍 Like this analysis & 🔔 Follow me for more trading updates and ideas.

💬 What’s your view? Drop your comments and ideas below!

The index is forming a Triple Bottom pattern, signaling strong accumulation and potential bullish reversal from the 23,600 – 23,700 support zone. Price is currently testing neckline resistance around 23,800, and a breakout above this level could confirm upside momentum.

🔎 Key Levels

Support / Stop Out Zone: 23,600 – 23,650

Immediate Resistance: 23,800

Target Zone: 23,920 – 23,950

⚡ Fundamental Outlook

Market sentiment remains cautious but supported by optimism around U.S. tech earnings and macroeconomic stability. If positive catalysts continue, the index could extend gains toward the 23,927 target zone.

📈 Trading Idea

Bullish bias above 23,700 with confirmation on neckline breakout. A sustained move could open room toward 23,927+. Failure to hold support may trigger stop-outs below 23,600.

👍 Like this analysis & 🔔 Follow me for more trading updates and ideas.

💬 What’s your view? Drop your comments and ideas below!

Trade active

buying trade active guys Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.