Introduction:

Websol Energy System Limited is engaged in the business of manufacturing photovoltaic crystalline solar cells and related modules in India. Co. specializes in the production of photovoltaic crystalline solar cells and related PV modules. The Company’s products are used in both commercial and industrial Solar Energy panels in India and internationally.

Fundamentals:

Market Cap: ₹ 6,400 Cr.;

Stock P/E: 41.4 (Ind. P/E: 44.87) 👍;

ROCE: 59.2% 👍; ROE: 80.2% 👍;

PEG Ratio: 0.71 👍 (Stock price valuation is relatively undervalued related to its growth prospects)

3 Years Sales Growth: 39% 👍

3 Years Compounded Profit Growth: 160% 👍

3 Years Stock Price CAGR: 149% 👍

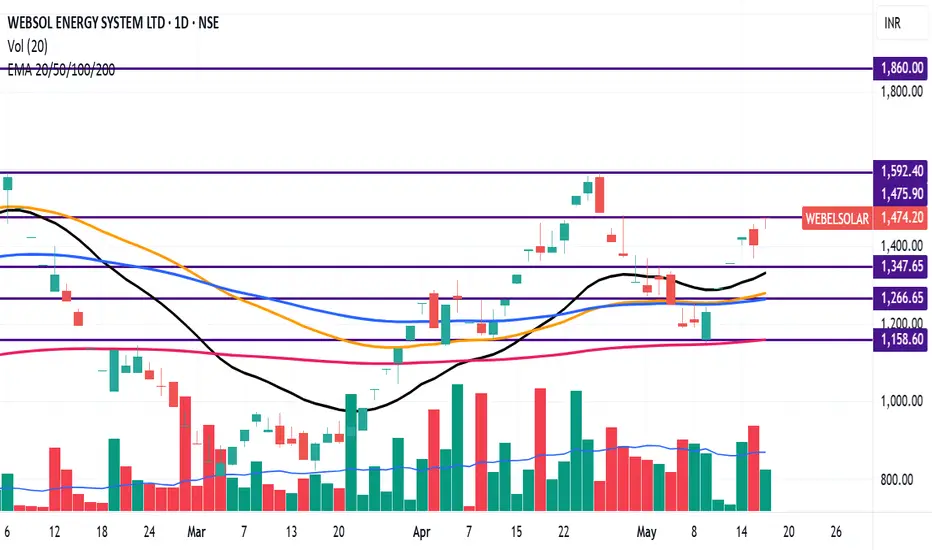

Technicals:

The stock is trading above 20 EMA(Black Line), 50 EMA (Orange Line), 100 EMAs (Blue Line) and 200 EMA (Pink line).

Resistance levels: 1475, 1592, 1860

Support levels: 1347, 1266, 1158,

The stock shows Bullish Momentum above Short, Medium and Long Term Moving Averages

Websol Energy System Limited is engaged in the business of manufacturing photovoltaic crystalline solar cells and related modules in India. Co. specializes in the production of photovoltaic crystalline solar cells and related PV modules. The Company’s products are used in both commercial and industrial Solar Energy panels in India and internationally.

Fundamentals:

Market Cap: ₹ 6,400 Cr.;

Stock P/E: 41.4 (Ind. P/E: 44.87) 👍;

ROCE: 59.2% 👍; ROE: 80.2% 👍;

PEG Ratio: 0.71 👍 (Stock price valuation is relatively undervalued related to its growth prospects)

3 Years Sales Growth: 39% 👍

3 Years Compounded Profit Growth: 160% 👍

3 Years Stock Price CAGR: 149% 👍

Technicals:

The stock is trading above 20 EMA(Black Line), 50 EMA (Orange Line), 100 EMAs (Blue Line) and 200 EMA (Pink line).

Resistance levels: 1475, 1592, 1860

Support levels: 1347, 1266, 1158,

The stock shows Bullish Momentum above Short, Medium and Long Term Moving Averages

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.