Stock Overview

Stock Name: Voltas Ltd.

Exchange: NSE (National Stock Exchange of India)

Current Price: 1,145.45 INR

Chart Timeframe: 1M (Monthly)

Company Business Profile: Voltas Ltd. is an Indian multinational company that provides engineering solutions for a wide spectrum of industries in areas such as heating, ventilation, air conditioning, refrigeration, electro-mechanical projects, and textile machinery.

Candlestick Pattern Analysis

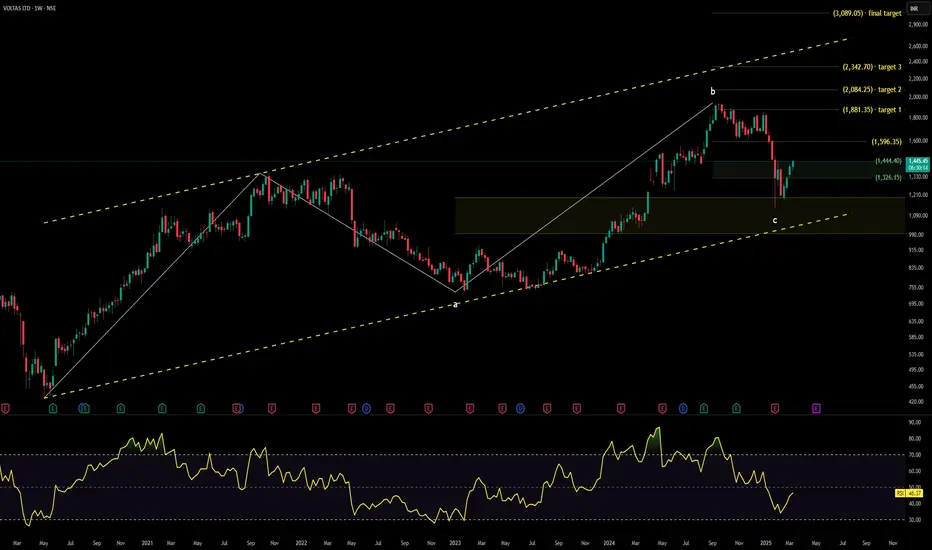

The chart shows a prominent uptrend followed by a correction phase. There is a visible bullish engulfing pattern around point 'a', indicating a potential reversal from the downtrend. Additionally, there is a bearish engulfing pattern near point 'b', suggesting a possible short-term top.

Key Levels

Support (Yellow Zone): 1,188.55 INR

Swing Zone (Green Zone): 1,326.15 INR

Target Levels (T): Target 1: 1,881.35 INR Target 2: 2,084.25 INR Target 3: 2,342.70 INR

Technical Indicators

RSI (Relative Strength Index): The RSI is currently at 55.08, which is in the neutral zone. This suggests that the stock is neither overbought nor oversold, indicating a balanced momentum.

Volume Trends

The volume trends show a significant spike during the initial uptrend, which is a positive sign of strong buying interest. However, there is a noticeable decline in volume during the correction phase, suggesting a lack of selling pressure. This could indicate that the correction might be temporary and the uptrend could resume.

Sector and Market Context

Voltas Ltd. operates in the engineering and air conditioning sector, which has shown resilience and growth potential in recent years. The overall market trend has been bullish, with the NSE index showing a steady uptrend. Voltas Ltd.'s performance is in line with the sector and market trends, indicating a strong position within its industry.

Risk Considerations

Possible risks include market volatility, changes in government policies, and economic conditions that could impact the engineering and air conditioning sector. Additionally, global supply chain disruptions and fluctuations in raw material prices could affect the company's performance.

Analysis Summary

Voltas Ltd. is currently in a correction phase after a strong uptrend. The technical indicators suggest a balanced momentum with no immediate signs of overbought or oversold conditions. The volume trends indicate strong buying interest during the uptrend and a lack of selling pressure during the correction. The stock is well-positioned within its sector and the overall market trend is positive. However, investors should be aware of potential risks and market conditions that could influence the stock's movement.

Stock Name: Voltas Ltd.

Exchange: NSE (National Stock Exchange of India)

Current Price: 1,145.45 INR

Chart Timeframe: 1M (Monthly)

Company Business Profile: Voltas Ltd. is an Indian multinational company that provides engineering solutions for a wide spectrum of industries in areas such as heating, ventilation, air conditioning, refrigeration, electro-mechanical projects, and textile machinery.

Candlestick Pattern Analysis

The chart shows a prominent uptrend followed by a correction phase. There is a visible bullish engulfing pattern around point 'a', indicating a potential reversal from the downtrend. Additionally, there is a bearish engulfing pattern near point 'b', suggesting a possible short-term top.

Key Levels

Support (Yellow Zone): 1,188.55 INR

Swing Zone (Green Zone): 1,326.15 INR

Target Levels (T): Target 1: 1,881.35 INR Target 2: 2,084.25 INR Target 3: 2,342.70 INR

Technical Indicators

RSI (Relative Strength Index): The RSI is currently at 55.08, which is in the neutral zone. This suggests that the stock is neither overbought nor oversold, indicating a balanced momentum.

Volume Trends

The volume trends show a significant spike during the initial uptrend, which is a positive sign of strong buying interest. However, there is a noticeable decline in volume during the correction phase, suggesting a lack of selling pressure. This could indicate that the correction might be temporary and the uptrend could resume.

Sector and Market Context

Voltas Ltd. operates in the engineering and air conditioning sector, which has shown resilience and growth potential in recent years. The overall market trend has been bullish, with the NSE index showing a steady uptrend. Voltas Ltd.'s performance is in line with the sector and market trends, indicating a strong position within its industry.

Risk Considerations

Possible risks include market volatility, changes in government policies, and economic conditions that could impact the engineering and air conditioning sector. Additionally, global supply chain disruptions and fluctuations in raw material prices could affect the company's performance.

Analysis Summary

Voltas Ltd. is currently in a correction phase after a strong uptrend. The technical indicators suggest a balanced momentum with no immediate signs of overbought or oversold conditions. The volume trends indicate strong buying interest during the uptrend and a lack of selling pressure during the correction. The stock is well-positioned within its sector and the overall market trend is positive. However, investors should be aware of potential risks and market conditions that could influence the stock's movement.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.