Viviana Power Tech Ltd, based in Gujarat, operates in the power transmission and distribution EPC space, offering services like EHV substations, underground cabling, and testing/commissioning. The company has shown rapid expansion in revenue and profitability, riding on India’s growing power infrastructure demand.

Fundamental Analysis

Financial Performance

Revenue Growth: From ₹66 crore (FY24) to ~₹235 crore TTM, reflecting a 250%+ YoY growth.

Net Profit: Jumped from ₹7 crore (FY24) to ~₹22 crore TTM.

EPS (TTM): ~₹28–35 depending on consolidation basis.

Key Ratios

Fundamental Analysis

Financial Performance

Revenue Growth: From ₹66 crore (FY24) to ~₹235 crore TTM, reflecting a 250%+ YoY growth.

Net Profit: Jumped from ₹7 crore (FY24) to ~₹22 crore TTM.

EPS (TTM): ~₹28–35 depending on consolidation basis.

Key Ratios

- P/E Ratio: ~34–36× (slightly expensive compared to sector peers).

- P/B Ratio: ~12.5× (stretched valuations).

- ROE / ROCE: Strong at ~28–31%, respectively.

- Debt-to-Equity: Moderate at ~0.48.

- Promoter Holding: ~70.3% (indicating strong skin in the game).

Outlook

Strengths: Explosive revenue and profit growth, high return ratios, strong order book visibility.

Risks: Expensive valuations, thin dividend track record, seasonal volatility in September.

Technical Analysis

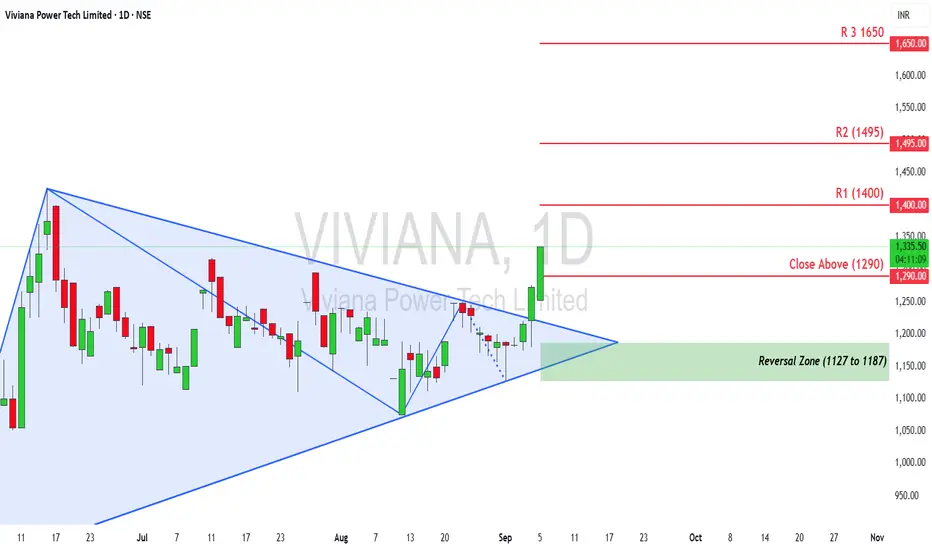

Pattern Formation:

The stock has been consolidating inside a symmetrical triangle since June, and has now given a breakout with strong bullish candles.

Key Levels:

Close Above Zone: ₹1,290 – A decisive breakout level.

Immediate Resistances:

R1: ₹1,400

R2: ₹1,495

R3: ₹1,650

Support/Reversal Zone: ₹1,127 – ₹1,187

Momentum: The breakout with a ~4.7% surge on above-average volumes suggests the beginning of a fresh upward trend.

Trend Outlook:

If the stock sustains above ₹1,290, momentum traders can eye ₹1,400–₹1,495 in the near term, with ₹1,650 as a medium-term target. A fall below ₹1,187 may invalidate the bullish view.

Techno-Fundamental Verdict

Viviana Power Tech stands out as a high-growth mid-cap in the power EPC sector with strong fundamentals, backed by robust ROE and revenue expansion. The recent technical breakout from consolidation adds a bullish confirmation, suggesting renewed investor interest.

For Investors: Attractive for long-term growth seekers, but valuation is expensive—advisable to accumulate on dips near support zones.

For Traders: Sustaining above ₹1,290 opens the door for a rally toward ₹1,400–₹1,495 in the short term. Stop-loss should be placed below ₹1,180 for risk management.

Conclusion:

Viviana is a growth-driven, high-potential, but richly valued stock. Fundamentals indicate strength, and the technical chart signals bullish continuation. A balanced approach—combining staggered investment with tactical trading entries—may offer the best risk-reward.

Disclaimer:lnkd.in/gJJDnvn2

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.