📊  VRT | Vertiv Holdings – AI vs Trader Mindset

VRT | Vertiv Holdings – AI vs Trader Mindset

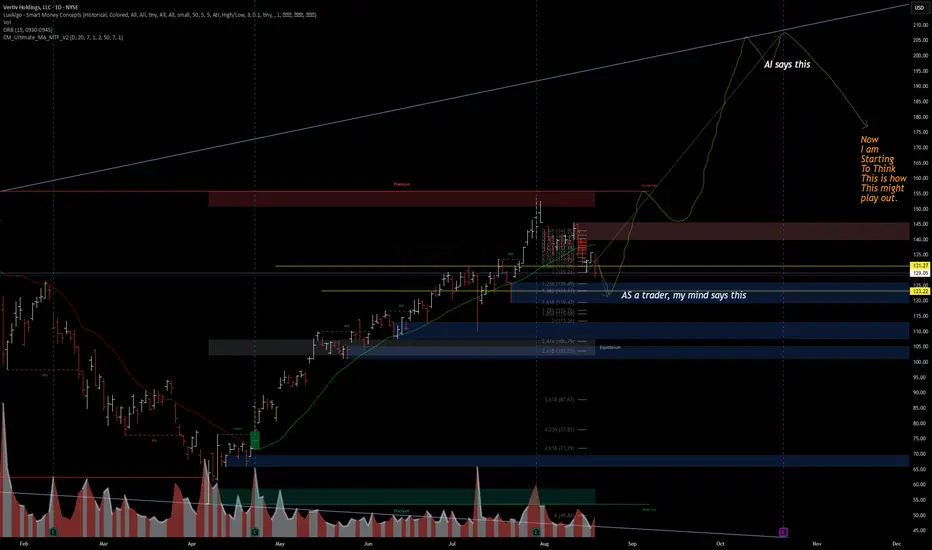

Interesting divergence here:

AI projection (yellow path) suggests a continuation higher toward $200+ before a macro pullback.

Trader’s view (blue zones) highlights liquidity gaps and possible retracement targets at $123, $116, and $106 before any bigger rally.

🔎 Chart Breakdown

Premium zone rejection near $140+

Equilibrium sits closer to $106

If downside liquidity sweep plays out, retracement into $116–123 demand zones could reload the uptrend.

⚖️ Key Levels

Bullish continuation: $145 → $175 → $200+

Bearish retracement: $123 → $116 → $106

💡 Sometimes AI favors trend continuation, while traders look for liquidity sweeps first. This setup could play out as a blend of both.

Interesting divergence here:

AI projection (yellow path) suggests a continuation higher toward $200+ before a macro pullback.

Trader’s view (blue zones) highlights liquidity gaps and possible retracement targets at $123, $116, and $106 before any bigger rally.

🔎 Chart Breakdown

Premium zone rejection near $140+

Equilibrium sits closer to $106

If downside liquidity sweep plays out, retracement into $116–123 demand zones could reload the uptrend.

⚖️ Key Levels

Bullish continuation: $145 → $175 → $200+

Bearish retracement: $123 → $116 → $106

💡 Sometimes AI favors trend continuation, while traders look for liquidity sweeps first. This setup could play out as a blend of both.

WaverVanir ⚡ To grow and conquer

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

WaverVanir ⚡ To grow and conquer

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.