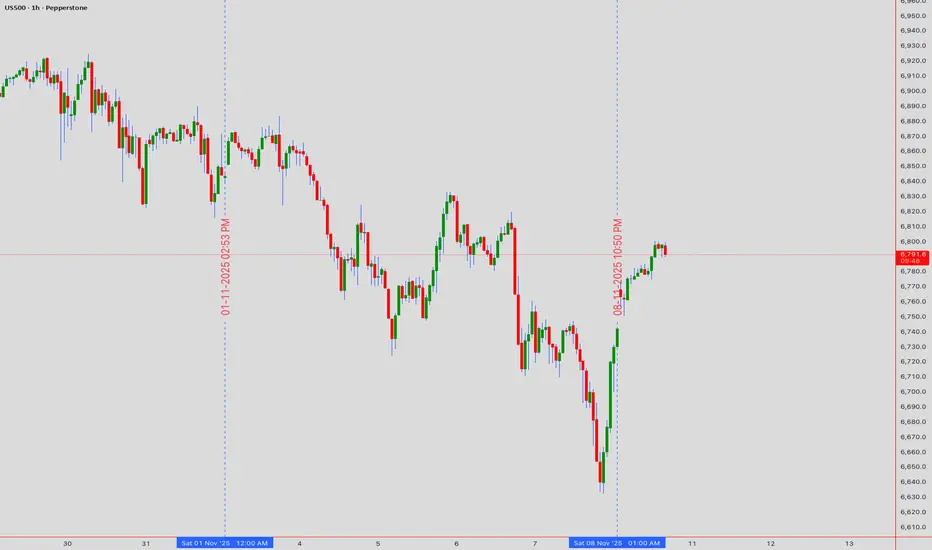

📊 US500 Intraday Technical Analysis - 10 Nov 2025

S&P 500 at 6,792 (4:45 PM UTC+4) — Major breakout setup with confluence

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🔍 MARKET STRUCTURE

🔸 Wyckoff Phase D re-accumulation; Dow Theory primary uptrend intact

🔸 Gann Square-of-9 targets: 6,950 (resistance) / 6,650 (support)

🔸 Elliott Wave (3) extension in progress toward 6,950-7,050

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📈 TIMEFRAME MATRIX

Daily (1D): Rising channel 6,700-6,900; RSI 62 (bullish); Ichimoku cloud support 6,550

4H: Broadening wedge 6,750-6,900; EMA21>EMA50>EMA200 (golden cross); VWAP 6,680

1H: Cup-and-handle pattern; BB expanding; VWAP slope bullish

30M: Symmetrical triangle 6,780-6,850; hidden bull divergence on RSI; volume contracting

15M: Bull flag above 6,790; Tenkan>Kijun bullish; stochastic reset ready

5M: Falling wedge retest 6,800; hammer shows demand; watch false breakout

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎯 PRIMARY LONG (HIGH PROBABILITY)

⚡ MOMENTUM SCALP

Add above 6,950 ONLY if RSI >65 + volume surge; trail stop 6,920

🔻 REVERSAL SHORT

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🚨 BREAKOUT ALERTS

✅ BULL: 1H close >6,950 confirms breakout → target 7,150; move SL to BE+25

✅ BEAR: 1H close <6,780 with volume → retest 6,650 cloud support

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📊 INDICATOR SNAPSHOT

BB Squeeze (30M) expanding | MACD histogram positive | VWAP slope up | EMA21 = trigger line | Hidden bull divergence confirmed on RSI

⚠️ PATTERN RECOGNITION

Harmonic Bat PRZ: 7,050 | Rising Wedge failure <6,790 = Wyckoff spring | H&S risk if 6,700 breaks | Bull trap risk above 6,950 without volume

📈 TIMING & VOLATILITY

Gann 90° window 21:00 UTC (US close) | ATR(14) ≈100 pts | Earnings whispers elevate risk | Risk ≤1% per setup; lock TP1; avoid chasing sub-avg volume

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

S&P 500 at 6,792 (4:45 PM UTC+4) — Major breakout setup with confluence

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🔍 MARKET STRUCTURE

🔸 Wyckoff Phase D re-accumulation; Dow Theory primary uptrend intact

🔸 Gann Square-of-9 targets: 6,950 (resistance) / 6,650 (support)

🔸 Elliott Wave (3) extension in progress toward 6,950-7,050

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📈 TIMEFRAME MATRIX

Daily (1D): Rising channel 6,700-6,900; RSI 62 (bullish); Ichimoku cloud support 6,550

4H: Broadening wedge 6,750-6,900; EMA21>EMA50>EMA200 (golden cross); VWAP 6,680

1H: Cup-and-handle pattern; BB expanding; VWAP slope bullish

30M: Symmetrical triangle 6,780-6,850; hidden bull divergence on RSI; volume contracting

15M: Bull flag above 6,790; Tenkan>Kijun bullish; stochastic reset ready

5M: Falling wedge retest 6,800; hammer shows demand; watch false breakout

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎯 PRIMARY LONG (HIGH PROBABILITY)

- Entry: 6,790-6,820 (flag support + VWAP confluence)

- SL: 6,750 (below triangle base)

- TP1: 6,880 (+90 pips)

- TP2: 6,950 (+160 pips — channel resistance)

- TP3: 7,050 (+260 pips — harmonic extension)

- Confirmation: RSI >55, volume +20%, VWAP holding

⚡ MOMENTUM SCALP

Add above 6,950 ONLY if RSI >65 + volume surge; trail stop 6,920

🔻 REVERSAL SHORT

- Entry: 6,950-7,000 (supply resistance)

- SL: 7,050 (above wedge)

- Targets: 6,900 → 6,820 → 6,750 (Gann support)

- Trigger: Bearish engulfing + RSI divergence on 5M/15M

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🚨 BREAKOUT ALERTS

✅ BULL: 1H close >6,950 confirms breakout → target 7,150; move SL to BE+25

✅ BEAR: 1H close <6,780 with volume → retest 6,650 cloud support

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📊 INDICATOR SNAPSHOT

BB Squeeze (30M) expanding | MACD histogram positive | VWAP slope up | EMA21 = trigger line | Hidden bull divergence confirmed on RSI

⚠️ PATTERN RECOGNITION

Harmonic Bat PRZ: 7,050 | Rising Wedge failure <6,790 = Wyckoff spring | H&S risk if 6,700 breaks | Bull trap risk above 6,950 without volume

📈 TIMING & VOLATILITY

Gann 90° window 21:00 UTC (US close) | ATR(14) ≈100 pts | Earnings whispers elevate risk | Risk ≤1% per setup; lock TP1; avoid chasing sub-avg volume

Educational analysis only. Follow your plan, manage risk, adapt to live price action.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

I am nothing @shunya.trade

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

I am nothing @shunya.trade

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.